Quickbooks Owners Draw

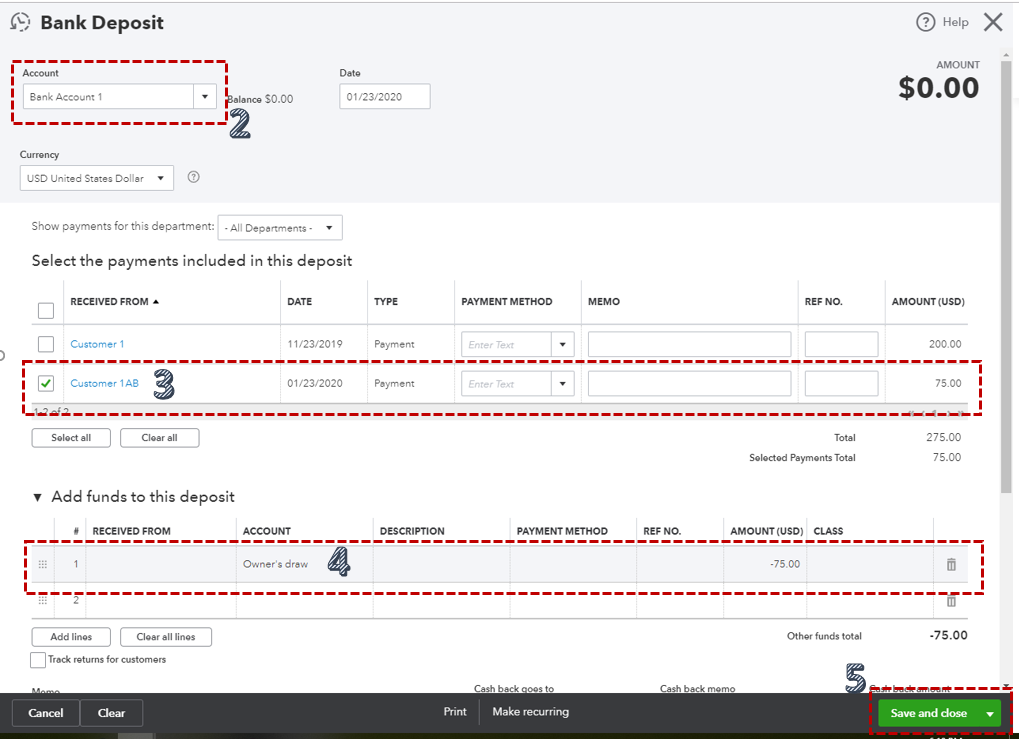

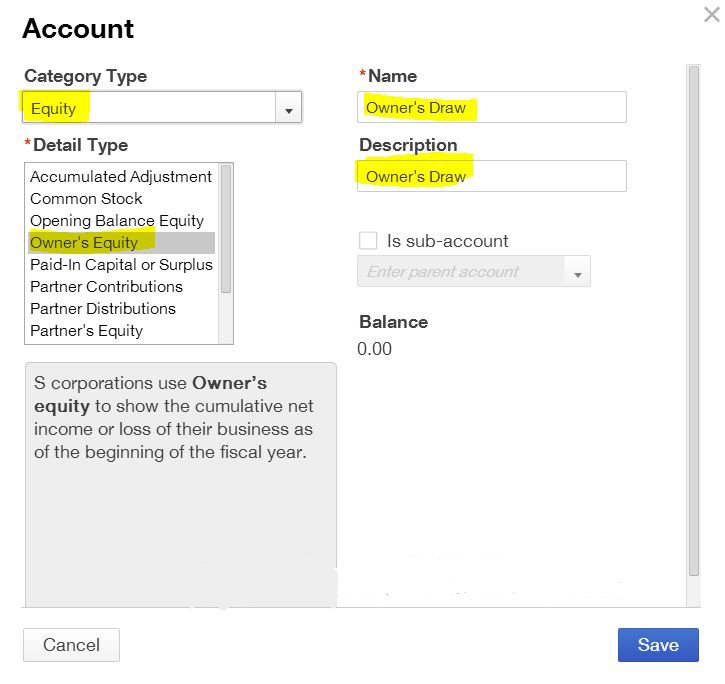

Quickbooks Owners Draw - Enter the name, and the opening balance. Go to chart of accounts. Web an owner's draw is an account where the owner takes the money out of the business. Owner equity (parent account) owner draws (sub account of owner equity) owner investment (sub account of owner equity) 6. How to pay yourself as a business owner.

Find the account, go it its action column and click view register. See this screenshot from my chart of accounts): Quickbooks will randomly suggest a method to record a downloaded transaction. Owners draw is the expense (reason) for the check. The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. Type the name of the owner's draw account in the search box. Choose the bank account where your money will be withdrawn.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

It's great to see you posting today! Typically this would be a sole. Web an owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner. If you work as a sole proprietor, your compensation would typically come as an owner's draw.

how to take an owner's draw in quickbooks Masako Arndt

You are right about categorizing the downloaded draw instead of recording it. In the pay to the order of field, enter your name. The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. An owner's draw account is an equity account used.

How to pay invoices using owner's draw? QuickBooks Community

If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. Web open the chart of accounts, use run report on that account from the drop down arrow far right of the account name. How to pay yourself as a business owner. When you put money in.

How to record an Owner's Draw The YarnyBookkeeper

You can check these articles for more information: Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. Web an owner's draw is an account where the owner takes the money out of the business. As always, i suggest reaching out to your accountant on the.

Owners draw QuickBooks Desktop Setup, Record & Pay Online

Your owner's draw account is the cumulative total of all draws you have taken out of the business since day 1. I'm happy to provide details about recording an owner's draw from a downloaded transaction. Save time, reduce errors, and improve accuracy Go to accounting on the left menu. If you're a sole proprietor, you.

Owner Draw Report Quickbooks

If you work as a sole proprietor, your compensation would typically come as an owner's draw rather than a regular paycheck processed through payroll. The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. Web an owner's draw is an account where.

how to take an owner's draw in quickbooks Masako Arndt

Enter the amount of the draw in the amount field. If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. Web an owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner..

How to Record Owner’s Draw in QuickBooks Desktop

Don't forget to like and subscribe. Draws can happen at regular intervals or when needed. Web open the chart of accounts, use run report on that account from the drop down arrow far right of the account name. Web the best way to do it would be to go back and change the expense account.

how to take an owner's draw in quickbooks Masako Arndt

That would keep the books cleaner. Save time, reduce errors, and improve accuracy Don't forget to like and subscribe. Web am i entering owner's draw correctly? Go to the banking menu and select write checks. Web the best way to do it would be to go back and change the expense account from owner's personal.

Quickbooks Owner Draws & Contributions YouTube

Find the account, go it its action column and click view register. If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. Record creation it is necessary to make a record for the transactions of the owner’s withdrawal for the financial reasons of the company. I'm.

Quickbooks Owners Draw Draws can happen at regular intervals or when needed. In the memo field, you can enter something like “owner’s draw for march.” 6. That would keep the books cleaner. Web an owner's draw is an account where the owner takes the money out of the business. Go to chart of accounts.

Enter The Amount Of The Draw In The Amount Field.

So when you see the bank feed that is the expense account you select. The business owner takes funds out of the business for personal use. Web open the chart of accounts, use run report on that account from the drop down arrow far right of the account name. A complete quickbooks training free course!

This Article Describes How To Setup And Pay Owner’s Draw In Quickbooks Online & Desktop.

See this screenshot from my chart of accounts): So your chart of accounts could look like this. An owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. Web owner draw is an equity type account used when you take funds from the business.

There Are An Array Of Ways Available That Can Help Record An Owner’s Draw In Quickbooks, Such As Banking And Chart Of Accounts Options.

I'm happy to provide details about recording an owner's draw from a downloaded transaction. If you're unable to edit the amount on this screen, in some cases. Choose the bank account where your money will be withdrawn. Web in this video, i'll show you how to enter the owner's draw in quickbooks online.

Go To Accounting On The Left Menu.

Web an owner's draw is an account where the owner takes the money out of the business. Web owner’s draw in quickbooks: We'll have to set up an owner's draw account first. An owner’s draw is when an owner takes money out of the business.