Owner's Draw In Quickbooks

Owner's Draw In Quickbooks - Don't forget to like and subscribe. Web a draw is simply a cash withdrawal that reduces the ownership investment you have made in your company. Web an owner's draw is an amount of money taken out from a sole proprietorship, partnership, limited liability company (llc), or s corporation by the owner for their personal use. Locate your opening balance entry, then choose it. Go to accounting on the left menu.

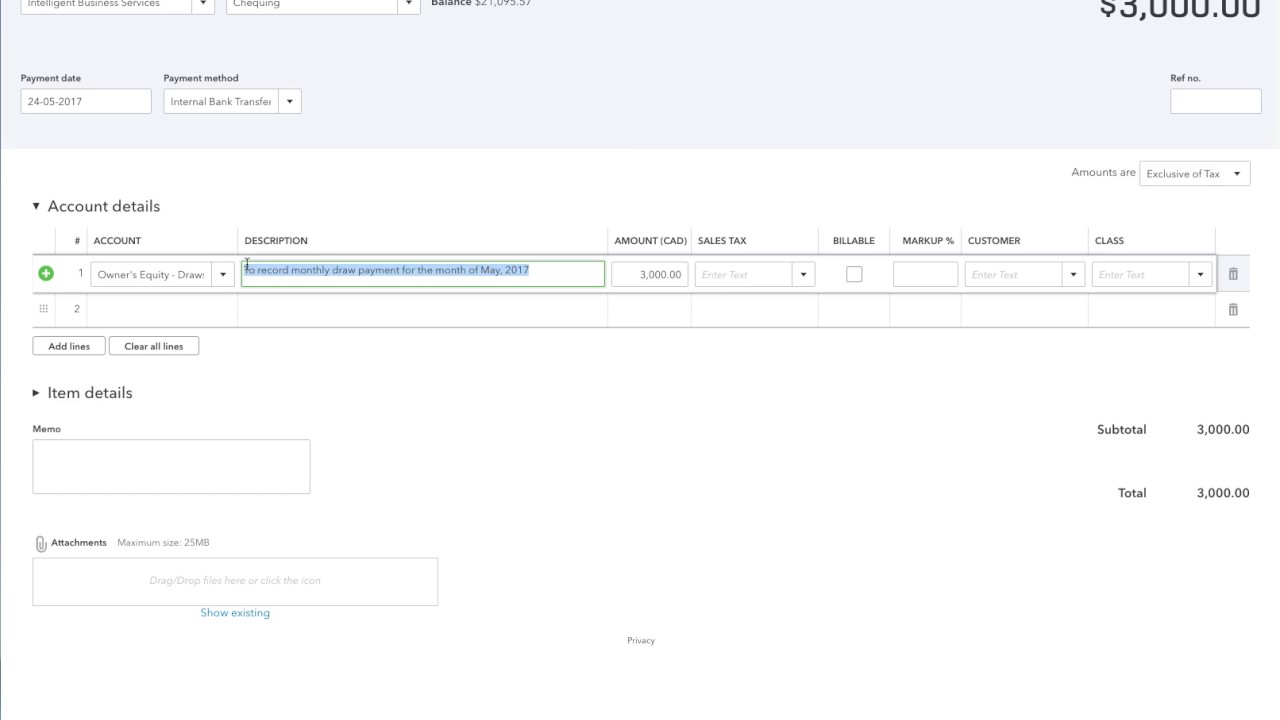

Web learn more about owner's draw vs payroll salary and how to pay yourself as a small business owner: Don't forget to like and subscribe. Enter the amount of the draw in the amount field. We can run this report by running a quick report of the owner’s equity account. Web owner’s draw in quickbooks: The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. It's a way for them to pay themselves instead of taking a salary.

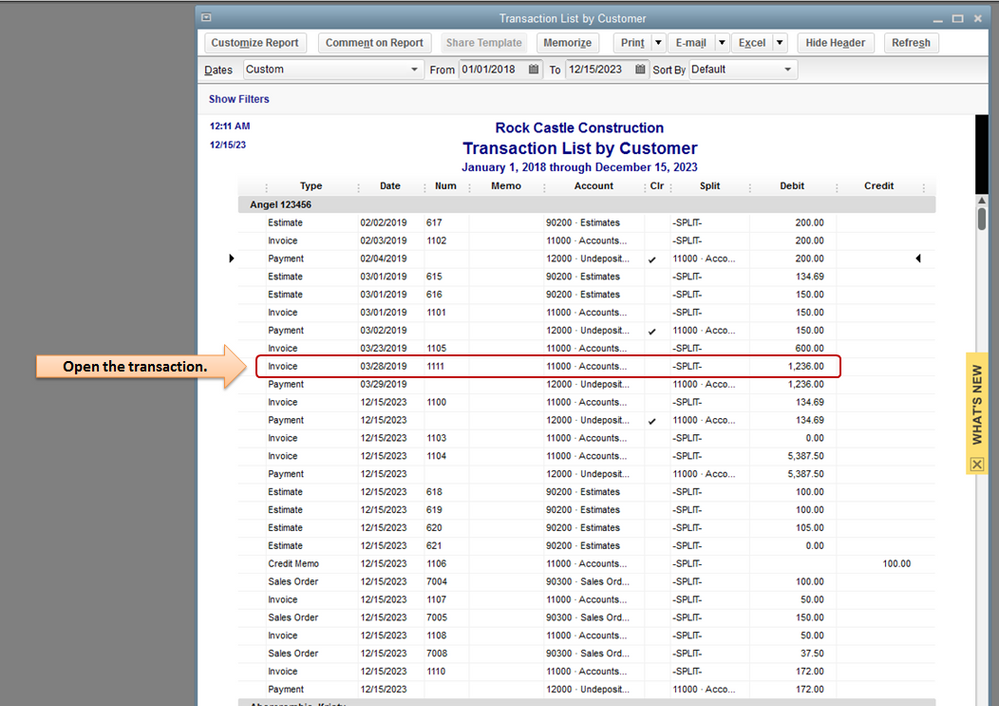

Owner Draw Report Quickbooks

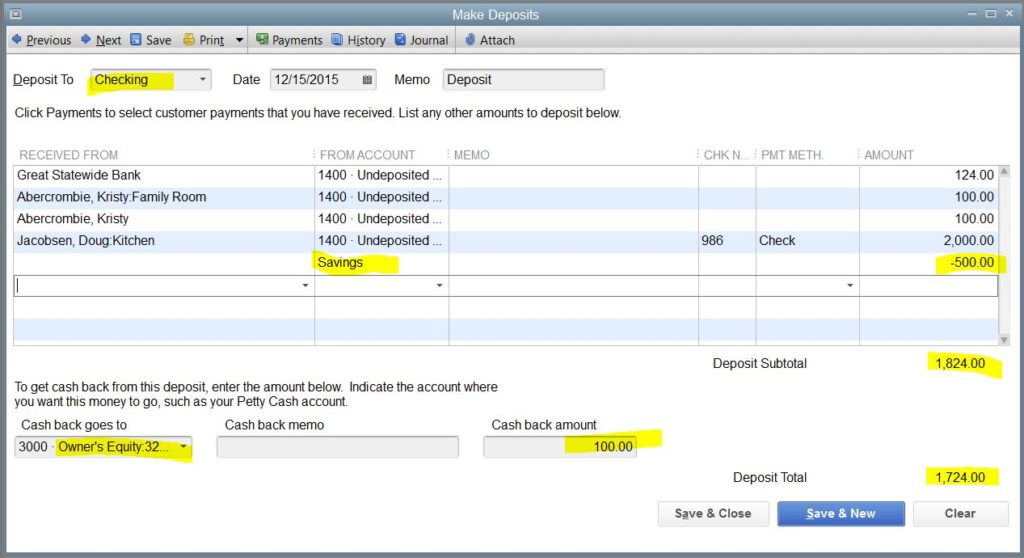

The business owner takes funds out of the business for personal use. Let me show you how: Draws can happen at regular intervals or when needed. I've got an owner's equity equity account set up and any time i take money from my pocket and spend it on the company, i log it in this.

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

Business owners might use a draw for compensation versus paying themselves a salary. Web learn more about owner's draw vs payroll salary and how to pay yourself as a small business owner: Web 164 share 10k views 1 year ago an owner’s draw is when an owner takes money out of the business. The business.

How to Record Owner's Equity Draws in QuickBooks Online YouTube

Locate your opening balance entry, then choose it. I've got an owner's equity equity account set up and any time i take money from my pocket and spend it on the company, i log it in this account and categorize it properly for tracking purposes. Draws can happen at regular intervals or when needed. Find.

how to take an owner's draw in quickbooks Masako Arndt

Web to create an owner's equity: In the memo field, you can enter something like “owner’s draw for march.” 6. Web click sales tax. I'm a sole member llc. Don't forget to like and subscribe. Web 1.3k views 1 year ago quickbooks desktop pro 2022 training tutorial: Go to chart of accounts. There are an.

how to take an owner's draw in quickbooks Masako Arndt

Don't forget to like and subscribe. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. Record creation it is necessary to make a record for the transactions of the owner’s withdrawal for the financial reasons of the company. Web december 10, 2018 05:29 pm last.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Web a draw is simply a cash withdrawal that reduces the ownership investment you have made in your company. The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. This article describes how to setup and pay owner’s draw in quickbooks online.

how to take an owner's draw in quickbooks Masako Arndt

An owner’s draw is the process in which a business owner takes funds out of their account for their personal use. If you have any video requests it’s cable reimagined. If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. If you work as a sole.

how to take an owner's draw in quickbooks Masako Arndt

It's a way for them to pay themselves instead of taking a salary. Web an owner's draw is an amount of money taken out from a sole proprietorship, partnership, limited liability company (llc), or s corporation by the owner for their personal use. Use your gear ( ⚙️) icon. Web owner’s draw in quickbooks: Business.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

An owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. Web click sales tax. We can run this report by running a quick report of the owner’s equity account. Record creation it is necessary to make a record for the transactions of.

How to Record Owner’s Draw in QuickBooks Desktop

Web a draw is simply a cash withdrawal that reduces the ownership investment you have made in your company. How does owner's draw work? Let me show you how: I'm a sole member llc. Save time, reduce errors, and improve accuracy Enter the name, and the opening balance. If you have any video requests it’s.

Owner's Draw In Quickbooks Locate your opening balance entry, then choose it. Enter the tax payment amount in the tax payment field. Paying yourself as an owner with hector garcia | quickbooks payroll Web an owner's draw is an amount of money taken out from a sole proprietorship, partnership, limited liability company (llc), or s corporation by the owner for their personal use. There are an array of ways available that can help record an owner’s draw in quickbooks, such as banking and chart of accounts options.

In The Memo Field, You Can Enter Something Like “Owner’s Draw For March.” 6.

Use your gear ( ⚙️) icon. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. Web what is an owner’s draw account? From the bank account dropdown, select the account you're making the payment from.

I'm A Sole Member Llc.

Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Web learn how to pay an owner of a sole proprietor business in quickbooks online. The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. Web owner's draw vs payroll salary:

Web 164 Share 10K Views 1 Year Ago An Owner’s Draw Is When An Owner Takes Money Out Of The Business.

I've got an owner's equity equity account set up and any time i take money from my pocket and spend it on the company, i log it in this account and categorize it properly for tracking purposes. Record creation it is necessary to make a record for the transactions of the owner’s withdrawal for the financial reasons of the company. Web owner’s draw in quickbooks: Don't forget to like and subscribe.

Click ‘Save And Close’ To Create The Account.

These need to be deposited separately, usually through quarterly estimated tax deposits to the irs and to any relevant state agency. This article describes how to setup and pay owner’s draw in quickbooks online & desktop. An owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. Let me show you how: