Owner Draws In Quickbooks

Owner Draws In Quickbooks - Web enroll in my home bookkeeper masterclass: As we mentioned before, this. Web 164 share 10k views 1 year ago an owner’s draw is when an owner takes money out of the business. Web here are few steps given to set up the owner’s draw in quickbooks online: Typically this would be a sole proprietorship or llc where the business and the owner are.

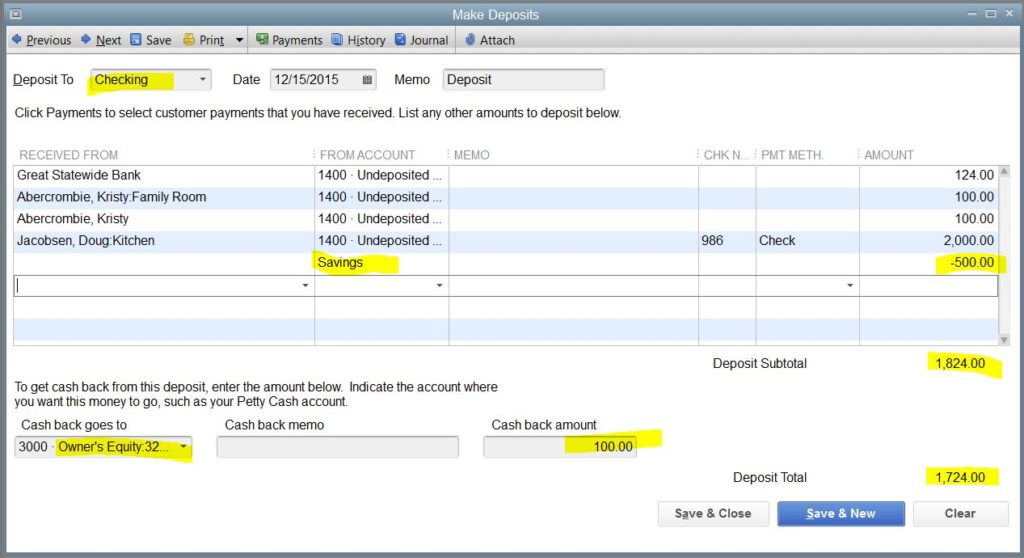

The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. Web from the sales tax owed list, select the tax agency you're recording the payment for, then select record tax payment. A clip from mastering quickbooks made easy. Web an owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner. In the “from” field, select the bank account from which the owner’s draw is being made. I’ll try to explain it in a way that makes sense to people who use quickbooks. Web 1 reply 2 comments rustler level 15 july 21, 2020 04:23 am when you write a check to yourself, that is an owner draw.

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. Web what is owner's draw in quickbooks? The business owner takes funds out of the business for personal use. In the “from” field, select the bank account from which the owner’s draw.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

When you're ready to make a tax payment, select. This article describes how to setup and pay owner’s draw in quickbooks online & desktop. Make payroll & employee time tracking easier with quickbooks time: In the memo field, you can enter something like “owner’s draw for march.” 6. Draws can happen at regular intervals or.

how to take an owner's draw in quickbooks Masako Arndt

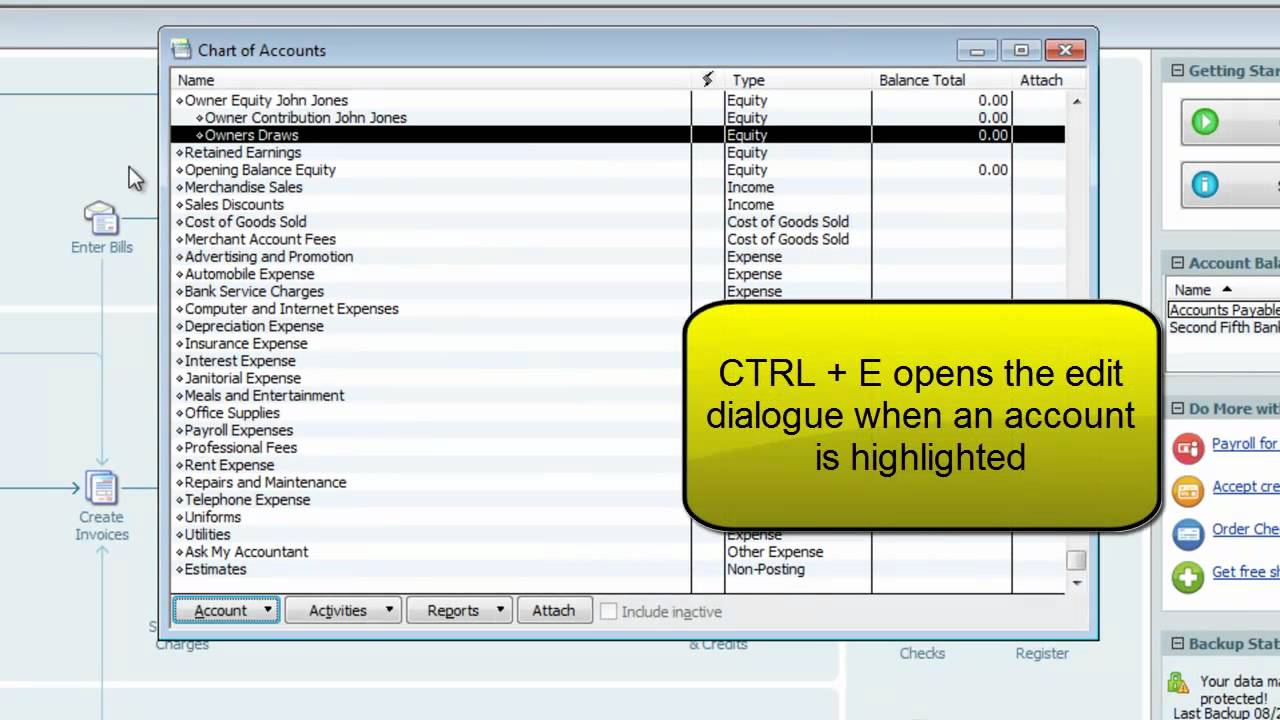

Now hit on the “ chart of accounts ” option and click new. Draws can happen at regular intervals or when needed. Enter the tax payment amount in the tax payment field. Paying yourself as an owner with hector garcia | quickbooks payroll Web what is owner's draw in quickbooks? Go to the chart of.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Enter the amount of the draw in the amount field. Web learn how to pay an owner of a sole proprietor business in quickbooks online. Web this guide will show you the steps to create an owner’s draw account and record transactions. Select equity, then select continue. The business owner takes funds out of the.

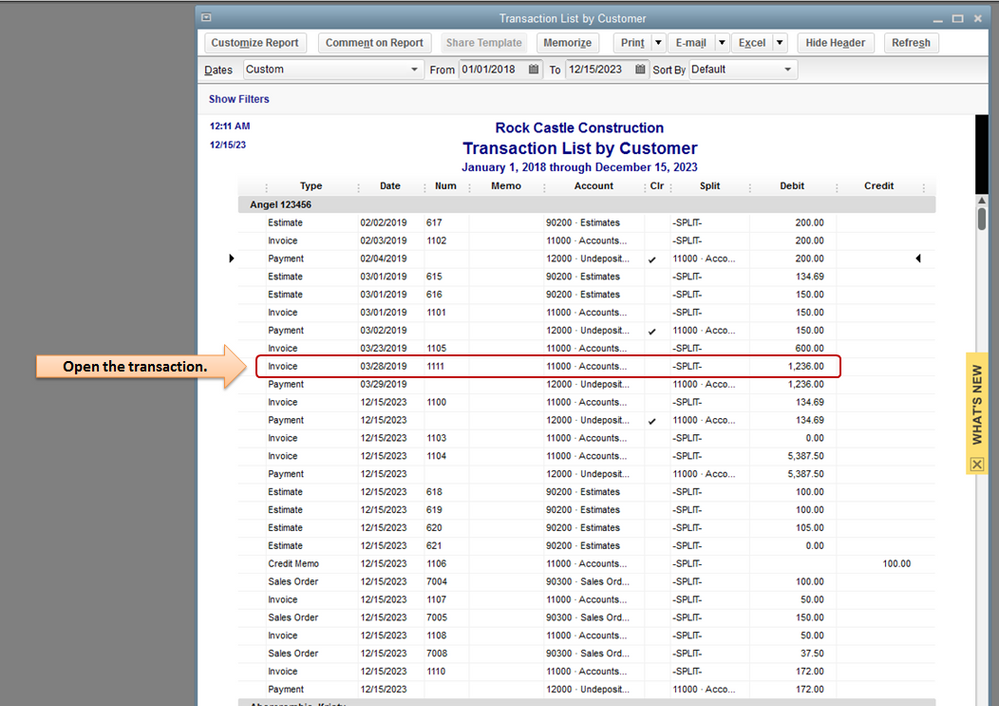

Owner Draw Report Quickbooks

If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. Here's an article for more details: Owners draw is the expense (reason) for the check. In the “from” field, select the bank account from which the owner’s draw is being made. Web if you work as.

Quickbooks Owner Draws & Contributions YouTube

Web 9.4k views 2 years ago. Owners draw is the expense (reason) for the check. When you're ready to make a tax payment, select. Web what is owner's draw in quickbooks? Save time, reduce errors, and improve accuracy Make payroll & employee time tracking easier with quickbooks time: If you're unable to edit the amount.

how to take an owner's draw in quickbooks Masako Arndt

Make payroll & employee time tracking easier with quickbooks time: Learn how to record owner’s draw in quickbooks desktop to keep track of the money withdrawn from the business for personal use. Web learn how to pay an owner of a sole proprietor business in quickbooks online. We'll have to set up an owner's draw.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Get the complete tutorial for. To record an owner’s draw in quickbooks online (qbo), follow these steps: Make payroll & employee time tracking easier with quickbooks time: Web frequently asked questions how do i record the owner’s draw in quickbooks online? So when you see the bank feed that is the expense account you select.

how to take an owner's draw in quickbooks Masako Arndt

Web if you work as a sole proprietor, your compensation would typically come as an owner's draw rather than a regular paycheck processed through payroll. Locate your opening balance entry, then choose it. This guide will show you the steps to create an owner’s draw account and record transactions. Web $4.95 teachucomp owner's draw vs.

how to take an owner's draw in quickbooks Masako Arndt

Owners draw is the expense (reason) for the check. Web 164 share 10k views 1 year ago an owner’s draw is when an owner takes money out of the business. We'll have to set up an owner's draw account first. To record the owner’s draw in quickbooks online, follow these steps: This guide will show.

Owner Draws In Quickbooks Web $4.95 teachucomp owner's draw vs payroll salary: Draws can happen at regular intervals or when needed. Set up and pay an owner's draw. Go to the “banking” tab and select “make a transfer.”. In the memo field, you can enter something like “owner’s draw for march.” 6.

Web 9.4K Views 2 Years Ago.

Owners draw is the expense (reason) for the check. To record the owner’s draw in quickbooks online, follow these steps: Web learn how to pay an owner of a sole proprietor business in quickbooks online. Get the complete tutorial for.

Draws Can Happen At Regular Intervals Or When Needed.

Enter the name, and the opening balance. If your business is formed as a partnership, each partner will be paid distributions based on the partnership agreement. Learn how to record owner’s draw in quickbooks desktop to keep track of the money withdrawn from the business for personal use. Use your gear ( ⚙️) icon.

Open The “ Quickbooks Online ” Application And Click On The “ Gear ” Sign.

As we mentioned before, this. Select equity, then select continue. Web setting up owner's draw in quickbooks online. Enter the amount of the draw in the amount field.

Paying Yourself As An Owner With Hector Garcia | Quickbooks Payroll

A clip from mastering quickbooks made easy. In the “to” field, select the owner’s equity account (such as “owner’s draw. Typically, that means receiving a base salary and a portion of the profits. If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll.