How To Find Payback Period In Excel

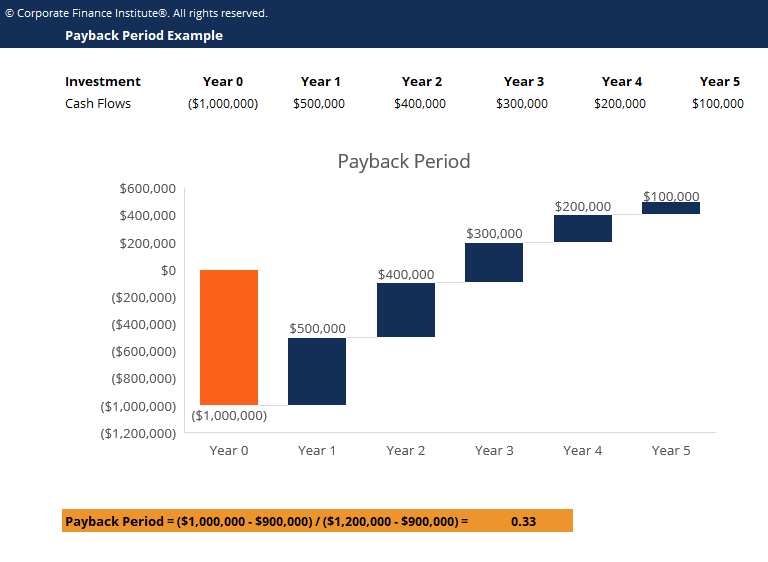

How To Find Payback Period In Excel - Web locating the breakeven point. Let’s start with the most obvious way to calculate the discounted payback period in excel. It counts all the number of negative cash flows in the cumulative cash flows line before it turns positive from years 2014 to 2020. \begin {aligned}\text {payback period}=\frac {\text {cost of investment}} {\text {average annual. This indicates the period at which the investment costs are fully recovered.

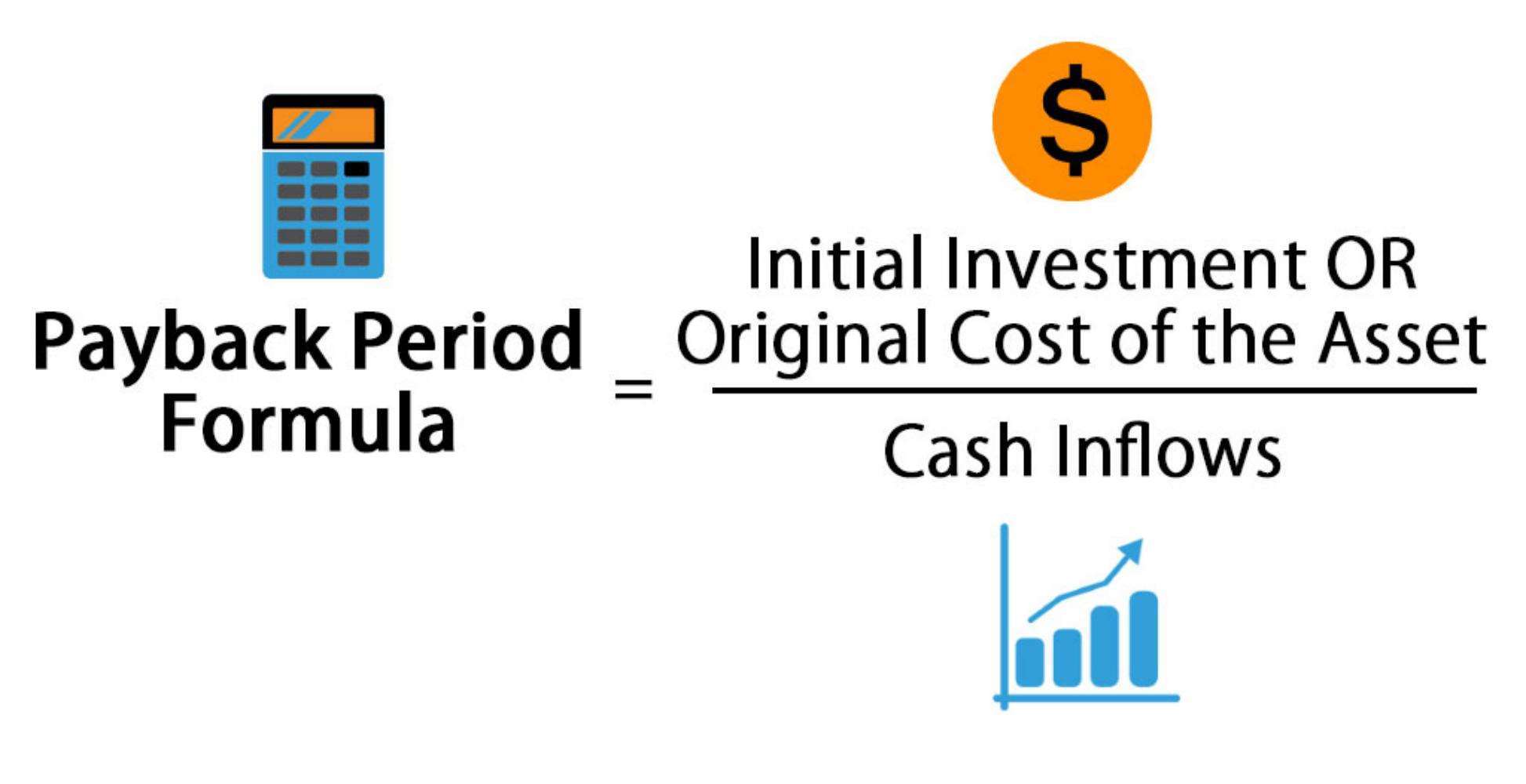

Subtract the investment cost from the cumulative cash flows until the result is zero or positive. Web locating the breakeven point. Web formula for payback period = initial investment/net annual cash inflow limitations of payback period: Web table of contents. Web payback period = initial investment / annual cash flow. Web in an excel spreadsheet, list the net profit in one cell (e.g., a1) and the total investment in another cell (e.g., b1 ). Web written by durjoy paul.

How to Calculate Discounted Payback Period in Excel

Calculate the net/ cumulative cash flow. We begin by transferring the data to an excel spreadsheet. In spite of its simplicity, the payback period cannot be the sole factor in selecting a project. Web but since the payback period metric rarely comes out to be a precise, whole number, the more practical formula is as.

How To Calculate Payback Period In Excel Using Formula

Using pv function to calculate discounted payback period. Web pp = initial investment / cash flow. Web locating the breakeven point. If you invested $8,000 and the cash flow remains $2,000 per year, the payback period reduces to 4 years: In general, the shorter the payback period, the better, as it means that the investment.

How to Calculate Payback Period in Excel (With Easy Steps)

Web written by durjoy paul. Web payback period = initial investment / annual cash flow. Then, it’s simply a matter of determining whether the number of years in the payback period is acceptable to you. \begin {aligned}\text {payback period}=\frac {\text {cost of investment}} {\text {average annual. It can be calculated from even or uneven cash.

Payback Period How to Use and Calculate It BooksTime

Web calculating the payback period in excel can be done using the match function to find the period when cumulative cash flows reach the initial investment. • generally, the longer the payback period, the higher the risk. This indicates the period at which the investment costs are fully recovered. This marks the breakeven point and.

How to Calculate Payback Period in Excel? QuickExcel

This formula divides net profit by total investment and multiplies the result by 100 for percentage representation. • the payback period is the estimated amount of time it will take to recoup an investment or to break even. Web if you just want to calculate the payback period using a simple formula and your cash.

How to Calculate Payback Period in Excel (With Easy Steps)

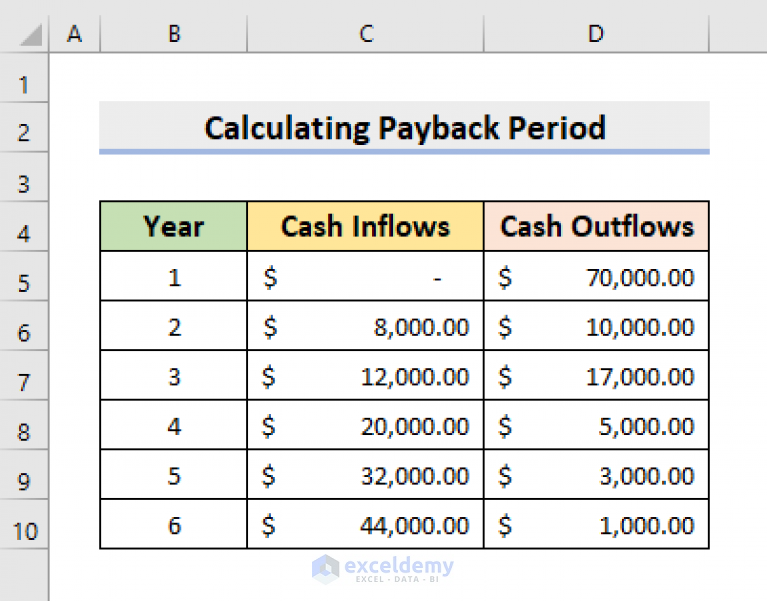

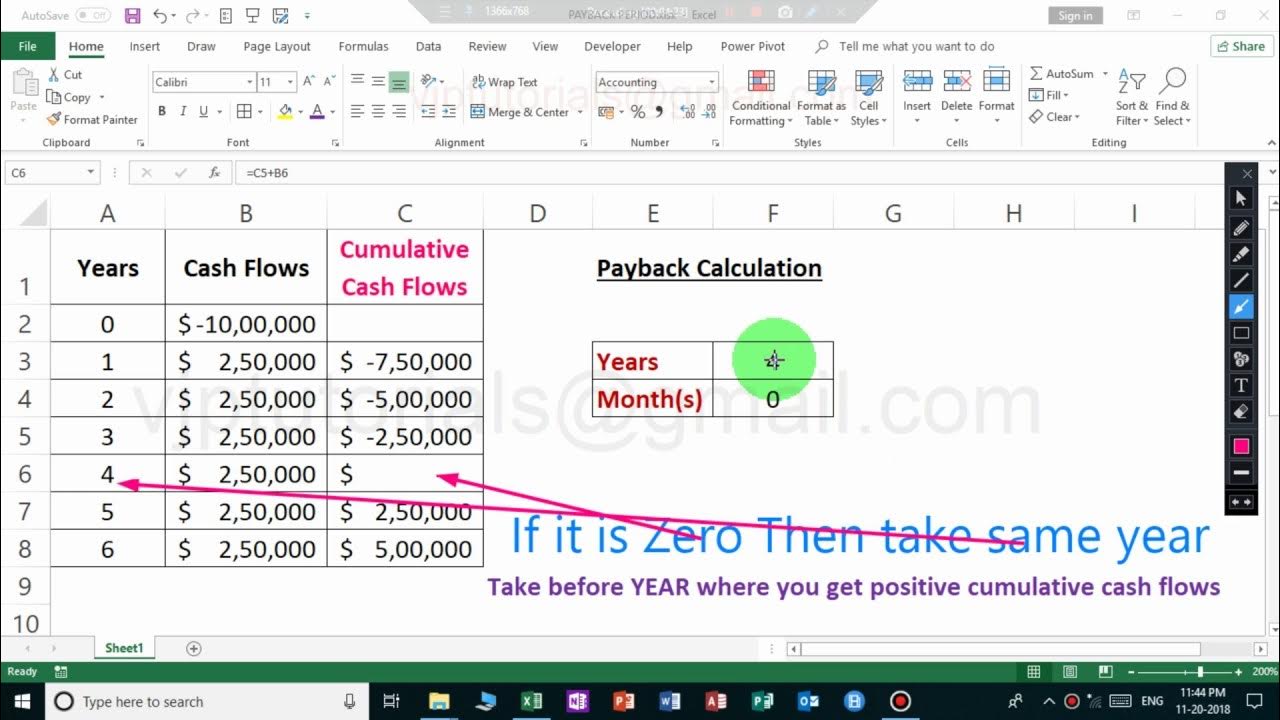

The above screenshot gives you the formulae that i have used to determine the payback period in excel. In this example, we’ll type cash inflows and cash outflows of 6 years. Utilize the countif function to determine the number of periods with negative cumulative cash flow. Web use the =match() function in excel to determine.

How to calculate PAYBACK PERIOD in MS Excel Spreadsheet 2019 YouTube

In this example, we’ll type cash inflows and cash outflows of 6 years. Excel offers advanced tools to refine your payback period analysis. • there are two formulas for calculating the payback period: For example, if you invested $10,000 in a business that gives you $2,000 per year, the payback period is $10,000 / $2,000.

Payback period calculation formula NosheenRayan

This marks the breakeven point and sets the stage for determining the payback period. Without any further ado, let’s get started with calculating the payback period in excel. It can be calculated from even or uneven cash flows. Suppose the initial investment amount of a project is $60,000, calculate the payback period if the cash.

How to Calculate Payback Period in Excel (With Easy Steps)

Web in an excel spreadsheet, list the net profit in one cell (e.g., a1) and the total investment in another cell (e.g., b1 ). Web but since the payback period metric rarely comes out to be a precise, whole number, the more practical formula is as follows. This formula divides net profit by total investment.

How to Calculate the Payback Period With Excel

Web the payback period is a straightforward calculation of how long it will take for the initial investment to pay off. This formula divides net profit by total investment and multiplies the result by 100 for percentage representation. The above screenshot gives you the formulae that i have used to determine the payback period in.

How To Find Payback Period In Excel Web use the =match() function in excel to determine the exact year in which the cumulative cash flow becomes positive. Dive into your excel sheet to identify the point where cumulative cash flows turn positive. Web steps to calculate payback period in excel. This formula is used where you have a constant cash inflow. Refining your analysis with excel tools.

In Addition To Other Capital Budgeting Techniques, It Can Also Be Used Independently.

Using pv function to calculate discounted payback period. The payback period calculates how much time is required to return the initial capital from an investment. Web how to calculate the payback period in excel sheet with formula? This indicates the period at which the investment costs are fully recovered.

• There Are Two Formulas For Calculating The Payback Period:

Web to calculate the payback period in excel, list all projected cash flows in a single column. Web use the =match() function in excel to determine the exact year in which the cumulative cash flow becomes positive. Dive into your excel sheet to identify the point where cumulative cash flows turn positive. Let’s start with the most obvious way to calculate the discounted payback period in excel.

The Payback Period Helps Us To Calculate The Time Taken To Recover The Initial Cost Of Investment Without Considering The Time Value Of Money.

• generally, the longer the payback period, the higher the risk. Without any further ado, let’s get started with calculating the payback period in excel. Use autofill to complete the rest. Discounted payback period example calculation.

This Formula Is Used Where You Have A Constant Cash Inflow.

Web calculating the payback period in excel can be done using the match function to find the period when cumulative cash flows reach the initial investment. Enter financial data in your excel worksheet. Calculate the net/ cumulative cash flow. Web in an excel spreadsheet, list the net profit in one cell (e.g., a1) and the total investment in another cell (e.g., b1 ).