How To Find Beta In Excel

How To Find Beta In Excel - Now, if this equation is freaking you out, please don’t let it freak you out. Beta= covariance of the portfolio returns with the expected returns / variance of the portfolio returns. While calculating the beta, you need to calculate the returns of your stock price first. Let’s assume you’re analyzing the beta of stock abc to the s&p 500 index. Represents the beta of the portfolio.

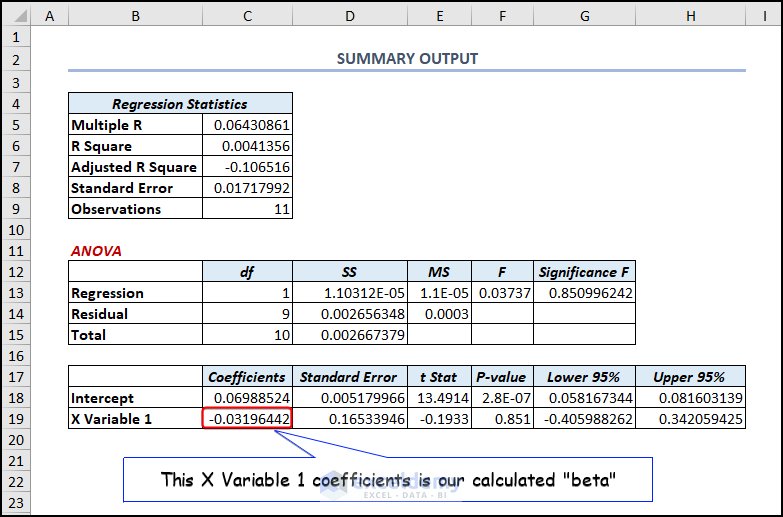

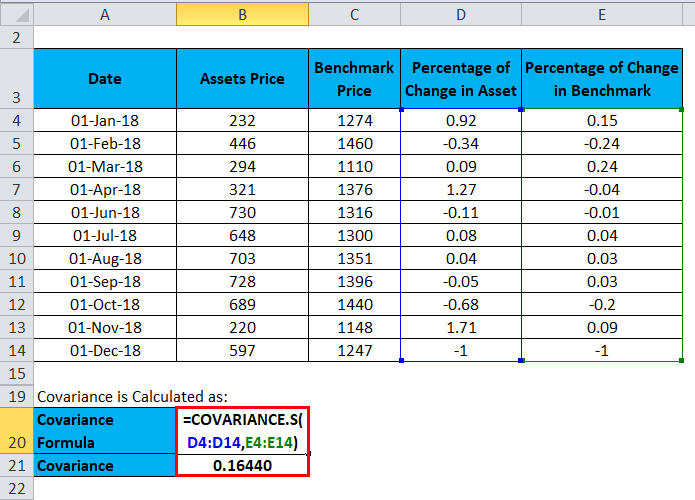

Web the formula to calculate beta is: Congratulations, you now know how to calculate beta in excel using these simple steps. Google offers a free course and certification via its educational arm, to help aspiring user experience professionals learn the skills they need for the workplace. Web you find the beta value in the coefficients column in the summary output sheet; Web \begin {aligned}&\beta_p=\frac {cov (r_p,r_b)} {var (r_b)}\end {aligned} β p = v ar(rb)c ov(rp,rb) what is beta? 57k views 13 years ago excel finance free. Let’s break down this definition.

How to Calculate Beta in Excel StepByStep Video on Calculation of

Denotes the weight or proportion invested in stock / asset. This measure provides insights into the level of risk of a stock relative to the market. Let’s assume you’re analyzing the beta of stock abc to the s&p 500 index. Treasury bills for investments in u.s. Beta looks at the correlation in price movement between.

How to Calculate Beta in Excel (4 Easy Methods) ExcelDemy

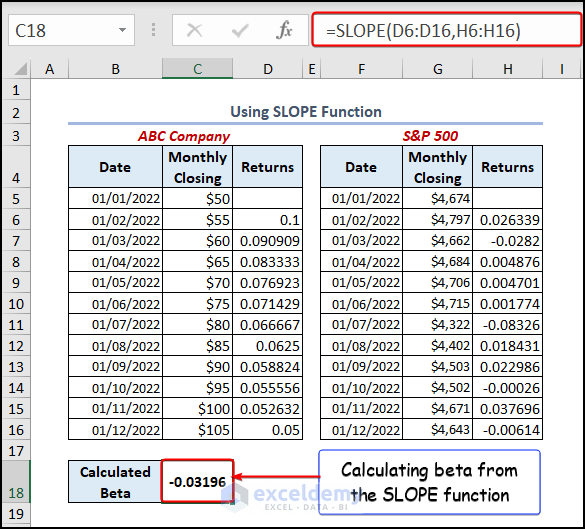

This is the rate of return an investor could expect on an investment in which his or her money is not at risk, such as u.s. Web to calculate beta, you must use the formula: Denotes the weight or proportion invested in stock / asset. It can be calculated using the covariance/variance method, the slope.

Calculate The Beta Of A Portfolio In Excel The Excel Hub YouTube

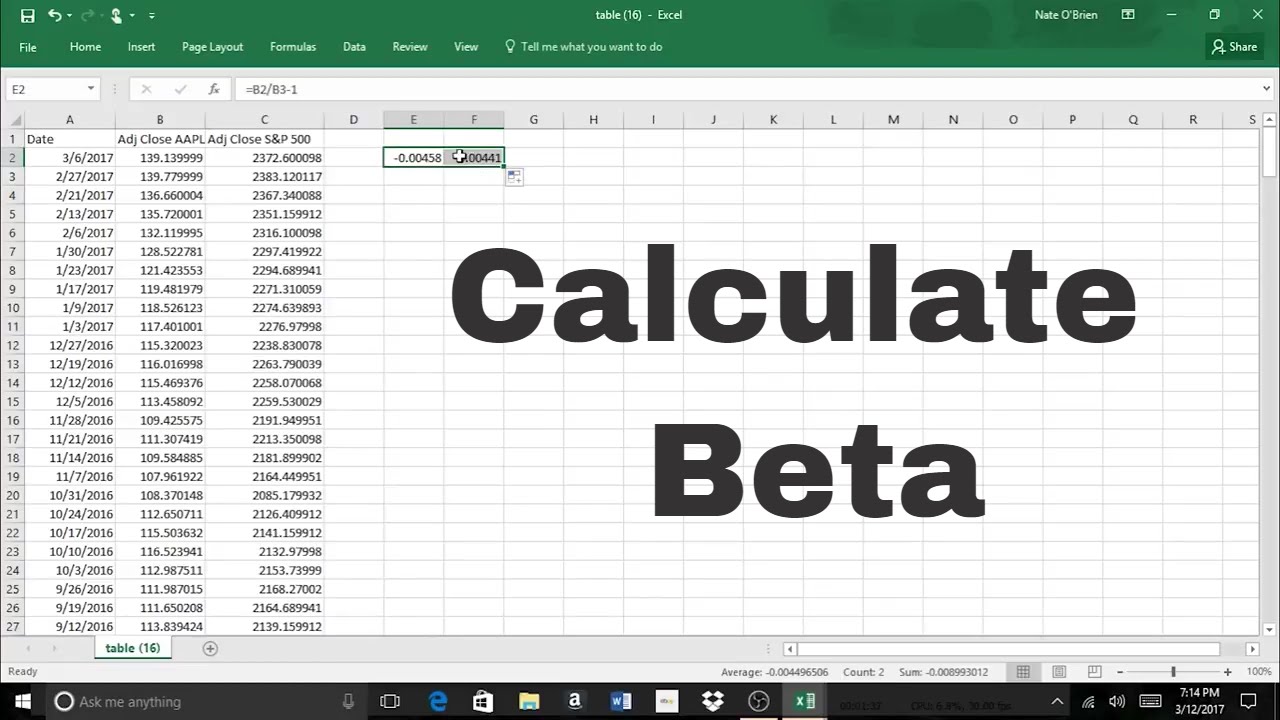

Beta formula = covar (d1: Web the example considers the values of the last three years (about 750 days of trading) and a formula in excel, to calculate beta. Excel provides the following functions: Below is a sample dataset: While calculating the beta, you need to calculate the returns of your stock price first. Google.

How To Calculate The Beta Of A Stock In Excel Haiper

Web use excel's =covariance.s function to find the covariance between the asset and the benchmark. Web excel worksheet functions. Web the formula to calculate beta is: Web formula for calculating beta: Web the formula is: Web the example considers the values of the last three years (about 750 days of trading) and a formula in.

How To Calculate Beta on Excel Linear Regression & Slope Tool YouTube

Web the formula is: To prepare a dataset for calculating the beta of a stock in excel, you’ll need historical stock prices for the specific stock and a market index. This is the rate of return an investor could expect on an investment in which his or her money is not at risk, such as.

How to type beta symbol in Excel YouTube

Beta is a measure of a particular stock's relative risk to the broader stock market. The beta coefficient represents the slope of the regression line that fits the stock returns and market returns. It can be calculated using the covariance/variance method, the slope method in excel, and the correlation method. Let’s break down this definition..

How to Calculate Beta in Excel (4 Easy Methods) ExcelDemy

Web excel worksheet functions. Web to calculate beta, you must use the formula: The beta formula measures a stock’s volatility relative to the overall stock market. The beta coefficient represents the slope of the regression line that fits the stock returns and market returns. Web calculating beta using a simple equation. Web learn how to.

Beta Formula Calculator for Beta Formula (With Excel template)

If a stock moves less than the market, the stock's beta is less than 1.0. To calculate beta, our first step is ought to be. Beta formula = covar (d1: Web learn how to calculate beta in excel by understanding what beta is, what data to factor in and how to interpret the total. Web.

How to Calculate Beta In Excel All 3 Methods (Regression, Slope

While calculating the beta, you need to calculate the returns of your stock price first. Web excel worksheet functions. The beta is then calculated by dividing the covariance by the variance. The beta formula measures a stock’s volatility relative to the overall stock market. Congratulations, you now know how to calculate beta in excel using.

How to Calculate Beta in Excel for a Stock Wisesheets Blog

Let’s assume you’re analyzing the beta of stock abc to the s&p 500 index. The beta coefficient represents the slope of the regression line that fits the stock returns and market returns. 57k views 13 years ago excel finance free. To put it another way, beta compares the volatility of a stock (or a portfolio).

How To Find Beta In Excel Web steps to calculate beta in excel. Reflects the beta of a given stock / asset , and. Beta = variance of an equity’s return / covariance of the stock index’s return. 57k views 13 years ago excel finance free. Web the example considers the values of the last three years (about 750 days of trading) and a formula in excel, to calculate beta.

Denotes The Weight Or Proportion Invested In Stock / Asset.

Web what is beta a stock that swings more than the market over time has a beta greater than 1.0. For project beta, use the pure play method. Web both manually and using the microsoft excel program. The output will show you the beta, from which you can make a decision about your future investment.

Let’s Get Started With The Calculation Of Beta In Excel By Implementing The Above Mathematical Formula.

Beta.inv(p, α, β) = x such that beta.dist (x, α, β, true) = p. The covariance measures the extent to which the returns of the stock are related to the returns of the market. Then you can use the covariance.p and var.p functions. Let’s assume you’re analyzing the beta of stock abc to the s&p 500 index.

Web Calculating Beta Using A Simple Equation.

Reflects the beta of a given stock / asset , and. It can be calculated using the covariance/variance method, the slope method in excel, and the correlation method. Excel provides the following functions: This simple, yet easy to understand video provides you with the ability to.

The Beta Is Then Calculated By Dividing The Covariance By The Variance.

Web excel finance class 107: Web the formula to calculate beta is: Congratulations, you now know how to calculate beta in excel using these simple steps. Web learn how to calculate beta in excel by understanding what beta is, what data to factor in and how to interpret the total.