How To Calculate Ytm In Excel

How To Calculate Ytm In Excel - Web the formula for yield to maturity in excel is: Web to calculate ytm in excel, use the yieldmat function. Web this may be solved using a trial and error process or the equation may be solved for in excel using the goal seek functionality. These include the initial principal amount invested, the interest rate to be. Trial and error process for.

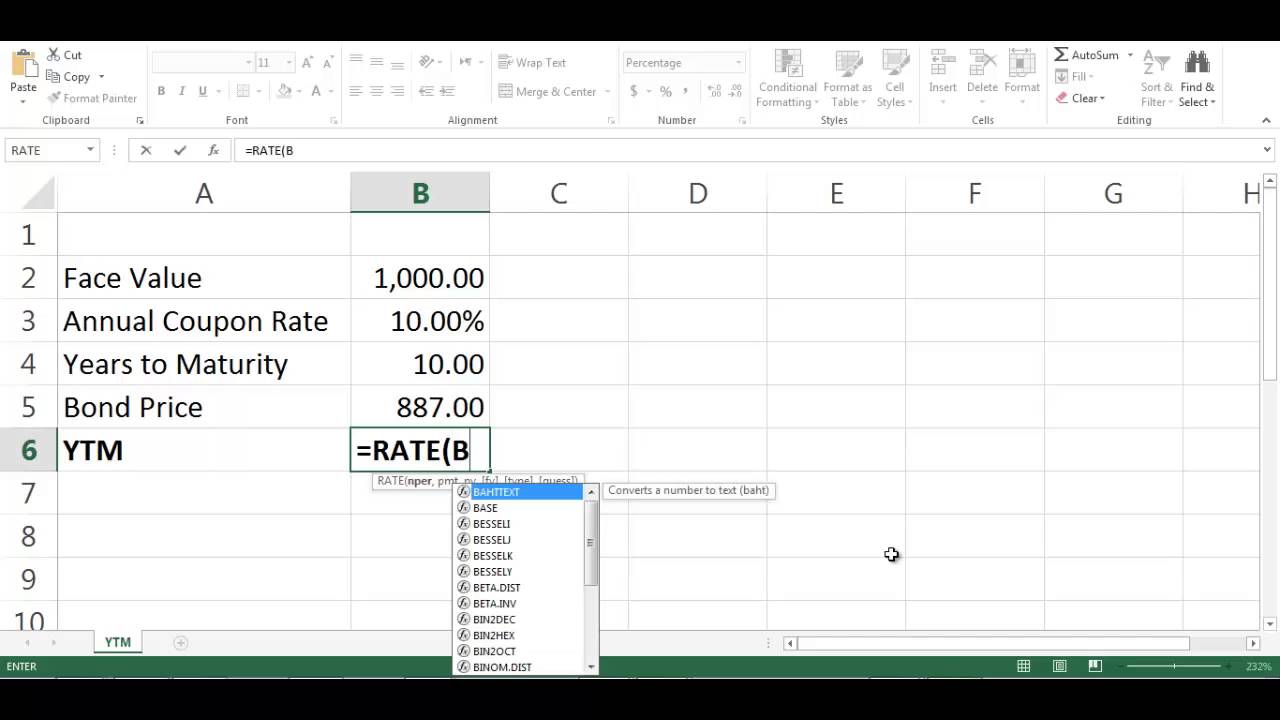

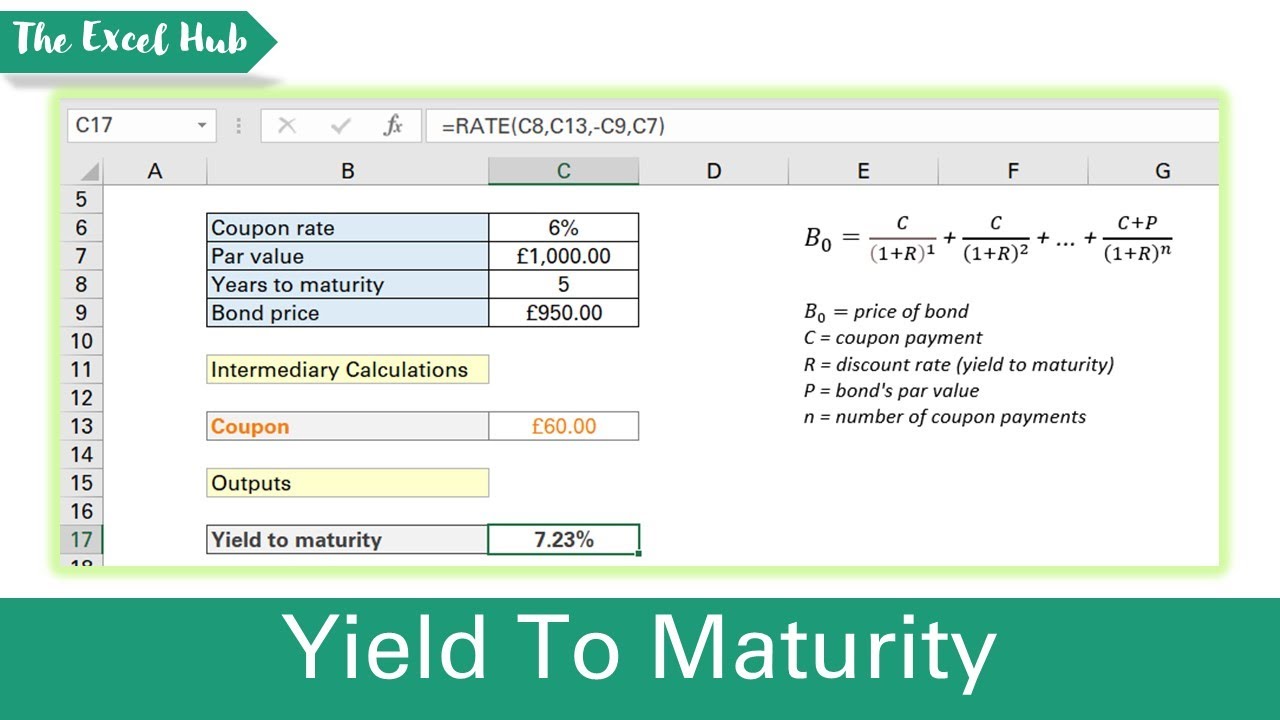

Calculate the ytm of a bond using the. How to use =rate in ms excel to calculate ytm for bonds. Calculating ytm allows investors to compare different bond options and make choices based on potential. Go through the other videos on this playlist to see how to. Learn how to calculate the yield to maturity (ytm) of bond using excel in this video. Web with your excel sheet set up, calculating ytm is straightforward. Web the web page explains how to price a bond and calculate its yield to maturity (ytm) using excel.

Finding Yield to Maturity using Excel YouTube

Web to calculate ytm in excel, use the yieldmat function. Web the formula for yield to maturity in excel is: 35k views streamed 6 years ago. The video also briefly covers the basics of bond. Web the web page explains how to price a bond and calculate its yield to maturity (ytm) using excel. =irr(range.

How to calculate YTM in Excel Basic Excel Tutorial

The video also briefly covers the basics of bond. Specifically i show how students can use =rate and =irr functions. C = annual coupon payment f = face value of the bond p = price paid for the bond n = number of years to maturity. Use the rate () function to calculate ytm in.

How to Make a Yield to Maturity Calculator in Excel ExcelDemy

=ytm(n,c1:cn,p,fv) where n is the number of periods,. Web you will now use the irr formula to calculate the ytm: Web in this video, students will learn how to think about and calculate the yield to maturity of a bond. Learn how to calculate the yield to maturity (ytm) of bond using excel in this.

How to calculate YTM in Excel Basic Excel Tutorial

Use the rate () function to calculate ytm in excel. C = annual coupon payment f = face value of the bond p = price paid for the bond n = number of years to maturity. How to calculate the yield to maturity with the irr function. =ytm(n,c1:cn,p,fv) where n is the number of periods,..

How to Calculate YTM and effective annual yield from bond cash flows in

The yield to maturity (ytm) is. Web this article describes the formula syntax and usage of the yield function in microsoft excel. Web this may be solved using a trial and error process or the equation may be solved for in excel using the goal seek functionality. Web to calculate ytm in excel, use the.

Calculating bond’s yield to maturity using excel YouTube

Web the yield formula in excel helps you to calculate the yield to maturity of a bond by entering the following information (arguments) into the formula: C = annual coupon payment f = face value of the bond p = price paid for the bond n = number of years to maturity. Web with your.

Calculate The Yield To Maturity Of A Bond In Excel YouTube

C = annual coupon payment f = face value of the bond p = price paid for the bond n = number of years to maturity. Use the rate () function to calculate ytm in excel. Returns the yield on a security that pays periodic interest. Web the web page explains how to price a.

Calculate The YTM Of A Bond With Semi Annual Coupon Payments In Excel

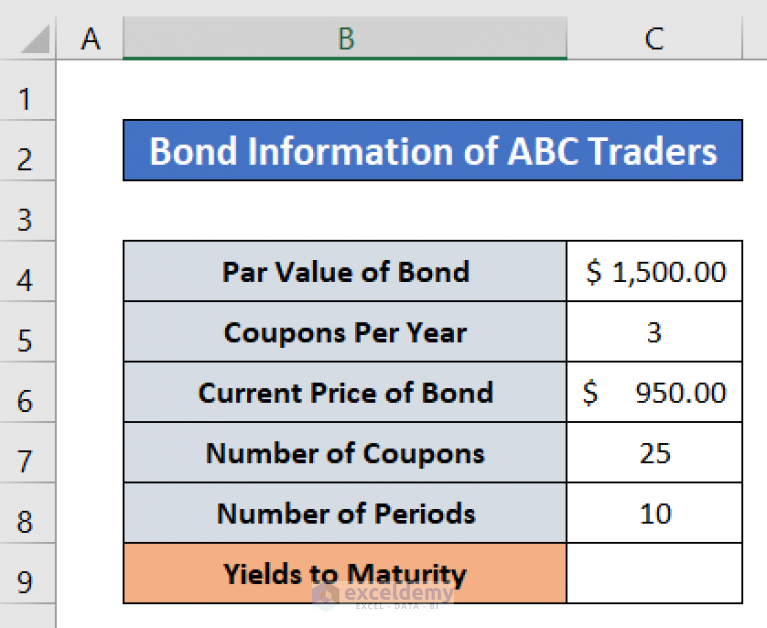

Settlement date, maturity date, issue date, rate, price per $100 face value (pr), and day. Use direct formula to calculate the ytm of a bond. These include the initial principal amount invested, the interest rate to be. Calculating ytm allows investors to compare different bond options and make choices based on potential. Learn how to.

How to Calculate YTM of a Bond in Excel (4 Suitable Methods)

Web with your excel sheet set up, calculating ytm is straightforward. Calculating ytm allows investors to compare different bond options and make choices based on potential. =irr(range of cash flows, [guess]) in this formula, the range of cash flows is the range of interest rates that. You’ll need to use the following formula: Values is.

How to Calculate Yield to Maturity Excel YTM YIELDMAT Function Earn

Web in this video, students will learn how to think about and calculate the yield to maturity of a bond. The yield to maturity (ytm) is. Web to calculate ytm in excel, use the yieldmat function. Learn how to calculate the yield to maturity (ytm) of bond using excel in this video. 35k views streamed.

How To Calculate Ytm In Excel Learn how to calculate the yield to maturity (ytm) of bond using excel in this video. Use direct formula to calculate the ytm of a bond. Returns the yield on a security that pays periodic interest. You’ll need to use the following formula: The video also briefly covers the basics of bond.

Use Direct Formula To Calculate The Ytm Of A Bond.

=irr(range of cash flows, [guess]) in this formula, the range of cash flows is the range of interest rates that. Guess is an optional argument that. The video also briefly covers the basics of bond. The yield to maturity (ytm) is.

Web Ytm Is The Total Return Anticipated On A Bond If It Is Held Until It Matures.

It provides a formula, an example, and a graphic to show how the pricing of a bond depends on the difference between the coupon rate and the. \begin {aligned}&\text {yield to maturity}\\&\qquad=\left. =ytm(n,c1:cn,p,fv) where n is the number of periods,. Trial and error process for.

Web This May Be Solved Using A Trial And Error Process Or The Equation May Be Solved For In Excel Using The Goal Seek Functionality.

Calculating ytm allows investors to compare different bond options and make choices based on potential. Returns the yield on a security that pays periodic interest. Web the yield to maturity (ytm) is the expected annual rate of return earned on a bond, assuming the debt security is held until maturity. Web this article describes the formula syntax and usage of the yield function in microsoft excel.

Web To Calculate Ytm In Excel, Use The Yieldmat Function.

Web the yield formula in excel helps you to calculate the yield to maturity of a bond by entering the following information (arguments) into the formula: These include the initial principal amount invested, the interest rate to be. Since the yield to maturity represents the annualized return on a bond, you can also use the internal. Calculate the ytm of a bond using the.