How To Calculate Bond Price In Excel

How To Calculate Bond Price In Excel - For example, the price function can be used to determine the clean. This is the face value of the bond, typically $1,000 or $1,000,000. The current price of a bond is the sum of the present value of its remaining coupons and principal. Web the first step in calculating bond price in excel is to input the bond's par value. See examples, formulas and screenshots for different.

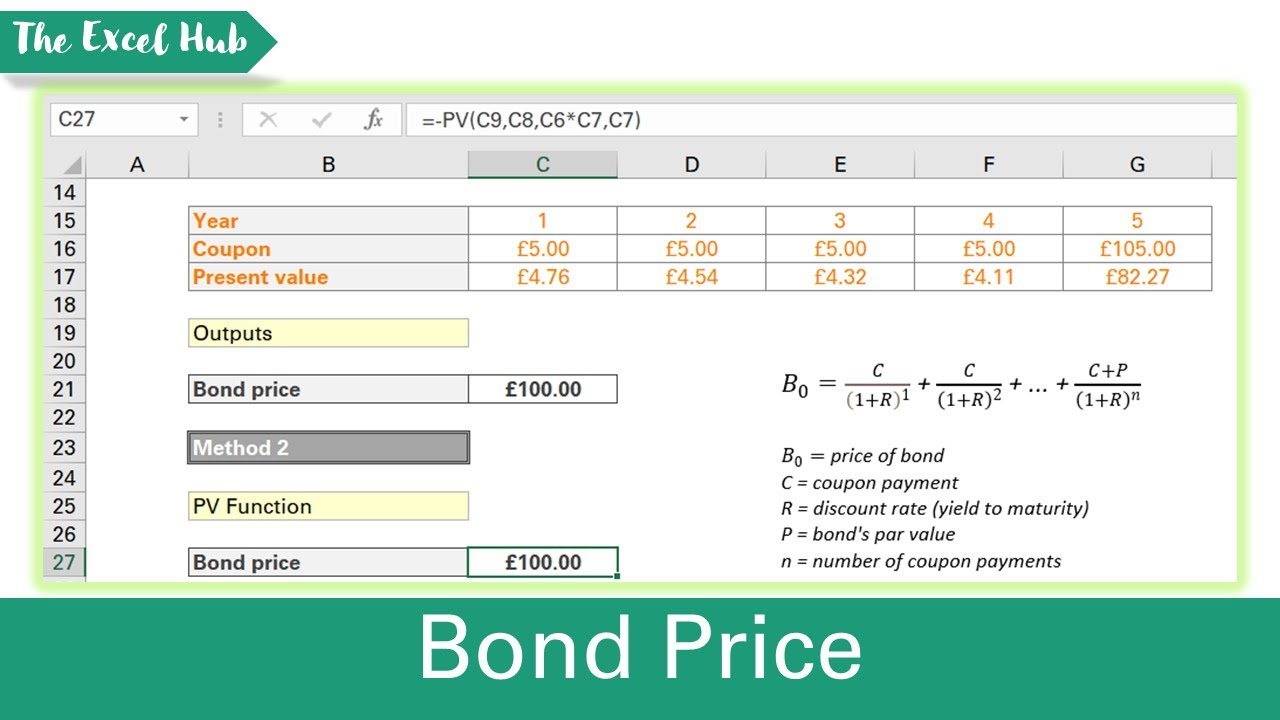

Web the first step is to input the necessary data for your bond valuation. Web the excel price function returns the price per $100 face value of a security that pays periodic interest. Web steps to calculate the bond price using excel. Web in this tutorial, i show you how you can use the price function in microsoft excel to calculate the price of a bond that has periodic coupon payments. It is used to value bonds. In excel, you can simply enter this. Web price calculates the cost of a bond per $100 face value based on inputs like settlement date, maturity, coupon rate, yield, and frequency.

Calculate Bond Price from Yield in Excel (3 Easy Ways) ExcelDemy

Web want to learn how to calculate bond price in excel? It is used to value bonds. Web learn different methods to calculate bond price in excel using conventional formulas, pv function, price function, and dirty bond price. The current price of a bond is the sum of the present value of its remaining coupons.

How to Calculate the Issue Price of a Bond in Excel ExcelDemy

Web how to calculate the price of a bond in excel. See examples, screenshots, and download the workbook for practice. Web the first step in calculating bond price in excel is to input the bond's par value. Combine components to determine the discount rate. It will calculate the price of a bond per $100 face.

3 Ways to Calculate Bond Value in Excel wikiHow

Web vba/macros course (40% discount): See examples, screenshots, and download the workbook for practice. This includes the bond’s par value, coupon rate, time to maturity, and yield to maturity. Web the first step is to input the necessary data for your bond valuation. This tutorial demonstrates how to use the excel price function in excel.

How to Calculate Bond Yield in Excel 7 Steps (with Pictures)

Web the pricedisc function is categorized under excel financial functions. Web vba/macros course (40% discount): Web the first step is to input the necessary data for your bond valuation. It is used to value bonds. Web first, enter the bond criteria given, including its maturity date, the face value of the bond, the number of.

Calculate Bond Price from Yield in Excel (3 Easy Ways) ExcelDemy

This tutorial demonstrates how to use the excel price function in excel to calculate the. Web the first step in calculating bond price in excel is to input the bond's par value. Web want to learn how to calculate bond price in excel? Web the excel price function returns the price per $100 face value.

How To Calculate The Price Of A Bond In Excel YouTube

Web how to calculate the price of a bond in excel. This includes the bond’s par value, coupon rate, time to maturity, and yield to maturity. Web the first step in calculating bond price in excel is to input the bond's par value. The current price of a bond is the sum of the present.

Calculate Bond Price from Yield in Excel (3 Easy Ways) ExcelDemy

This tutorial demonstrates how to use the excel price function in excel to calculate the. Web first, enter the bond criteria given, including its maturity date, the face value of the bond, the number of compounding periods, the stated rate of the bond, and the. Number of years to maturity is 9. Web the first.

How to Calculate Bond Price in Excel (4 Simple Ways) ExcelDemy

Web learn different methods to calculate bond price in excel using conventional formulas, pv function, price function, and dirty bond price. It is used to value bonds. See examples, screenshots, and download the workbook for practice. Web the first step in calculating bond price in excel is to input the bond's par value. In excel,.

How to Calculate the Issue Price of a Bond in Excel ExcelDemy

Web the formula for calculating bond price involves several components, including the bond's par value, coupon rate, time to maturity, and the prevailing market interest rate. The current price of a bond is the sum of the present value of its remaining coupons and principal. For example, the price function can be used to determine.

How to Calculate Bond Price in Excel (4 Simple Ways) ExcelDemy

Number of years to maturity is 9. Web this video shows how to price a bond with excel (premium, discount and at par) and amortize the bond using the interest method. Web the pricedisc function is categorized under excel financial functions. For example, the price function can be used to determine the clean. Web want.

How To Calculate Bond Price In Excel Combine components to determine the discount rate. Web the first step is to input the necessary data for your bond valuation. Web first, enter the bond criteria given, including its maturity date, the face value of the bond, the number of compounding periods, the stated rate of the bond, and the. Web the first step in calculating bond price in excel is to input the bond's par value. Web steps to calculate the bond price using excel.

Number Of Years To Maturity Is 9.

Web steps to calculate the bond price using excel. Let’s explore the process of calculating the following bond price using excel: Web want to learn how to calculate bond price in excel? Web the excel price function returns the price per $100 face value of a security that pays periodic interest.

Web How To Calculate The Price Of A Bond In Excel.

For example, the price function can be used to determine the clean. It will calculate the price of a bond per $100 face value of a discounted security. Web learn different methods to calculate bond price in excel using conventional formulas, pv function, price function, and dirty bond price. This includes the bond’s par value, coupon rate, time to maturity, and yield to maturity.

Web In This Tutorial, I Show You How You Can Use The Price Function In Microsoft Excel To Calculate The Price Of A Bond That Has Periodic Coupon Payments.

Web this video shows how to price a bond with excel (premium, discount and at par) and amortize the bond using the interest method. See examples, screenshots, and download the workbook for practice. Web price calculates the cost of a bond per $100 face value based on inputs like settlement date, maturity, coupon rate, yield, and frequency. It is used to value bonds.

Web The First Step In Calculating Bond Price In Excel Is To Input The Bond's Par Value.

This is the face value of the bond, typically $1,000 or $1,000,000. Web vba/macros course (40% discount): This tutorial demonstrates how to use the excel price function in excel to calculate the. Web the formula for calculating bond price involves several components, including the bond's par value, coupon rate, time to maturity, and the prevailing market interest rate.