How To Calculate Beta In Excel

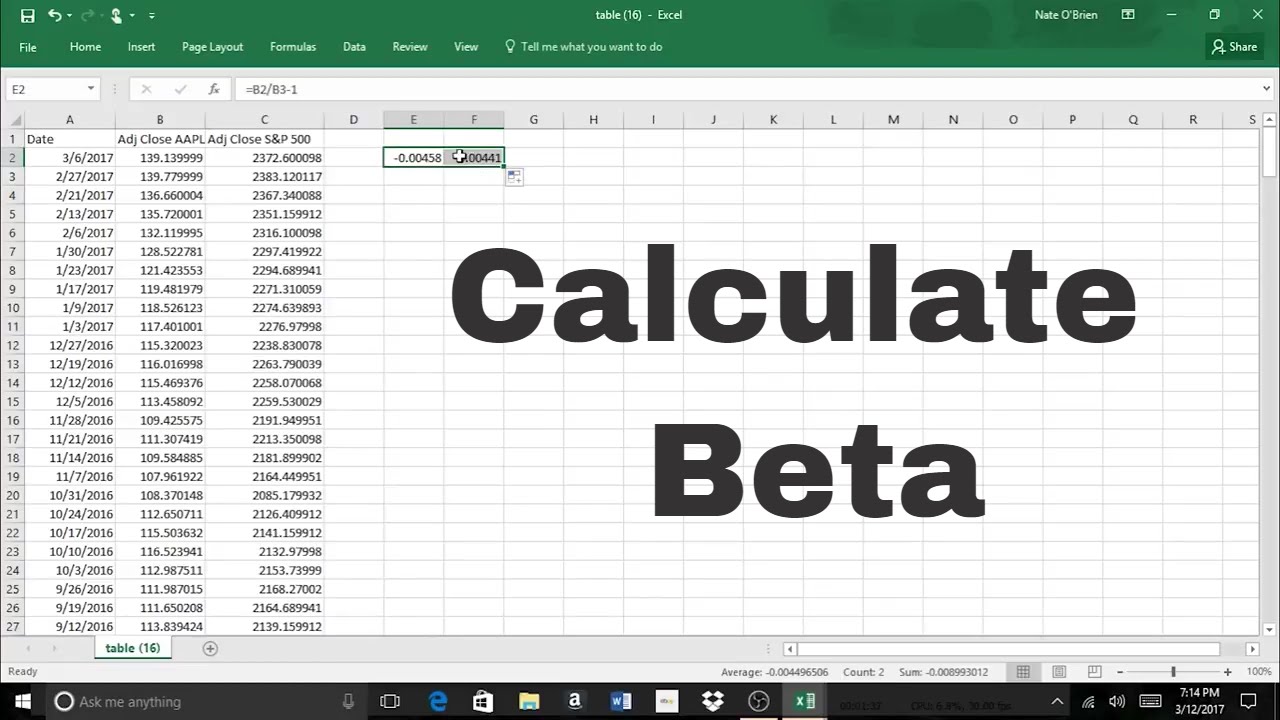

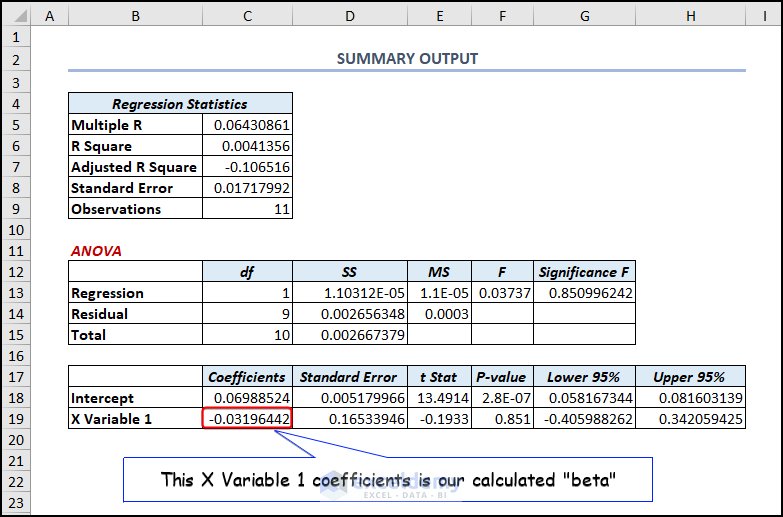

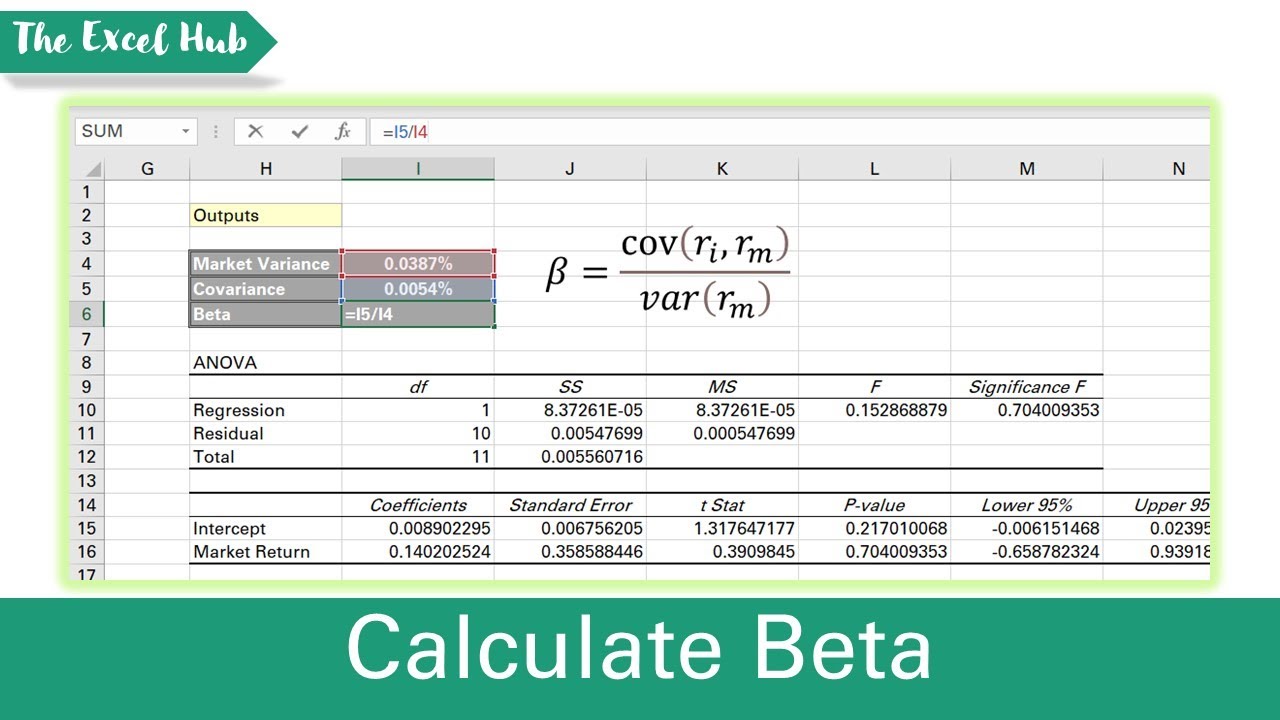

How To Calculate Beta In Excel - The covariance measures the extent to which the returns of the stock are related to the returns of the market. Beta = covariance of stock and market/ market variance. Calculate the slope (beta) of the linear regression line through data points (price. Essentially, beta measures the volatility of a stock relative to the broader market. Web to determine the beta of a stock in excel, you’ll use the covariance and variance values calculated earlier.

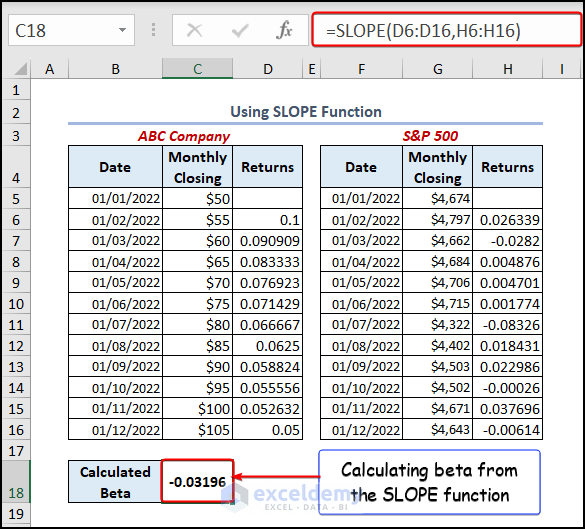

Beta formula = covar (d1: You could of course merge the two functions into a combined formula like this: Then you can use the covariance.p and var.p functions. Calculate the slope (beta) of the linear regression line through data points (price. Download historical security prices for the asset whose beta you want to measure. The beta coefficient represents the slope of the regression line that fits the stock returns and market returns. The formula for beta is:

How To Calculate Beta on Excel Linear Regression & Slope Tool YouTube

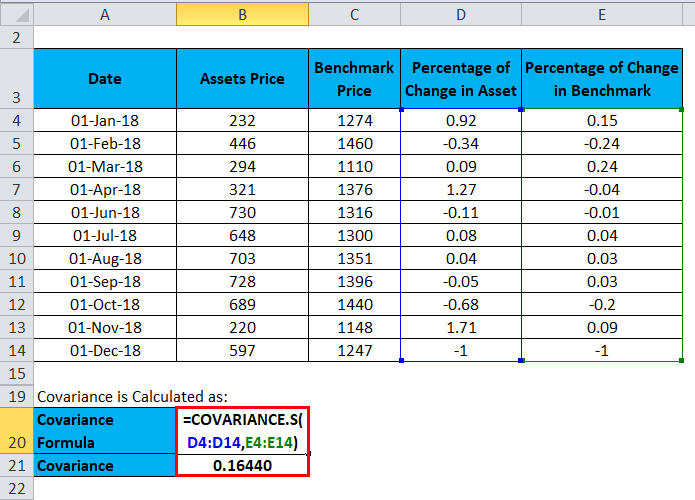

Beta formula = covar (d1: In this data, the covariance is in cell c12, and the market variance is in cell c13. Essentially, beta measures the volatility of a stock relative to the broader market. Calculate the slope (beta) of the linear regression line through data points (price. Web learn how to calculate your own.

How to Calculate Beta in Excel StepByStep Video on Calculation of

Beta = covariance of stock and market/ market variance. Beta = covariance (stock returns, market returns) / variance (market returns) to use this formula, you need to have historical returns data for the stock and the market. Beta = covariance / variance. Web divide the covariance by the variance to calculate beta. Web to calculate.

Beta Formula Calculator for Beta Formula (With Excel template)

Beta = covariance of stock and market/ market variance. Beta = covariance / variance. Finally, you can calculate the beta of the stock by dividing the covariance by the variance: The output will show you the beta, from which you can make a decision about your future investment. Congratulations, you now know how to calculate.

How to Calculate Beta in Excel (4 Easy Methods) ExcelDemy

A beta of 1 indicates that the stock’s price will move in lockstep with the market. Then you can use the covariance.p and var.p functions. The output will show you the beta, from which you can make a decision about your future investment. Web learn how to calculate your own beta using microsoft excel in.

How to Calculate Beta in Excel (4 Easy Methods) ExcelDemy

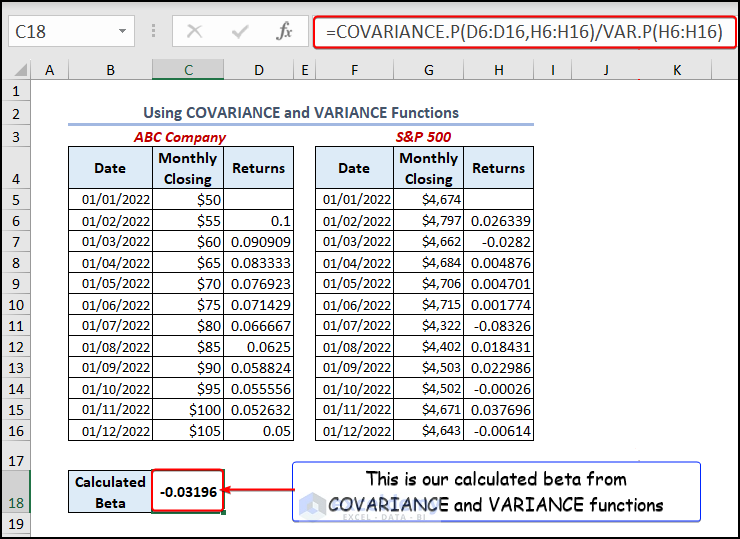

Finally, you can calculate the beta of the stock by dividing the covariance by the variance: You could of course merge the two functions into a combined formula like this: Web the formula to calculate beta is: Web the formula is: This measure provides insights into the level of risk of a stock relative to.

How To Calculate The Beta Of A Stock In Excel Haiper

Calculate the slope (beta) of the linear regression line through data points (price. This measure provides insights into the level of risk of a stock relative to the market. The formula for beta is: The covariance measures the extent to which the returns of the stock are related to the returns of the market. Beta.

How to Calculate Beta in Excel for a Stock Wisesheets Blog

Web =var.s (index returns) step 4: This measure provides insights into the level of risk of a stock relative to the market. Web learn how to calculate your own beta using microsoft excel in order to provide a risk measure that's personalized for your individual portfolio. While calculating the beta, you need to calculate the.

How to Calculate Beta In Excel All 3 Methods (Regression, Slope

Beta = covariance / variance. Web to calculate beta in excel: Download historical security prices for the comparison benchmark. A beta of 1 indicates that the stock’s price will move in lockstep with the market. Beta = covariance / variance. You could of course merge the two functions into a combined formula like this: Web.

How to Calculate Beta in Excel (4 Easy Methods) ExcelDemy

Beta formula = covar (d1: Web to determine the beta of a stock in excel, you’ll use the covariance and variance values calculated earlier. Beta = covariance / variance. Web =var.s (index returns) step 4: Web the example considers the values of the last three years (about 750 days of trading) and a formula in.

Calculate The Beta Of A Portfolio In Excel The Excel Hub YouTube

Beta = covariance / variance. Web to calculate beta in excel: Web divide the covariance by the variance to calculate beta. Web to determine the beta of a stock in excel, you’ll use the covariance and variance values calculated earlier. Beta = covariance of stock and market/ market variance. Web the example considers the values.

How To Calculate Beta In Excel A beta of 1 indicates that the stock’s price will move in lockstep with the market. Web to calculate beta in excel: You could of course merge the two functions into a combined formula like this: Web to determine the beta of a stock in excel, you’ll use the covariance and variance values calculated earlier. Finally, you can calculate the beta of the stock by dividing the covariance by the variance:

This Measure Provides Insights Into The Level Of Risk Of A Stock Relative To The Market.

Web =var.s (index returns) step 4: Web to determine the beta of a stock in excel, you’ll use the covariance and variance values calculated earlier. The covariance measures the extent to which the returns of the stock are related to the returns of the market. While calculating the beta, you need to calculate the returns of your stock price first.

Beta = Covariance Of Stock And Market/ Market Variance.

Web to calculate beta in excel: Essentially, beta measures the volatility of a stock relative to the broader market. Web divide the covariance by the variance to calculate beta. Congratulations, you now know how to calculate beta in excel using these simple steps.

Web The Example Considers The Values Of The Last Three Years (About 750 Days Of Trading) And A Formula In Excel, To Calculate Beta.

Calculate the slope (beta) of the linear regression line through data points (price. Web learn how to calculate your own beta using microsoft excel in order to provide a risk measure that's personalized for your individual portfolio. Finally, you can calculate the beta of the stock by dividing the covariance by the variance: Download historical security prices for the asset whose beta you want to measure.

Web The Formula To Calculate Beta Is:

Beta = covariance / variance. In this data, the covariance is in cell c12, and the market variance is in cell c13. Then you can use the covariance.p and var.p functions. The formula for beta is: