How To Calculate Beta Excel

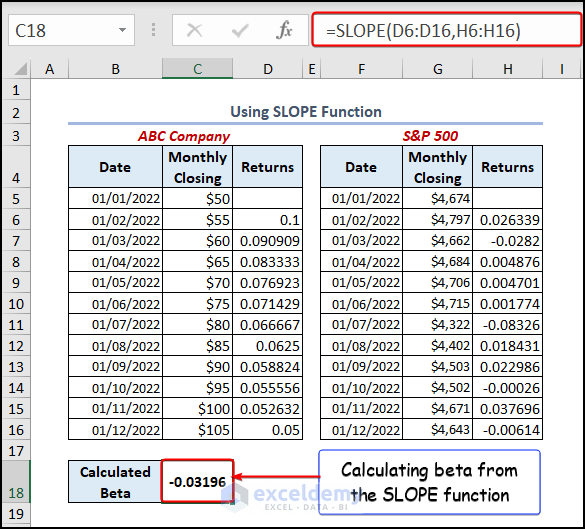

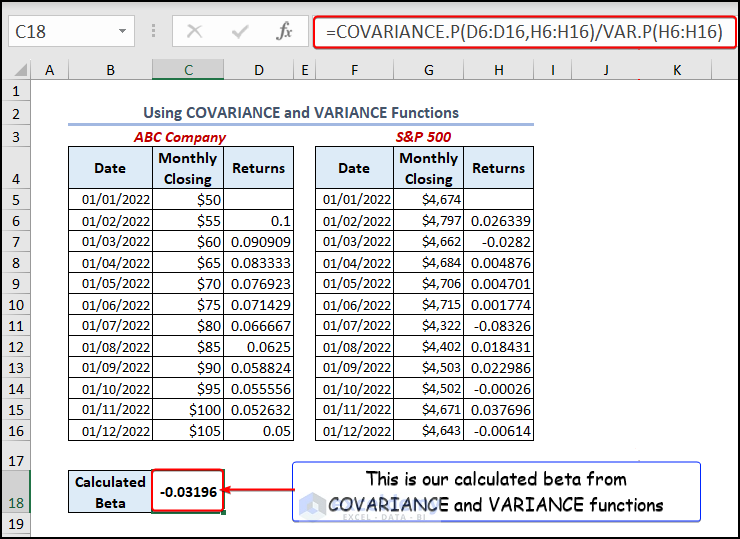

How To Calculate Beta Excel - Β = covariance / variance. You can calculate portfolio beta using this formula: Web you can use either of the three methods to calculate beta (β) in excel, you will arrive to the same answer independent of the method. Start by clicking on the empty cell where you want to display your beta. Web from the ribbon, click formulas > name manager.

Download historical security prices for the asset whose beta you want to measure. This simple, yet easy to understand video provides. 9.7k views 10 months ago analyzing stock returns. Beta = covariance of stock. Β = covariance / variance. Download historical security prices for the comparison. You can download my excel.

How To Calculate The Beta Of A Stock In Excel Haiper

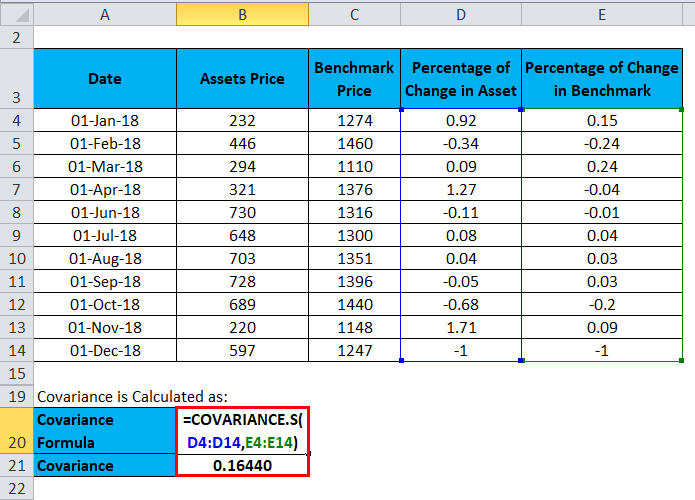

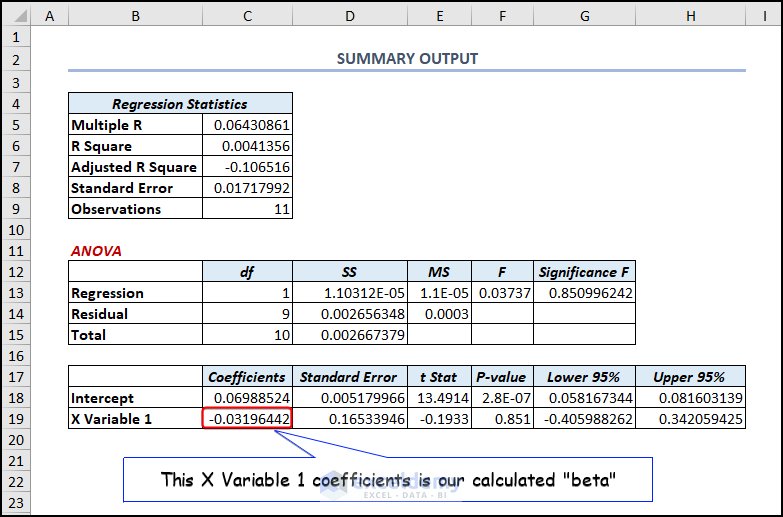

The beta coefficient represents the slope of the regression line that fits the stock returns and market returns. Web apply the beta formula: Finally, you can calculate the beta of the stock by dividing the covariance by the variance: Web from the ribbon, click formulas > name manager. Reflects the beta of a given stock.

How to Calculate Beta in Excel StepByStep Video on Calculation of

Β = covariance / variance. Is how two random variables move together. But first, you need to create a dataset where you need to insert the closing values of the stock. In the new name dialog box enter the following: Web the formula to calculate beta is: Finally, you can calculate the beta of the.

How to Calculate Beta in Excel (4 Easy Methods) ExcelDemy

You can download my excel. Also, you need to set the market value. Web from the ribbon, click formulas > name manager. Once calculated, interpreting the beta value is essential. In this video tutorial, we explain how to calculate beta in excel, using four. Web apply the beta formula: Represents the beta of the portfolio..

How To Calculate Beta on Excel Linear Regression & Slope Tool YouTube

What is the capm beta? Begin by transforming your dataset into a named table. Once calculated, interpreting the beta value is essential. Web the formula is: Web this is how you can calculate beta using a formula: How to manually calculate beta for a portfolio + an. Finally, you can calculate the beta of the.

Calculate The Beta Of A Portfolio In Excel The Excel Hub YouTube

296k views 6 years ago. Also, you need to set the market value. Is how two random variables move together. How to manually calculate beta for a portfolio + an. Web table of contents. Beta = covariance / variance. You can calculate portfolio beta using this formula: Reflects the beta of a given stock /.

Beta Formula Calculator for Beta Formula (With Excel template)

Web apply the beta formula: Download historical security prices for the asset whose beta you want to measure. Β = covariance / variance. You can download my excel. Web to calculate beta in excel: Reflects the beta of a given stock / asset , and. But first, you need to create a dataset where you.

How to Calculate Beta In Excel All 3 Methods (Regression, Slope

Web table of contents. Download historical security prices for the comparison. The formula for beta is: Web you can use either of the three methods to calculate beta (β) in excel, you will arrive to the same answer independent of the method. Web to calculate beta in excel: Begin by transforming your dataset into a.

How to Calculate Beta in Excel (4 Easy Methods) ExcelDemy

Represents the beta of the portfolio. Web one common way to calculate beta is through regression analysis, a statistical technique used to examine the relationship between two or more variables. Is how two random variables move together. Download historical security prices for the asset whose beta you want to measure. 9.7k views 10 months ago.

Beta Formula Calculator for Beta Formula (With Excel template)

Web the formula is: Web you can use either of the three methods to calculate beta (β) in excel, you will arrive to the same answer independent of the method. The formula for beta is: Start by clicking on the empty cell where you want to display your beta. There are several methods to calculate.

How to Calculate Beta in Excel (4 Easy Methods) ExcelDemy

Web from the ribbon, click formulas > name manager. It can be daily, weekly, monthly, or yearly. Web =var.s (index returns) step 4: How to manually calculate beta for a portfolio + an. You can calculate portfolio beta using this formula: The formula for beta is: Discover the method to calculate beta, a key financial.

How To Calculate Beta Excel Then, in the name manager dialog box click new. This simple step will make referencing. This simple, yet easy to understand video provides. Beta = covariance (stock returns, market returns) / variance (market returns) to use this formula, you need to have historical. Web to calculate beta in excel:

Represents The Beta Of The Portfolio.

Web suppose i have a following mini table [image below] andd what im trying to do is stack the column 1 and column 2 in one single column, however i also want to stack along with. Web the formula is: Begin by transforming your dataset into a named table. The beta coefficient represents the slope of the regression line that fits the stock returns and market returns.

You Can Calculate Portfolio Beta Using This Formula:

In this tutorial, we will. Download historical security prices for the asset whose beta you want to measure. Β = covariance / variance. It can be daily, weekly, monthly, or yearly.

Beta = Covariance (Stock Returns, Market Returns) / Variance (Market Returns) To Use This Formula, You Need To Have Historical.

Web beta = (covariance of stock and market returns) / (variance of market returns) covariance: Web this is how you can calculate beta using a formula: In this video tutorial, we explain how to calculate beta in excel, using four. In the new name dialog box enter the following:

Here, We Have Taken A Dataset Of The “Monthly Closing Of The Stock Price Of Abc.

Download historical security prices for the comparison. Finally, you can calculate the beta of the stock by dividing the covariance by the variance: Web apply the beta formula: Web the formula to calculate beta is: