How Do Construction Loan Draws Work

How Do Construction Loan Draws Work - (c) current cost to construct per sworn statement(s). Construction loans let future homeowners borrow money to purchase materials and pay for labor necessary to build a home. With a draw schedule in place, an owner or project manager will submit a detailed report of the work completed at certain points in the project. You can pick your lot, customize your floor plan and build the home of your dreams. This packet of documents outlines the.

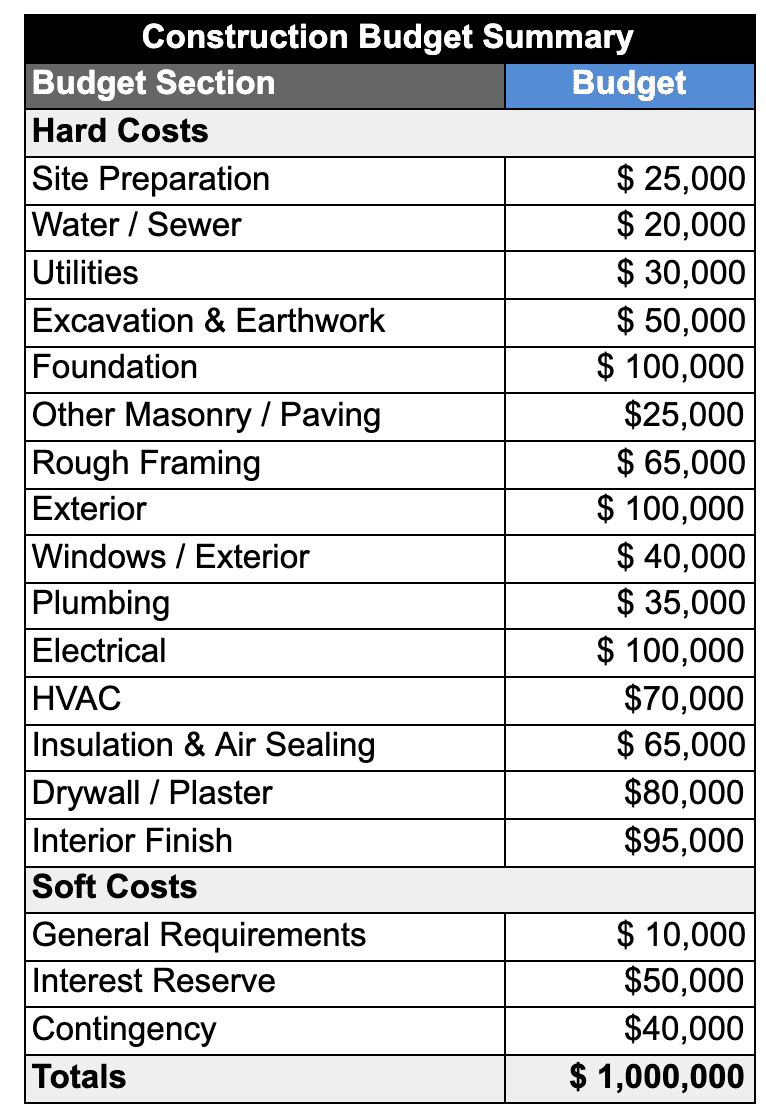

Before speaking to a lender, you need to have a strategic plan for how to use the financing during the construction phase. (c) current cost to construct per sworn statement(s). Web the amortization formula for construction loans is: Web draws are based on the greater of (a) original cost to construct (i.e., building agreement/cost breakdown); Construction loans let future homeowners borrow money to purchase materials and pay for labor necessary to build a home. Web 0:00 / 7:17 understanding the construction loan draw process dan moralez 215 subscribers subscribe 8.7k views 6 years ago construction loan information in this video i talk about the steps we. Web when applying for a heloc, most lenders will require a good credit score and verifiable income to show that you can make the payments.

How Home Construction Loans Work LendingTree

Web 0:00 / 7:17 understanding the construction loan draw process dan moralez 215 subscribers subscribe 8.7k views 6 years ago construction loan information in this video i talk about the steps we. A mortgage, on the other hand, often spans 30 years (or less depending on the. Then, the lender only pays 70 to 80%.

Construction Draw Schedule How Construction Draws are Funded YouTube

You can pick your lot, customize your floor plan and build the home of your dreams. Each “draw” pays the builder for that completed stage of construction. Let’s say you are doing a $200,000 renovation. Web when applying for a heloc, most lenders will require a good credit score and verifiable income to show that.

Understanding the Construction Draw Schedule PropertyMetrics

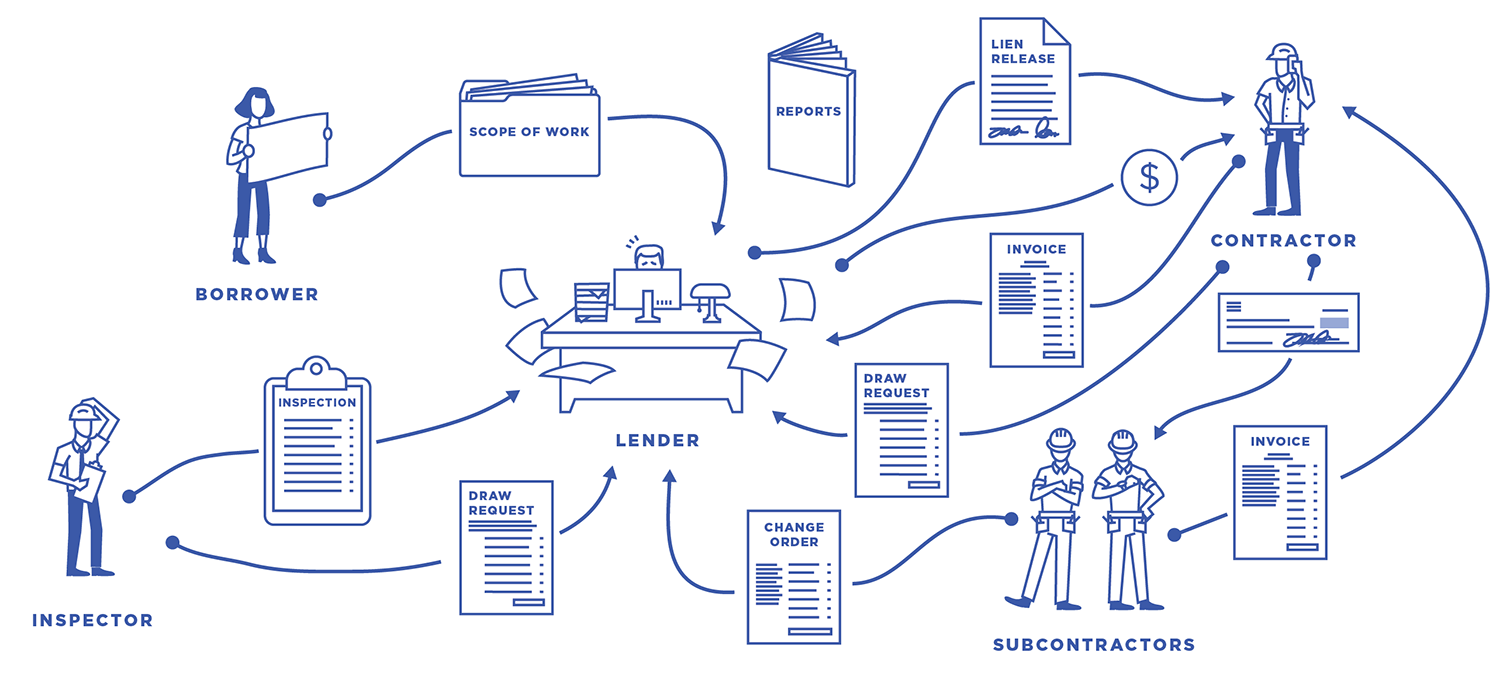

The draw schedule is a detailed payment plan for a construction project. Each “draw” pays the builder for that completed stage of construction. Web you apply for a construction loan from a lender and get approved. First, a construction loan is not a secured loan in the same way that a mortgage is. Web as.

How does a construction loan work? [INFOGRAPHIC] FFORWARD

A mortgage, on the other hand, often spans 30 years (or less depending on the. Your lender will typically disburse the funds in installments, or “draws,” as the construction progresses. The construction draw schedule and schedule of values With a draw schedule in place, an owner or project manager will submit a detailed report of.

How Construction Loan Software Fast Tracks the Construction Draw

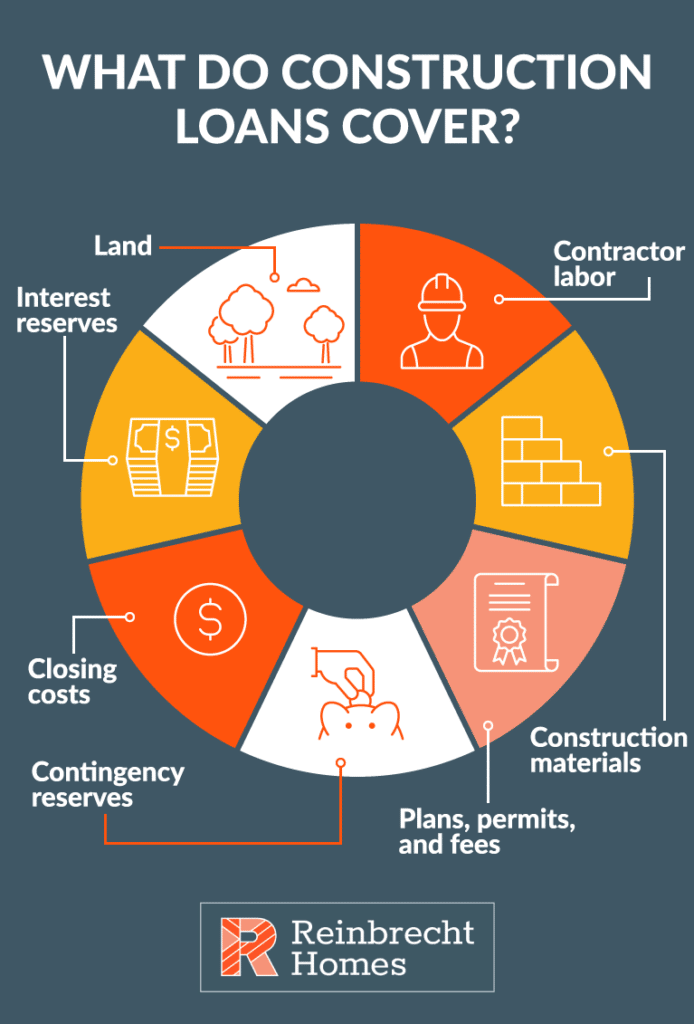

If a bank is financing the project, the draw schedule determines when the bank will disburse funds to you and the contractor. This type of financing can cover a wide range of costs associated with the homebuilding process, including: You must indicate any changes in cost from estimated costs and reflect them on the sworn.

Construction Loans and Draw Schedules Timeline Infographic

Web a construction loan typically lasts for one year, and borrowers pay only interest on the balance owed to the bank. Interest expense = loan balance x interest rate amortization payment = loan balance x amortization rate where: Web there are two main reasons for this. Web the amortization formula for construction loans is: You.

Guide To Building Your Home In The Shenandoah Valley, Virginia

This type of financing can cover a wide range of costs associated with the homebuilding process, including: Web lenders will only finance part of the project. Web draws are based on the greater of (a) original cost to construct (i.e., building agreement/cost breakdown); These are typically split up into various milestones or phases of the.

Understanding The Construction Loan Draw Process YouTube

Land labor costs material costs permits Web once the loan is paid in full, you receive the money. The builder or home buyer takes out a. Web building a home comes with many perks. Interest expense = loan balance x interest rate amortization payment = loan balance x amortization rate where: Web draws are based.

Construction Loans 101 Everything You Need To Know

Web with lenders shouldering more risk, borrowing money for a construction loan comes at a premium. You must indicate any changes in cost from estimated costs and reflect them on the sworn statement. (c) current cost to construct per sworn statement(s). Then, the lender only pays 70 to 80% of the project. Web a construction.

Construction Loans 101 Everything You Need To Know

If a bank is financing the project, the draw schedule determines when the bank will disburse funds to you and the contractor. Building or renovating a home is an exciting time for homeowners. The construction draw schedule and schedule of values Web as the construction project progresses, you’re able to draw down on the loan.

How Do Construction Loan Draws Work If a bank is financing the project, the draw schedule determines when the bank will disburse funds to you and the contractor. Web lenders will only finance part of the project. Then, the lender only pays 70 to 80% of the project. Construction loans typically have a variable interest rate. Web a draw schedule in a construction project outlines when the builder will receive payments—also known as draws—throughout the building process.

Web You Apply For A Construction Loan From A Lender And Get Approved.

You also can often use this. Web how do construction loans work? Web once the loan is paid in full, you receive the money. When taking out a construction loan, the bank isn’t just going to cut a check to your builder for $200,000 upfront.

Your Lender Will Probably Only Require You To Pay Interest During The Building Period.

Web to illustrate how a draw schedule works, assume that a borrower has been approved for a $1mm construction loan and, as part of their loan agreement, they have agreed to a 5 draw schedule where each draw is advanced when the project has reached a multiple of 20% completion. These are typically split up into various milestones or phases of the overall project. A cbl allows you to demonstrate. For commercial construction loans, many lenders ask for a minimum of 20% or more as the down payment.

With A Draw Schedule In Place, An Owner Or Project Manager Will Submit A Detailed Report Of The Work Completed At Certain Points In The Project.

The builder or home buyer takes out a. (c) current cost to construct per sworn statement(s). Web draws are based on the greater of (a) original cost to construct (i.e., building agreement/cost breakdown); When a bank is financing the project, the draw schedule is an agreement between the bank, the builder, and the customer.

This Packet Of Documents Outlines The.

Web there are two main reasons for this. But keep in mind, you’ll only pay the interest on the total amount drawn while your home is being built. Web 0:00 / 7:17 understanding the construction loan draw process dan moralez 215 subscribers subscribe 8.7k views 6 years ago construction loan information in this video i talk about the steps we. With a mortgage, the borrower puts up the home as collateral, which.

![How does a construction loan work? [INFOGRAPHIC] FFORWARD](https://i.pinimg.com/originals/e8/c2/9d/e8c29d6810af87855f2475a3a3573182.png)