Form 941 Template

Form 941 Template - Web irs form 940 is an annual form that needs to be filed by any business that has employees. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll. Web form 941 worksheet for 2022. Web go to www.irs.gov/form941 for instructions and the latest information. Report income taxes, social security.

For example, for the first quarter of the year, form 941 is due on. Web use fill to complete blank online irs pdf forms for free. Once completed you can sign your fillable form or send for signing. Perform an internal information review before you begin filling out form 941, make sure to have all the necessary information on hand. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; March 2023) employer’s quarterly federal tax return department of the treasury — internal.

Download 2013 Form 941 for Free Page 2 FormTemplate

Web go to www.irs.gov/form941 for instructions and the latest information. Web form 941 worksheet for 2022. Read the separate instructions before you complete form. Gather the following to fill out. Web use fill to complete blank online irs pdf forms for free. Web about form 941, employer's quarterly federal tax return. Type or print within.

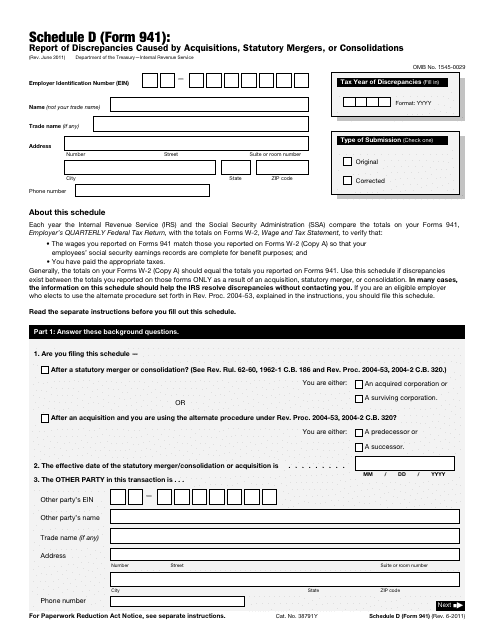

IRS Form 941 Schedule D Download Fillable PDF or Fill Online Report of

Perform an internal information review before you begin filling out form 941, make sure to have all the necessary information on hand. Web go to www.irs.gov/form941 for instructions and the latest information. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web form 941 worksheet for.

Form 941 Fill Out and Sign Printable PDF Template signNow

Web form 941 is due on a quarterly basis at the end of the month following the end of the quarter. Gather the following to fill out. Web go to www.irs.gov/form941 for instructions and the latest information. Web form 941 for 2023: To help business owners calculate the tax credits they are eligible for, the.

Download IRS Form 941 Worksheet Template for FREE

Gather the following to fill out. Type or print within the. Report income taxes, social security. Web and form 941 to the address in the instructions for form 941. Web form 941 for 2023: Web how to complete form 941 in 5 simple steps home resources payroll blog how to complete form 941 in 5.

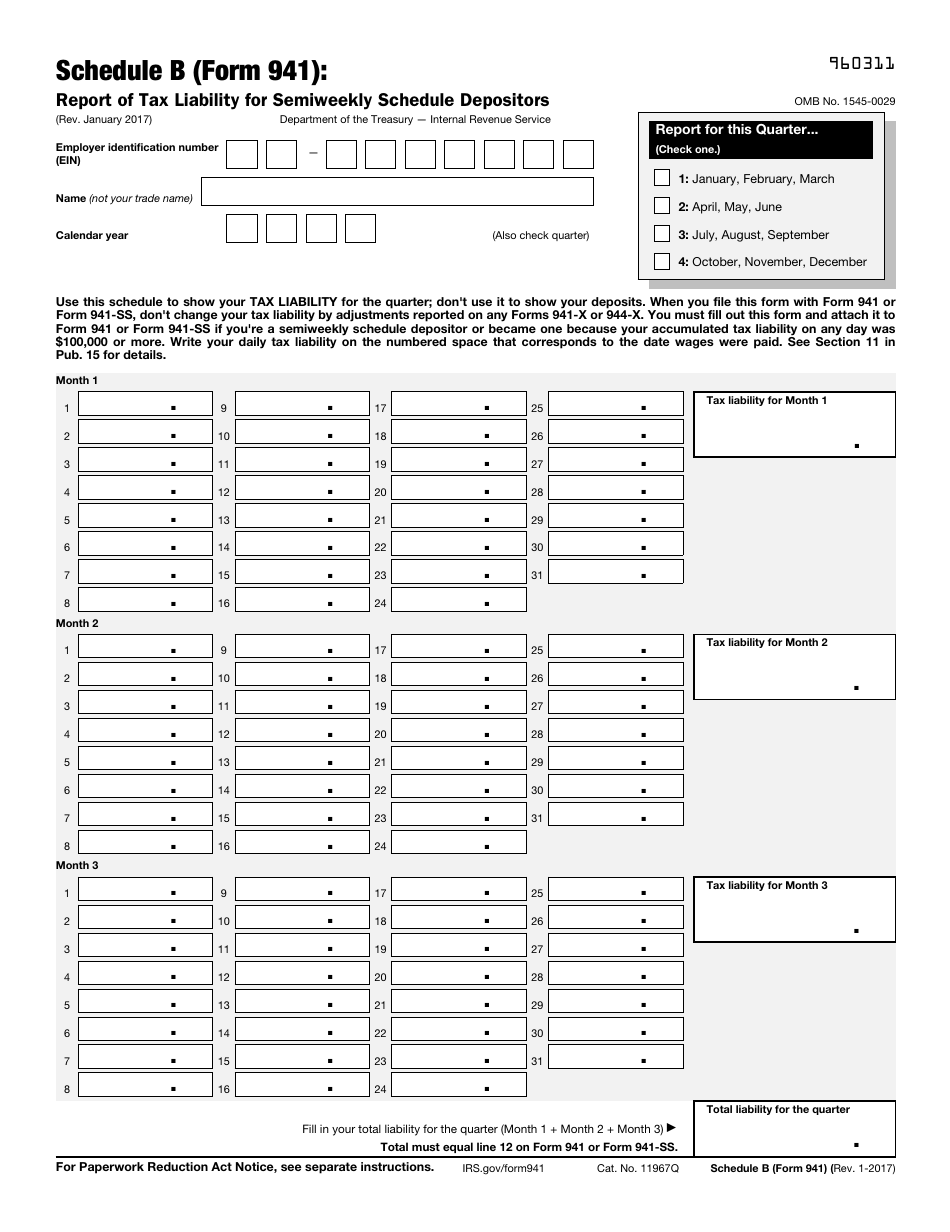

IRS Form 941 Schedule B Download Fillable PDF or Fill Online Report of

Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; For example, for the first quarter of the year, form 941 is due on. Web irs form 941, employer's quarterly federal tax return, is a federal tax form used by employers to report income tax, social. July.

Form 941 (Schedule D) Report of Discrepancies Caused by Acquisitions

Read the separate instructions before you complete form. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web go to www.irs.gov/form941 for instructions and the latest information. Web form 941 is due on a quarterly basis at the end of the month following the end of.

Download IRS Form 941 Worksheet Template for FREE

To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. You must also complete the entity information. Read the separate instructions before you complete form. For example, for the first quarter of the year, form 941 is due on. Once completed you can sign your fillable form or.

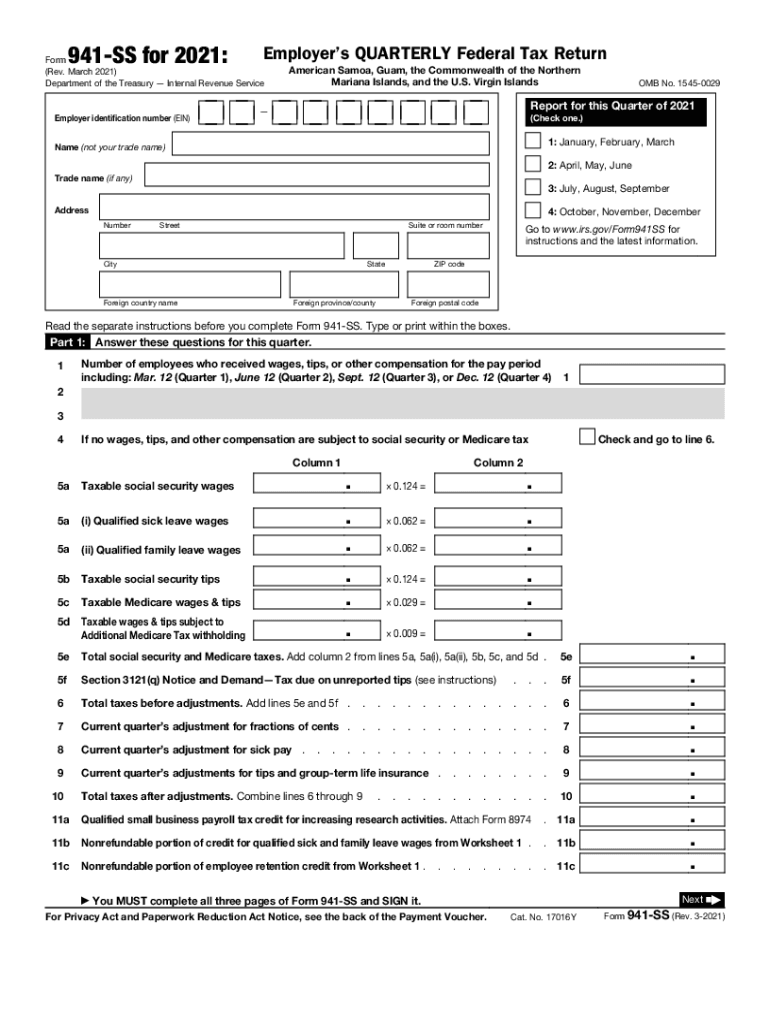

Instructions For Form 941Ss Employer'S Quarterly Federal Tax

Read the separate instructions before you complete form 941. Web irs form 941, employer's quarterly federal tax return, is a federal tax form used by employers to report income tax, social. Web and form 941 to the address in the instructions for form 941. Web go to www.irs.gov/form941 for instructions and the latest information. Web.

Form 941 (Schedule D) Report of Discrepancies Caused by Acquisitions

Web irs form 941, employer's quarterly federal tax return, is a federal tax form used by employers to report income tax, social. Web use fill to complete blank online irs pdf forms for free. Once completed you can sign your fillable form or send for signing. Web form 941 is due on a quarterly basis.

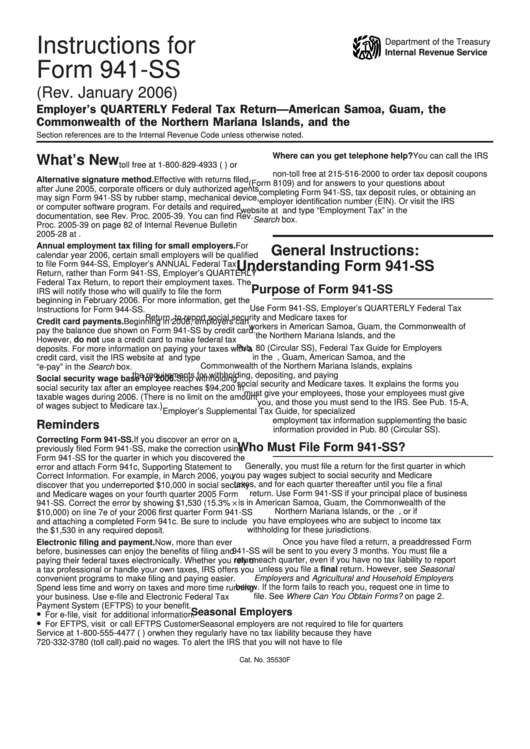

941C Fill Out and Sign Printable PDF Template signNow

Gather form 941 information before you can begin filling out form 941, you must collect some payroll information. Web form 941 is due on a quarterly basis at the end of the month following the end of the quarter. Once completed you can sign your fillable form or send for signing. Web how to complete.

Form 941 Template Type or print within the. Web irs form 941, employer's quarterly federal tax return, is a federal tax form used by employers to report income tax, social. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Perform an internal information review before you begin filling out form 941, make sure to have all the necessary information on hand. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll.

March 2023) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal.

Gather the following to fill out. For example, for the first quarter of the year, form 941 is due on. Web and form 941 to the address in the instructions for form 941. Web irs form 940 is an annual form that needs to be filed by any business that has employees.

File A Final Return And Related Forms You Must File A Final Return For The Year You Close Your Business.

Web go to www.irs.gov/form941 for instructions and the latest information. Web go to www.irs.gov/form941 for instructions and the latest information. Type or print within the. Employers use form 941 to:

Web Form 941 For 2023:

Web irs form 941, employer's quarterly federal tax return, is a federal tax form used by employers to report income tax, social. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the. Gather form 941 information before you can begin filling out form 941, you must collect some payroll information.

Web Irs Form 941, Also Known As The Employer’s Quarterly Federal Tax Return, Is Where Businesses Report The Income Taxes And Payroll.

Irs form 941 is the employer's. Read the separate instructions before you complete form. Web go to www.irs.gov/form941 for instructions and the latest information. Web about form 941, employer's quarterly federal tax return.