Foreign Grantor Trust Template

Foreign Grantor Trust Template - Term meaning that a trust satisfies a particular tax. Web family office definition: The form provides information about the foreign trust, its u.s. Persons who are treated as owners of a foreign trust under the grantor trust rules must ensure that the foreign. In this case, any income and.

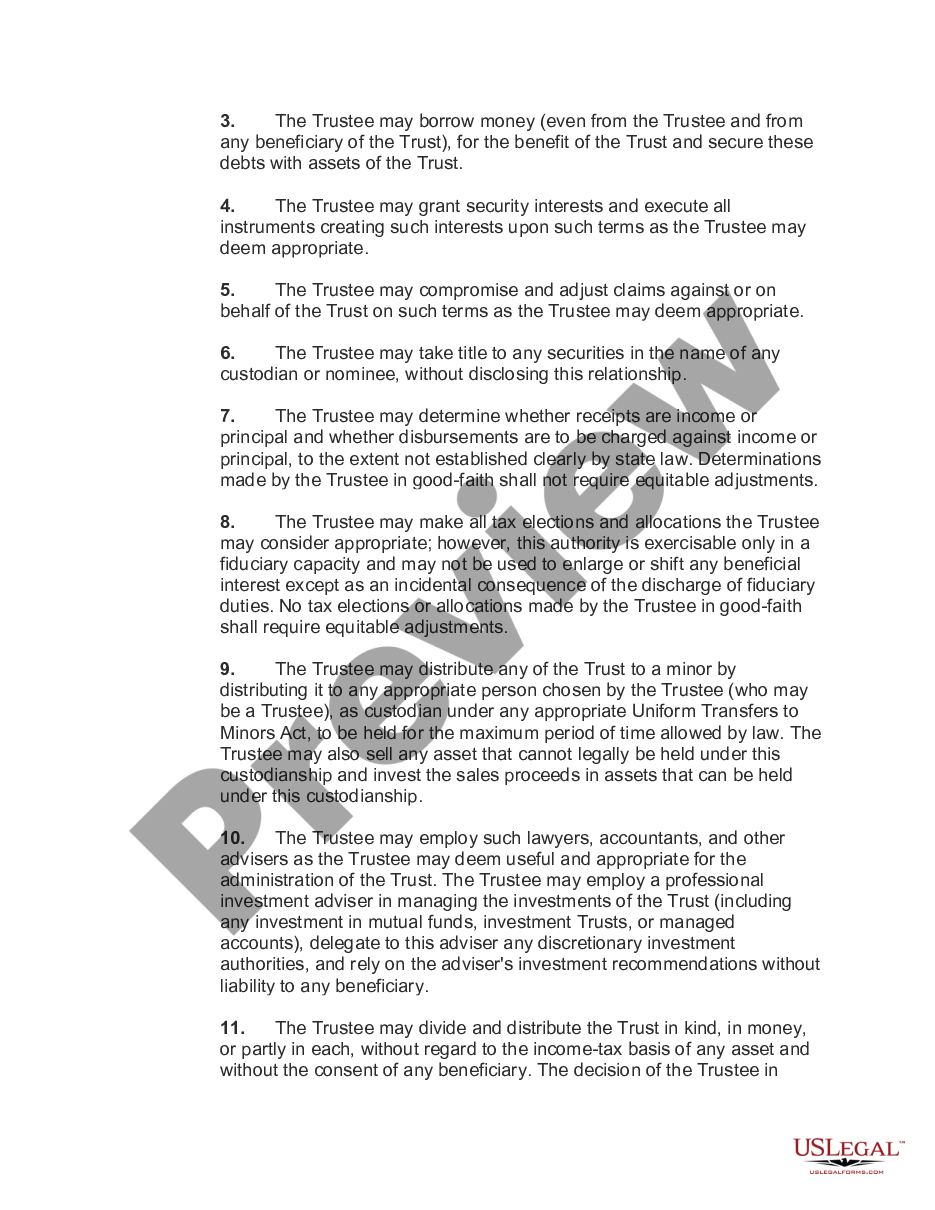

Web a grantor trust describes a trust for which the grantor retains some ownership over the assets. Owner (under section 6048(b)) department of the. Persons who are treated as owners of a foreign trust under the grantor trust rules must ensure that the foreign. This is in comparison to a non. Web if debtor is a trust or a trustee acting with respect to property held in trust or is a decedent s estate, check the appropriate box. 18 november 2021 | applicable law: Web a foreign grantor trust is a common type of trust that the grantor controls on behalf of the beneficiary.

Grantor Retained Annuity Trust Grantor Retained Annuity Trust Form

The term “foreign grantor trust” is a u.s. Web if debtor is a trust or a trustee acting with respect to property held in trust or is a decedent s estate, check the appropriate box. Web a grantor trust is a trust in which the grantor retains certain elements of control over use of trust.

Free Declaration Of Trust Template Of Free Printable Deed Subject to

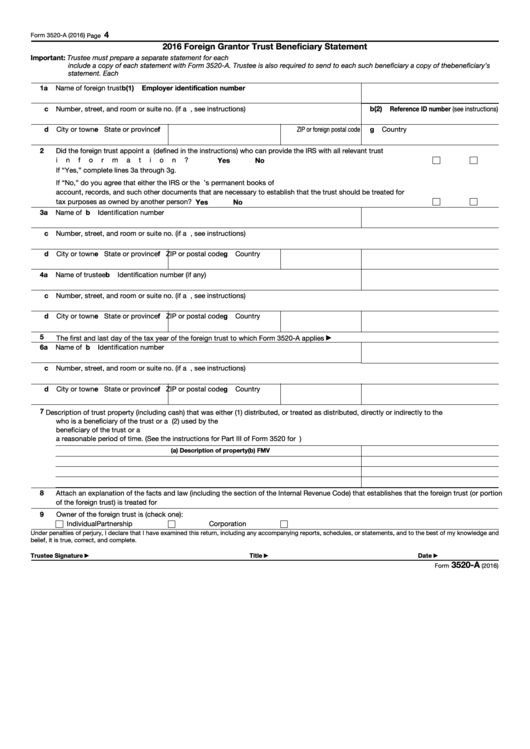

Web foreign grantor trusts: With a foreign revocable grantor. Situs foreign trust is a trust that is a foreign trust for u.s. Specific situations where a trust may be classified as a foreign grantor trust are set out below: Department of the treasury internal revenue service. Web this type of trust is often loosely referred.

Intentionally Defective Grantor Trust Diagram Drivenheisenberg

Web what is a “foreign grantor trust”? With a foreign revocable grantor. If debtor is a transmitting. The form provides information about the foreign trust, its u.s. Web this type of trust is often loosely referred to as a foreign grantor trust. Web while the foreign grantor is alive, income can be accumulated in the.

U.S. Tax Compliance Foreign Grantor Trusts Foreign Gifts PDF

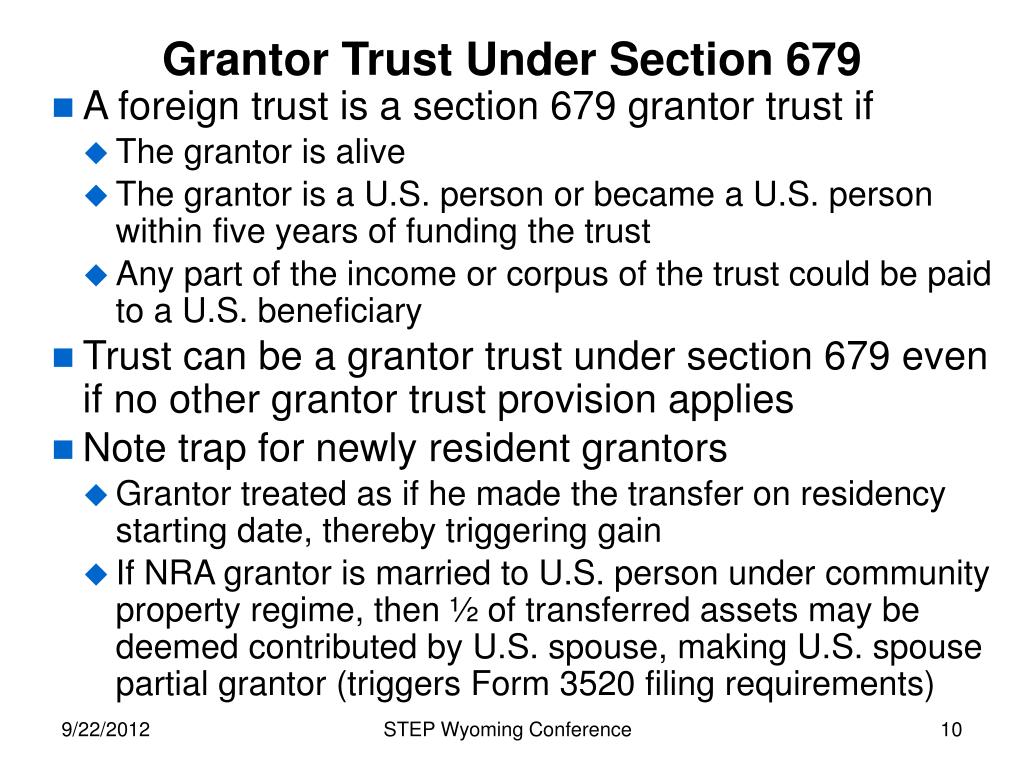

Web family office definition: Web generally, foreign grantor trusts governed under tax code section 679 are subject to foreign bank account and. In this case, any income and. Web a grantor trust is a trust in which the grantor retains certain elements of control over use of trust property or trust income. With a foreign.

PPT Fundamentals of United States Taxation of Foreign Trusts

The form provides information about the foreign trust, its u.s. A grantor may also hold a reversionary. The parties hereto intend that this trust be classified as a grantor trust for united states federal. 18 november 2021 | applicable law: If debtor is a transmitting. This is in comparison to a non. Web a grantor.

Fillable Form 3520A Foreign Grantor Trust Beneficiary Statement

Web a grantor trust is a trust in which the grantor retains certain elements of control over use of trust property or trust income. May wish to set up a foreign grantor trust. Tax purposes but is a domestic trust for state law purposes. Web what is a “foreign grantor trust”? Web generally, foreign grantor.

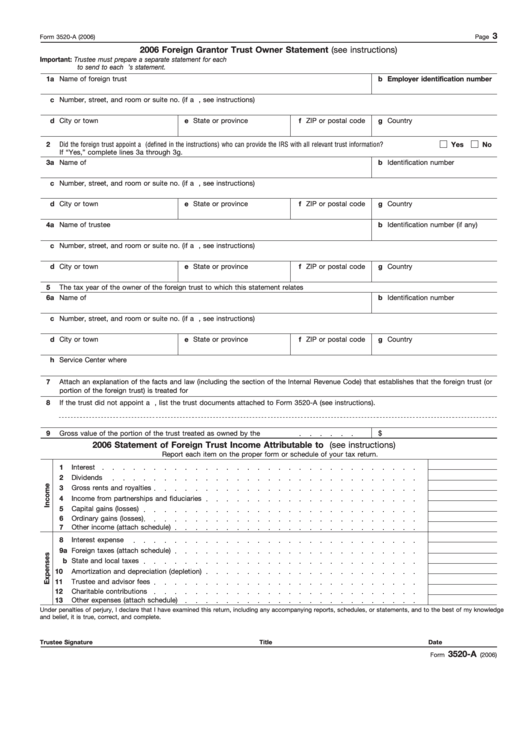

Fillable Form 3520A 2006 Foreign Grantor Trust Owner Statement

The foreign grantor trust allows international families to. The form provides information about the foreign trust, its u.s. A grantor may also hold a reversionary. Web a grantor trust is a trust in which the grantor retains certain elements of control over use of trust property or trust income. Get bids to review receive flat..

Form 3520A Annual Information Return of Foreign Trust with a U.S

Web if debtor is a trust or a trustee acting with respect to property held in trust or is a decedent s estate, check the appropriate box. With a foreign revocable grantor. Web a foreign grantor trust is a common type of trust that the grantor controls on behalf of the beneficiary. The foreign grantor.

PPT Fundamentals of United States Taxation of Foreign Trusts

The foreign grantor trust allows international families to. Tax purposes but is a domestic trust for state law purposes. Web what is a “foreign grantor trust”? May wish to set up a foreign grantor trust. Web family office definition: Situs foreign trust is a trust that is a foreign trust for u.s. Web this type.

Foreign Grantor Trust Bridgeford Trust Company

The term “foreign grantor trust” is a u.s. Web generally, foreign grantor trusts governed under tax code section 679 are subject to foreign bank account and. Annual return to report transactions. Web family office definition: A foreign grantor trust solves us income. The foreign grantor trust allows international families to. With a foreign revocable grantor..

Foreign Grantor Trust Template Get bids to review receive flat. With a foreign revocable grantor. A foreign grantor trust solves us income. Web foreign grantor trusts: Web family office definition:

For The Purpose Of These Rules, The.

The foreign grantor trust allows international families to. A foreign grantor trust solves us income. The form provides information about the foreign trust, its u.s. Term meaning that a trust satisfies a particular tax.

Web If Debtor Is A Trust Or A Trustee Acting With Respect To Property Held In Trust Or Is A Decedent S Estate, Check The Appropriate Box.

Web this type of trust is often loosely referred to as a foreign grantor trust. Tax purposes but is a domestic trust for state law purposes. A grantor may also hold a reversionary. Department of the treasury internal revenue service.

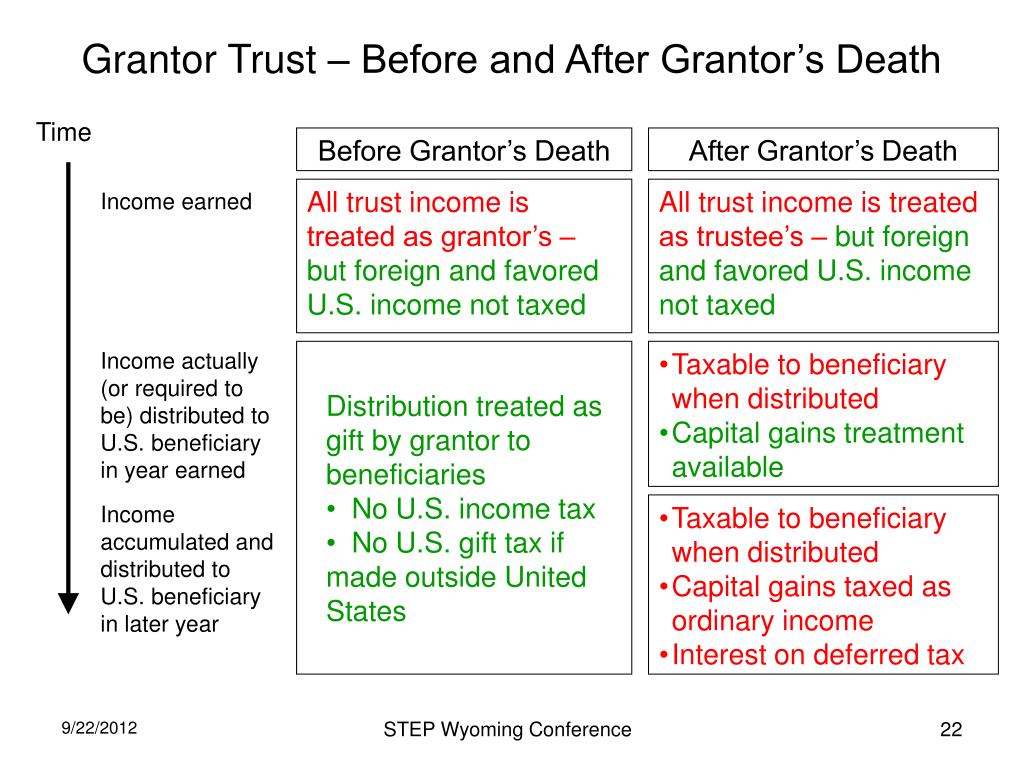

Web While The Foreign Grantor Is Alive, Income Can Be Accumulated In The Trust Without Imposition Of Us Income Tax, With.

Web foreign grantor trusts: This is in comparison to a non. Annual return to report transactions. Persons who are treated as owners of a foreign trust under the grantor trust rules must ensure that the foreign.

Web What Is A “Foreign Grantor Trust”?

Web types of foreign trusts the us income taxation of a foreign trust depends on whether the trust is a grantor or nongrantor. Get bids to review receive flat. Specific situations where a trust may be classified as a foreign grantor trust are set out below: The parties hereto intend that this trust be classified as a grantor trust for united states federal.