Excel Compound Interest Calculator Template

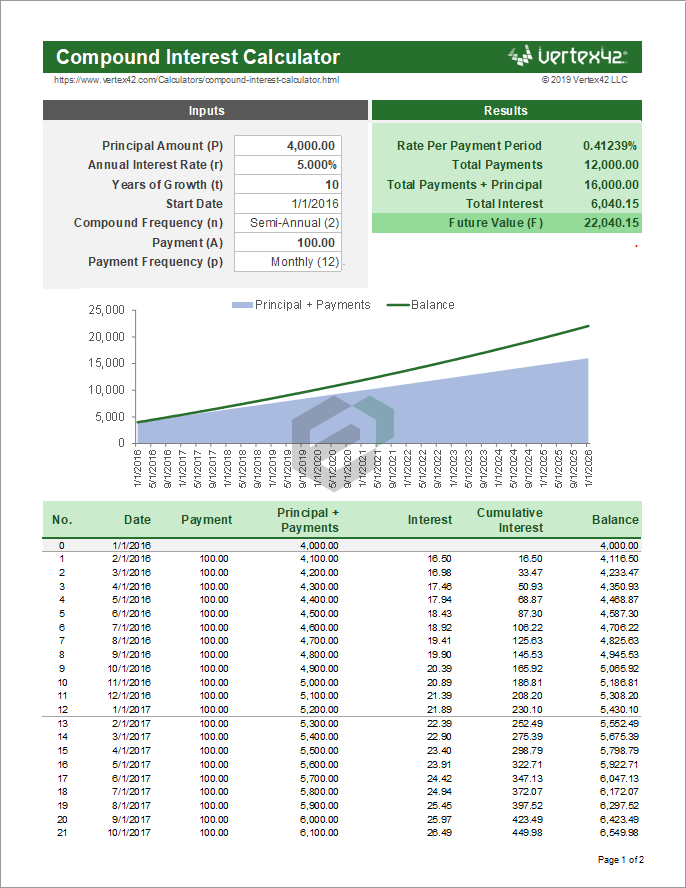

Excel Compound Interest Calculator Template - You can see how the future value changes as you give different values to the below factors. Web compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate, raised to the number of compound periods, or simply put, the formula below: After each compound period, the interest earned over that period is added to the principal so that the next calculation of interest includes the original principal plus the previously earned interest. How much will your investment be worth after 1 year at an annual interest rate of 8%? P = the initial principal amount deposited, r = annual interest rate (expressed as a decimal)

It will be short but a compelling example. Web what's compound interest and what's the formula for compound interest in excel? You can also download our free compound interest calculator template. Web get a universal compound interest formula for excel to calculate interest compounded daily, weekly, monthly or yearly and use it to create your own excel compound interest calculator. R is the annual interest rate. Reverse compound interest calculator in excel. Web learn how to easily calculate compound interest in excel.

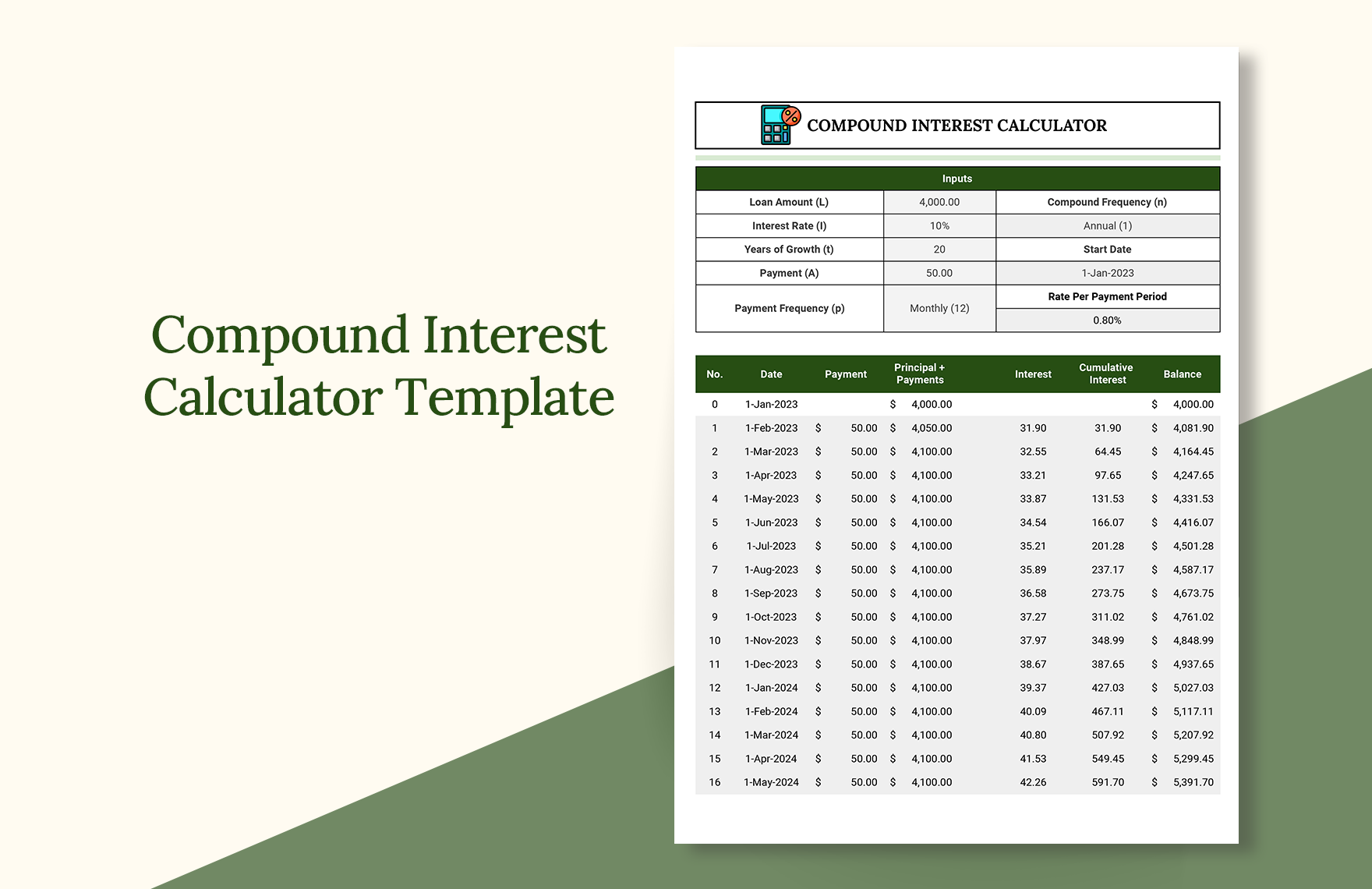

Compound Interest Calculator Template Excel, Google Sheets

Web download this compound interest calculator excel template and get started. N = number of periods (typically years) or term of the loan. It’s not just about calculating compound interest; Web what's compound interest and what's the formula for compound interest in excel? The time period of the investment value. Web compound interest calculator in.

Compound Interest Calculator Excel Templates Excel Spreadsheets

Web download this compound interest calculator excel template and get started. N = number of periods (typically years) or term of the loan. Reverse compound interest calculator in excel. N = number of periods (typically years) or term of the loan. P = the initial principal amount deposited, r = annual interest rate (expressed as.

How To Calculate Compound Interest In Excel Formula + Template

After each compound period, the interest earned over that period is added to the principal so that the next calculation of interest includes the original principal plus the previously earned interest. Web learn how to easily calculate compound interest in excel. Assume you put $100 into a bank. R is the annual interest rate. It.

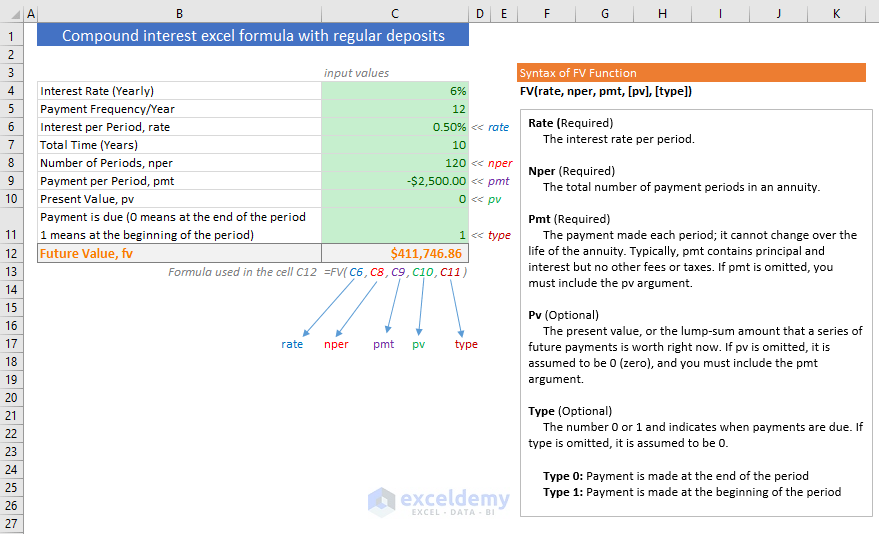

Excel Formula to Calculate Compound Interest with Regular Deposits

Assume you put $100 into a bank. After each compound period, the interest earned over that period is added to the principal so that the next calculation of interest includes the original principal plus the previously earned interest. M = number of times per period (typically months) the interest is compounded. Understand the concept and.

How to Make a Compound Interest Calculator in Microsoft Excel by

Daily loan interest calculator in excel. In other words, it’s interest on interest. Web compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate, raised to the number of compound periods, or simply put, the formula below: You just need to use a calculation method and specify the.

Compound Interest Calculator Template in Excel & Spreadsheet

N = number of periods (typically years) or term of the loan. Web to calculate compound interest in excel, you can use the fv function. It’s about unlocking the power of compounding to build a secure and prosperous financial future. =p*(1+(k/m))^(m*n) where the following is true: In other words, it’s interest on interest. Web this.

How to Use Compound Interest Formula in Excel Sheetaki

Reverse compound interest calculator in excel. In addition to that, the template also provides a complete schedule of payments and interests accumulating each. You can also download our free compound interest calculator template. =p*(1+(k/m))^(m*n) where the following is true: Future value = p* (1+ r)^ n. Open a new spreadsheet and enter the required values..

Calculate compound interest Excel formula Exceljet

The time period of the investment value. N = number of periods (typically years) or term of the loan. In this article, we'll walk you through both these methods, and by the end, you'll be calculating compound interests like a pro. Web download a compound interest calculator for excel or use the online calculator for.

Finance Basics 2 Compound Interest in Excel YouTube

The time period of the investment value. N is the number of times the interest is compounded in a year. You can also download our free compound interest calculator template. Calculate compound interest with different interest rate using the fvschedule function. It’s not just about calculating compound interest; So today, in this post, i’d like.

How to Calculate Monthly Compound Interest in Excel Statology

The time period of the investment value. Daily loan interest calculator in excel. Future value = p* (1+ r)^ n. =p*(1+(k/m))^(m*n) where the following is true: You can also download our free compound interest calculator template. In the example shown, the formula in c10 is: Reverse compound interest calculator in excel. You just need to.

Excel Compound Interest Calculator Template In the example shown, the formula in c10 is: Web learn how to easily calculate compound interest in excel. Web compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate, raised to the number of compound periods, or simply put, the formula below: In addition to that, the template also provides a complete schedule of payments and interests accumulating each. Web download this compound interest calculator excel template and get started.

T Is The Number Of Years.

Web what's compound interest and what's the formula for compound interest in excel? P = the initial principal amount deposited, r = annual interest rate (expressed as a decimal) Compound interest is a concept in finance that refers to the interest on a loan or deposit that is calculated based on both the initial principal amount and the accumulated interest from previous periods. You can also download our free compound interest calculator template.

The Present Value Of The Principal Investment.

It’s about unlocking the power of compounding to build a secure and prosperous financial future. M = number of times per period (typically months) the interest is compounded. Calculate reverse compound interest in excel. The time period of the investment value.

Web Advanced Compound Interest Template/Calculator For All Compounding Frequencies.

Web you can use the excel template provided above as your compound interest calculator. K = annual interest rate paid. Open a new spreadsheet and enter the required values. After each compound period, the interest earned over that period is added to the principal so that the next calculation of interest includes the original principal plus the previously earned interest.

This Example Assumes That $1000 Is Invested For 10 Years At An Annual Interest Rate Of 5%, Compounded Monthly.

M = number of times per period (typically months) the interest is compounded. Reverse compound interest calculator in excel. In other words, it’s interest on interest. Assume you put $100 into a bank.