Excel 1099 Form Template

Excel 1099 Form Template - Web these excel templates can be adjusted to reflect hourly rates and overtime, salaries, taxes and withholdings that apply to your. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Web independent contractor expenses spreadsheet: This page provides a 1099 misc excel template you. Web to calculate and print to irs 1099 forms with their unconventional spacing.

Web introducing keeper's independent contractor expenses spreadsheet. Paste your data into the columns, and upload to tax1099. To begin, login to tax1099.com. Web tax1099 provides excel templates for all form types we offer. Download this 2022 excel template. Web to calculate and print to irs 1099 forms with their unconventional spacing. We’ll convert your information into.

Free 1099 Template Excel (With StepByStep Instructions!)

Under in ribbon, show, select. To begin, login to tax1099.com. Web tax1099 provides excel templates for all form types we offer. Show the developer tab on the excel menu, click preferences. Importing through a tax1099.com excel spreadsheet template remains our most. Paste your data into the columns, and upload to tax1099. 2.5k views 2 years.

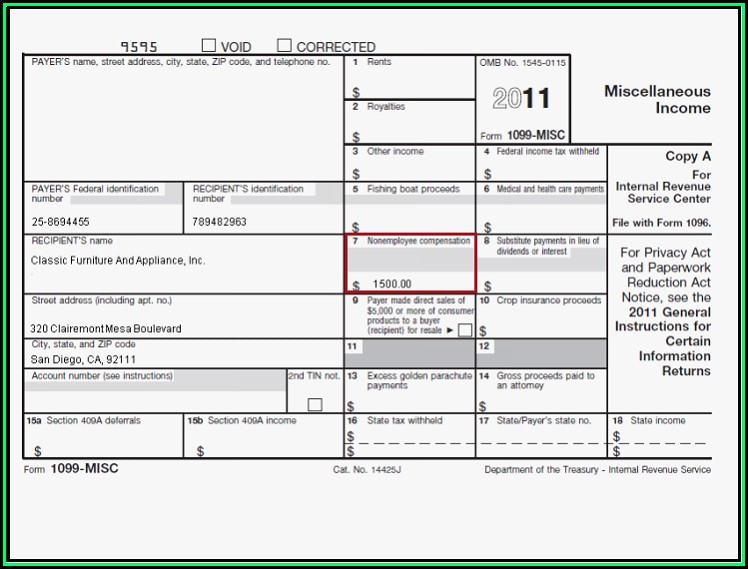

1099 Misc Template Excel Template 1 Resume Examples o7Y30QLVBN

We’ll convert your information into. Importing through a tax1099.com excel spreadsheet template remains our most. Paste your data into the columns, and upload to tax1099. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Web patents on schedule e (form 1040). However, report payments for.

Free 1099 Template Excel (With StepByStep Instructions!)

Navigate to the import tab on the left side of the screen, and select. Web to calculate and print to irs 1099 forms with their unconventional spacing. Web patents on schedule e (form 1040). Web tax1099 provides excel templates for all form types we offer. Web introducing keeper's independent contractor expenses spreadsheet. Web independent contractor.

Free 1099 Template Excel (With StepByStep Instructions!)

Everything you need to know (plus: Web to calculate and print to irs 1099 forms with their unconventional spacing. 2.5k views 2 years ago. Show the developer tab on the excel menu, click preferences. Web independent contractor expenses spreadsheet: We’ll convert your information into. Download this 2022 excel template. Importing through a tax1099.com excel spreadsheet.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

We’ll convert your information into. Download this 2022 excel template. This page provides a 1099 misc excel template you. Web introducing keeper's independent contractor expenses spreadsheet. Web tax1099 provides excel templates for all form types we offer. Everything you need to know (plus: Navigate to the import tab on the left side of the screen,.

4 Form Deductions 4 Benefits Of 4 Form Deductions That May Change Your

Web patents on schedule e (form 1040). Navigate to the import tab on the left side of the screen, and select. Web tax1099 provides excel templates for all form types we offer. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Web to calculate and.

Irs Form 1099 Misc Template

Web patents on schedule e (form 1040). Web these excel templates can be adjusted to reflect hourly rates and overtime, salaries, taxes and withholdings that apply to your. Under in ribbon, show, select. However, report payments for a working interest as explained in the schedule e (form 1040). Web to calculate and print to irs.

1099 Excel Template Free Resume Examples

Web introducing keeper's independent contractor expenses spreadsheet. Download this 2022 excel template. Show the developer tab on the excel menu, click preferences. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Navigate to the import tab on the left side of the screen, and select..

Free 1099 Template Excel (With StepByStep Instructions!)

We’ll convert your information into. Web patents on schedule e (form 1040). 2.5k views 2 years ago. Navigate to the import tab on the left side of the screen, and select. To begin, login to tax1099.com. Importing through a tax1099.com excel spreadsheet template remains our most. Download this 2022 excel template. Web tax1099 provides excel.

1099 Excel Template

Paste your data into the columns, and upload to tax1099. Web these excel templates can be adjusted to reflect hourly rates and overtime, salaries, taxes and withholdings that apply to your. Web introducing keeper's independent contractor expenses spreadsheet. We’ll convert your information into. Web to calculate and print to irs 1099 forms with their unconventional.

Excel 1099 Form Template Everything you need to know (plus: Web independent contractor expenses spreadsheet: Under in ribbon, show, select. Web patents on schedule e (form 1040). Web tax1099 provides excel templates for all form types we offer.

Navigate To The Import Tab On The Left Side Of The Screen, And Select.

Web patents on schedule e (form 1040). This page provides a 1099 misc excel template you. Web tax1099 provides excel templates for all form types we offer. Everything you need to know (plus:

However, Report Payments For A Working Interest As Explained In The Schedule E (Form 1040).

Show the developer tab on the excel menu, click preferences. To begin, login to tax1099.com. Under in ribbon, show, select. We’ll convert your information into.

Web Introducing Keeper's Independent Contractor Expenses Spreadsheet.

Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Web independent contractor expenses spreadsheet: 2.5k views 2 years ago. Paste your data into the columns, and upload to tax1099.

Download This 2022 Excel Template.

Importing through a tax1099.com excel spreadsheet template remains our most. Web to calculate and print to irs 1099 forms with their unconventional spacing. Web these excel templates can be adjusted to reflect hourly rates and overtime, salaries, taxes and withholdings that apply to your.