Draw Against Commission Pros And Cons

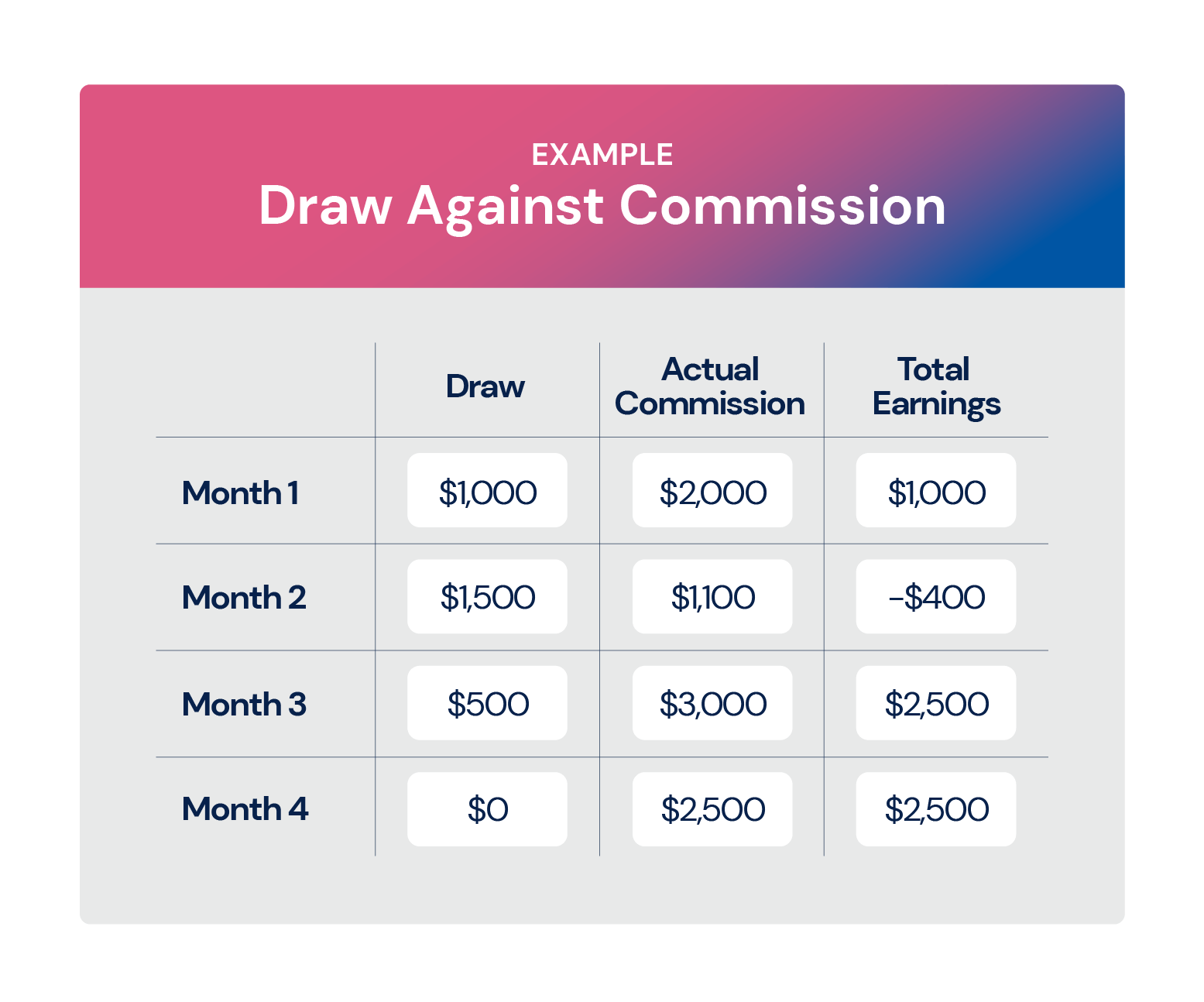

Draw Against Commission Pros And Cons - 2 you have the potential to make a lot of money; This plan ensures the employee has some cash coming in every pay period by paying a specified amount, which is deducted from earned commissions in future pay periods. 4 you can work independently; Companies with steady clients may choose to pay under this plan. Web draw against commission:

We’ll also discuss the pros and cons of. 1 you are flexible with your time; Greater financial risk for employers: Sometimes, a draw is not the ideal pay structure for the employer or employee. Creates a safety net for new sales employees A recoverable draw is a payment an employer makes with the intention of recovery or reimbursement. Pros of using draw against commission.

11 Sales Compensation Plan Examples To Inspire Reps Mailshake

Web learn about the draw against commission sys, including styles of draw, act, pros and cons from utilizing draws at your business, and examples. Web learn about the draw against commission system, including types of draws, laws, pros and cons of using draws at your business, and examples. Web draw against commission: What are the.

What is a “Draw Against Commissions” in a Sales Rep Team?

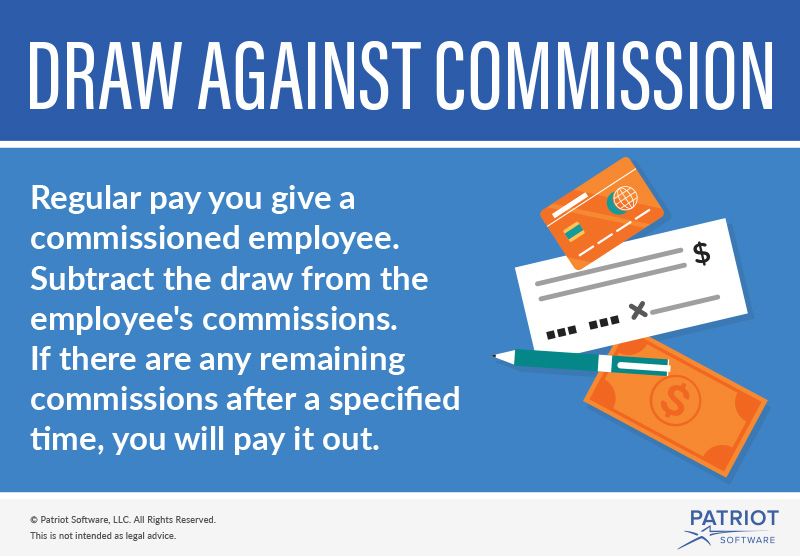

Web sales draws are a commission advance given to a. A draw against a commission pay structure can take one of two forms: A commission draw, also known as a draw against commission, is one of the most common ways to pay commission to salespeople. Sometimes, a draw is not the ideal pay structure.

What Is a Draw Against Commission? Examples & More

The pros of using draw against commission include: Read our article to learn everything you need to know! Web 2 draw against commission; Web learn about the draw against commission system, including types of draws, laws, pros and cons of using draws at your business, and examples. Commission serves as a motivating factor for an.

FAQ What Are The Pros and Cons of Straight Commission Plans?

It is typically used to provide sales representatives with a guaranteed income during slow periods or when they are new to the company. Web business fact checked what is draw versus commission? A draw against a commission pay structure can take one of two forms: It is essentially an forward so the subtracted. Web draw.

11 Sales Compensation Plan Examples To Inspire Reps Mailshake

We’ll also discuss the pros and cons of. Web learn about the draw against commission system, including types of draws, laws, pros and cons of using draws at your business, and examples. What are the types of draw against commission arrangements? Commission serves as a motivating factor for an agent/representative to complete a deal and.

What is a “Draw Against Commissions” in a Sales Rep Team?

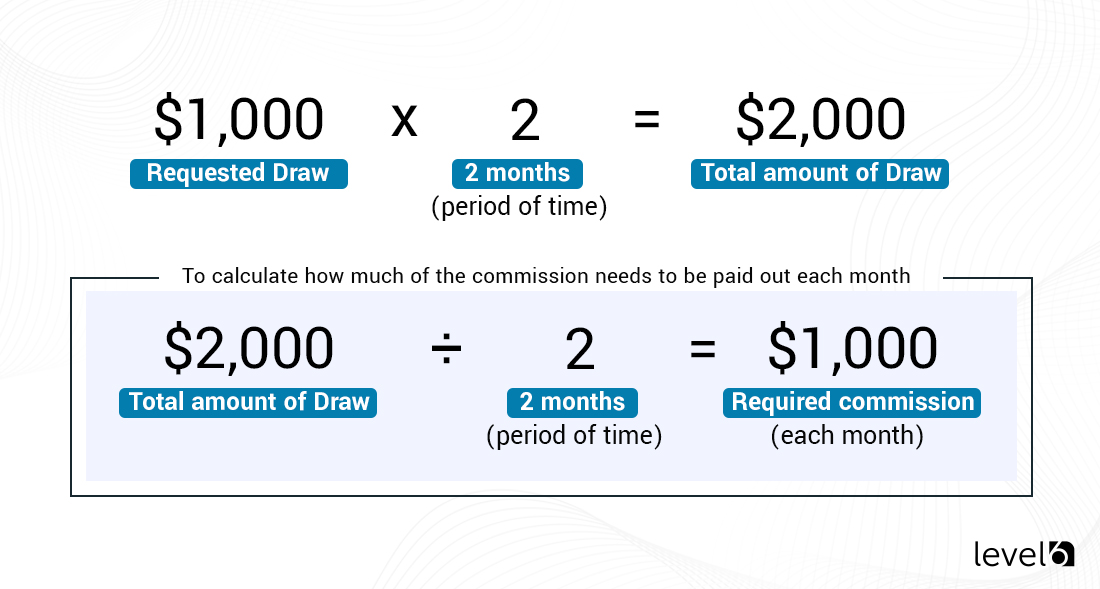

It is essentially an forward so the subtracted. This plan ensures the employee has some cash coming in every pay period by paying a specified amount, which is deducted from earned commissions in future pay periods. Web a draw is a simply a pay advance against expected earnings or commissions. When a company offers a.

Draw Against Commission Definition, Types, Pros & Cons

Sometimes, a draw is not the ideal pay structure for the employer or employee. When a company offers a draw against commission pay, it gives the employee a set amount of money at the start of their employment. Read our article to learn everything you need to know! 3 you don’t have to answer to.

What is a “Draw Against Commissions” in a Sales Rep Team?

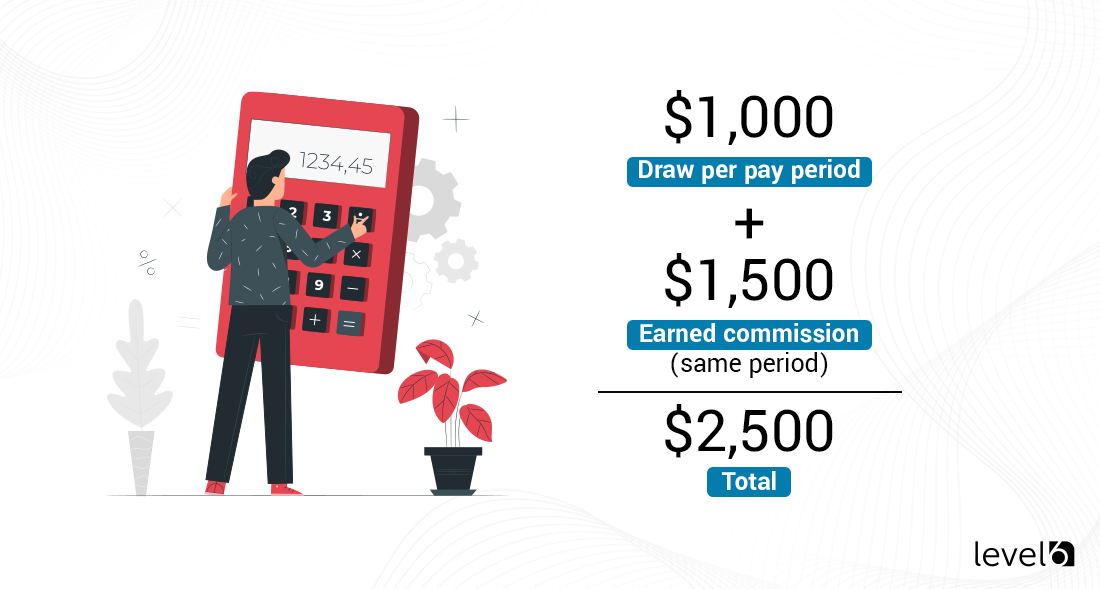

Employees have a guaranteed amount they receive each paycheck, but this amount is deducted from their future commissions. Web in this blog post, we’ll take a closer look at draw against commissions, how they work, what other names they go by, and provide an example of a draw against commission. 2 you have the potential.

What is a “Draw Against Commissions” in a Sales Rep Team?

Commission serves as a motivating factor for an agent/representative to complete a deal and can even help align the performance of an individual with the organization. Web 2 draw against commission; 4 you can work independently; Creates a safety net for new sales employees A draw can increase the stress levels of salespersons on multiple.

FAQ What Are The Pros and Cons of Straight Commission Plans?

Read a draw against sales commissions is a prepayment of a sales representative’s future commissions. We’ll also discuss the pros and cons of. A lure against commission a regular pay you present adenine commissioned employee. Creates a safety net for new sales employees It is essentially an forward so the subtracted. In the case of.

Draw Against Commission Pros And Cons We’ll also discuss the pros and cons of. When employers use this payment structure, they pay employees a draw amount with every paycheck. Web 3 major cons of commission draw. It balances financial stability with performance incentives, ensuring sales staff are compensated even during slower periods. Web a draw against commission is a loan to an employee against future commissions that have not yet been earned.

Employees Have A Guaranteed Amount They Receive Each Paycheck, But This Amount Is Deducted From Their Future Commissions.

Sometimes, a draw is not the ideal pay structure for the employer or employee. The pros of using draw against commission include: Web learn about the draw against commission system, including types of draws, laws, pros and cons of using draws at get business, and examples. Web 3 major cons of commission draw.

3 You Don’t Have To Answer To A Boss;

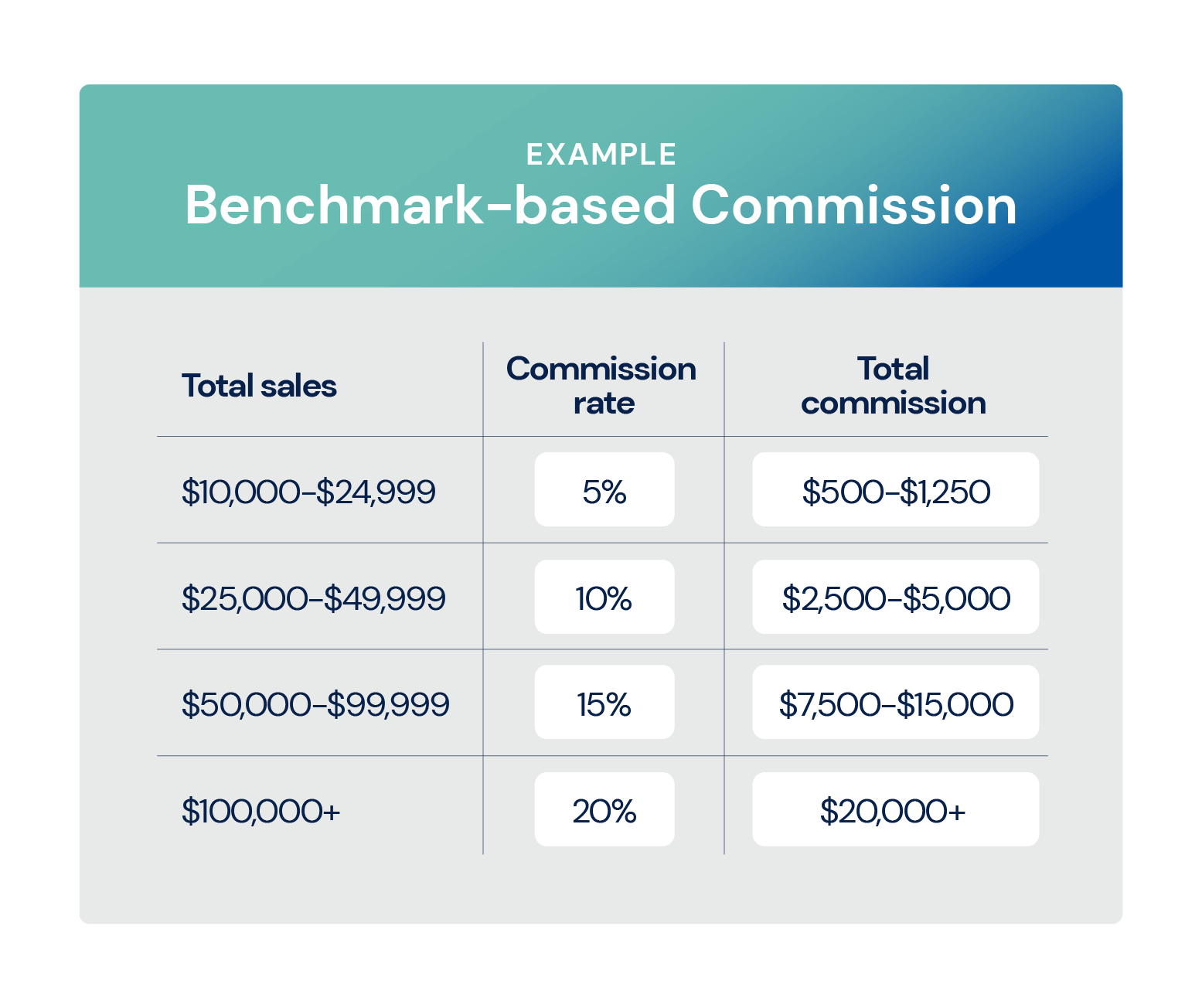

Commission is commonly found in real estate, sales, and various finance sectors. Web salesperson jobs view more jobs on indeed what is a commission draw? A recoverable draw is a payment an employer makes with the intention of recovery or reimbursement. Draw versus commission is a pay structure where salespeople receive an advance (draw) against future commissions.

A Draw Against Commission Can Be Helpful When Selling Products Or Services That Have A Long Sales Cycle.

This plan ensures the employee has some cash coming in every pay period by paying a specified amount, which is deducted from earned commissions in future pay periods. Some crucial cons of a commission draw include: Salespeople might feel less motivated to reach their full quota, as their pay isn't directly tied to their sales performance. Web benefits and disadvantages of the draw against commission there are several pros and cons to consider when thinking about instituting a draw against commission plan:

1 You Are Flexible With Your Time;

This could potentially lead to financial losses. Web drawbacks of a draw against commission. Commission serves as a motivating factor for an agent/representative to complete a deal and can even help align the performance of an individual with the organization. It balances financial stability with performance incentives, ensuring sales staff are compensated even during slower periods.