Depreciation Template In Excel

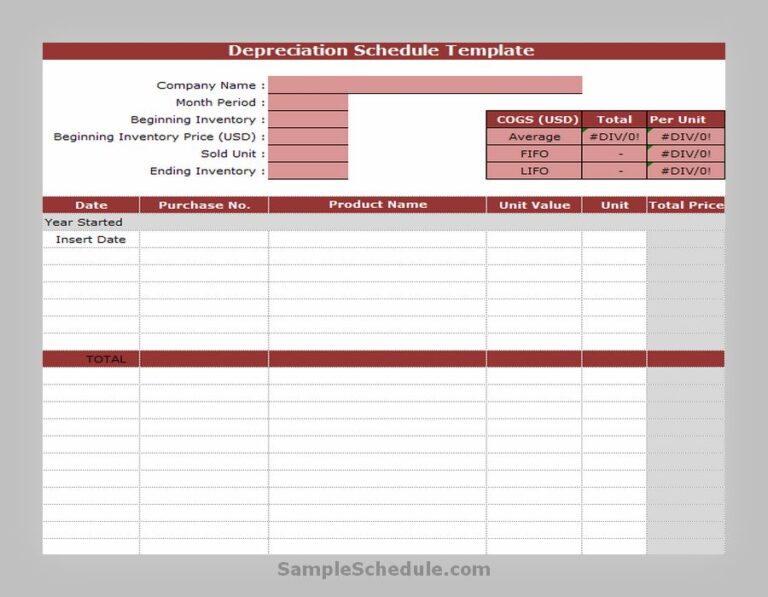

Depreciation Template In Excel - The function needs the initial and salvage costs of the asset, its useful life, and the period data by default. Here, we will walk you through some easy methods to do the task smoothly. The first method is to apply the sln function. Web in this article, you’ll find a collection of free simple depreciation schedule templates & samples in pdf, word, and excel format to help you make your document effective. What is a depreciation schedule?

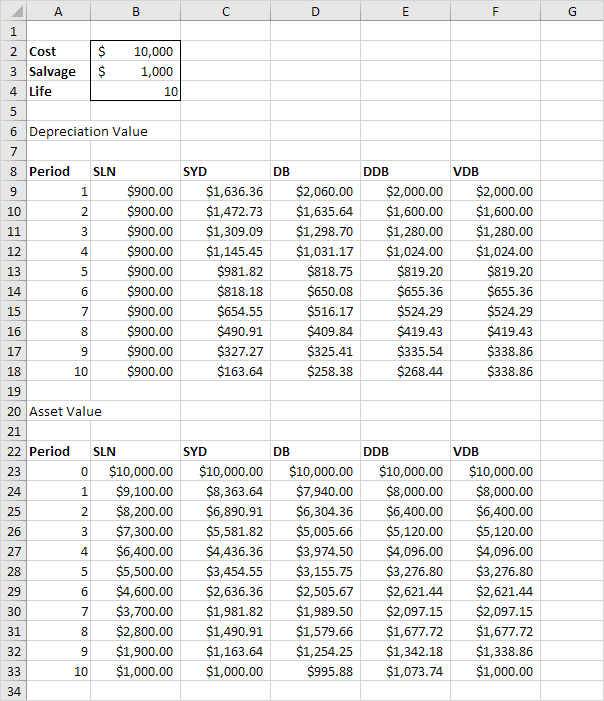

We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). The first method is to apply the sln function. I will use this data to calculate depreciation in excel. We have the initial cost, salvage value, and useful life of an instrument. Web excel offers five different depreciation functions. When to use this template: Depreciation is a term used to describe the reduction in the value of as asset over a number of years.

9 Free Depreciation Schedule Templates in MS Word and MS Excel

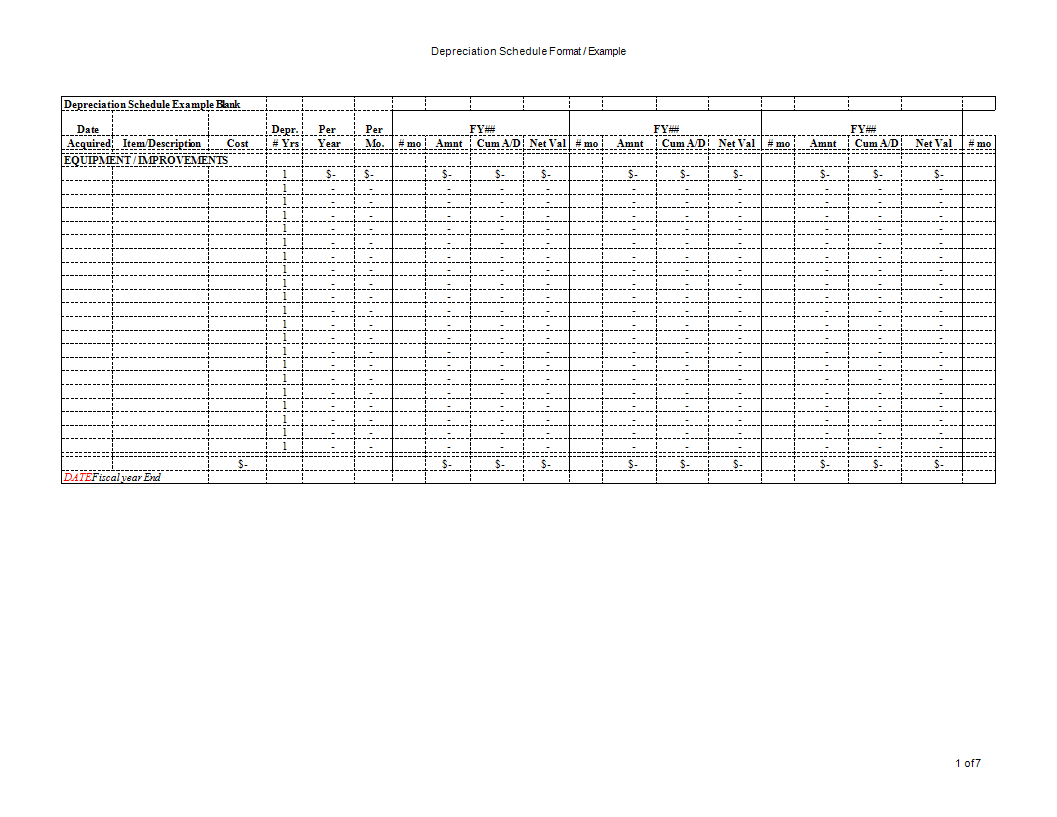

Thus, a depreciation schedule is a table that shows the depreciation amount over the span of the asset’s life. (years left of useful life) ÷. Web our formula will =sln (b2, b3, b4). Web in this article, we’ll teach you how to make a depreciation worksheet in excel, from assembling column headers to entering formulas,.

8 ways to calculate depreciation in Excel (2023)

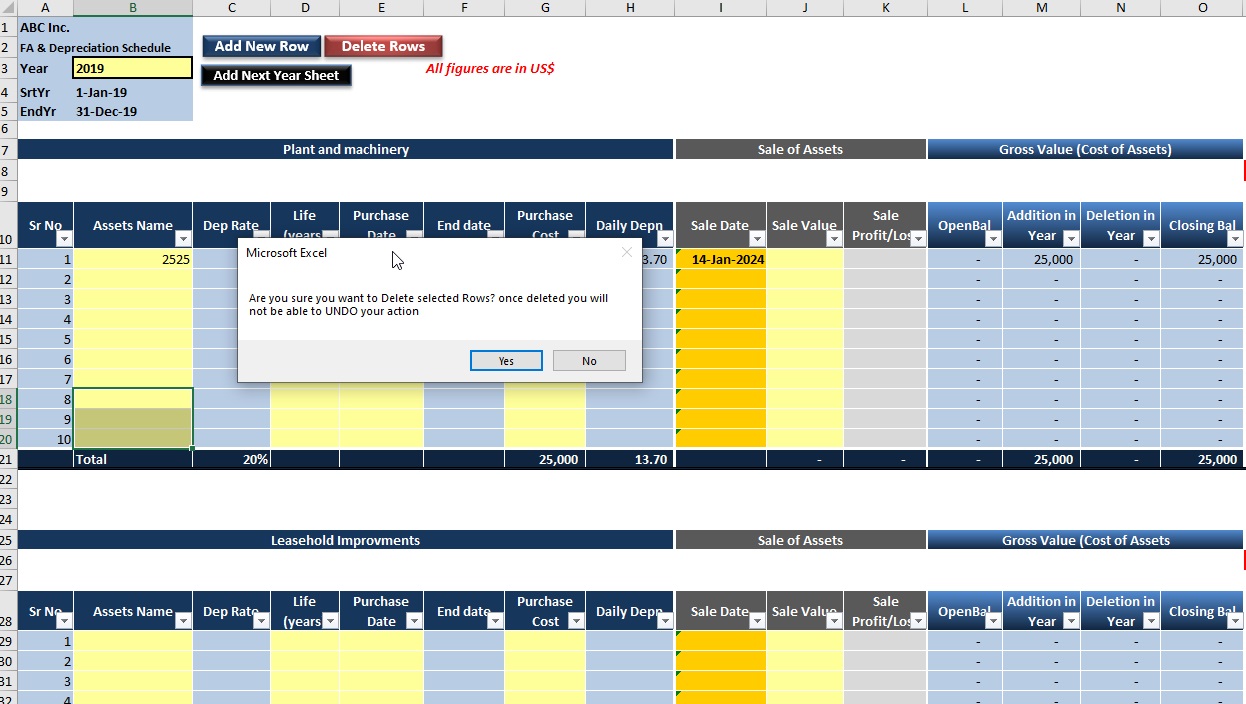

Web download a depreciation schedule template for excel. Depreciation is one of the most important features for real estate businesses apart from their regular expenses. With following rows of information for input. Web this straight line depreciation template demonstrates how to calculate depreciation expense using the straight line depreciation method. Using excel sln function in.

Practical of straight line depreciation in excel 2020 YouTube

This is the dataset for today’s article. The reduction in the value of an asset over multiple numbers of years is called depreciation. Web this straight line depreciation schedule calculator uses excel to produce a depreciation schedule based on asset cost, salvage value and depreciation rate. This simple scenario analysis spreadsheet template, with or without.

Create Depreciation Schedule in Excel (8 Suitable Methods) ExcelDemy

The spreadsheet is simple to use, and full instructions are included on this page. (years left of useful life) ÷. I will use this data to calculate depreciation in excel. Web our formula will =sln (b2, b3, b4). Data analysis, excel templates, financial statement. With following rows of information for input. Web excel offers five.

Depreciation Formulas in Excel Easy to Follow Tutorial

We’ve also prepared a downloadable depreciation worksheet template that’s ready to use. Web this depreciation methods template will show you the calculation of depreciation expenses using four types of commonly use depreciation methods. I will use this data to calculate depreciation in excel. Apply sln function to calculate depreciation. We consider an asset with an.

Depreciation and Fixed Assets Template in Excel Eloquens

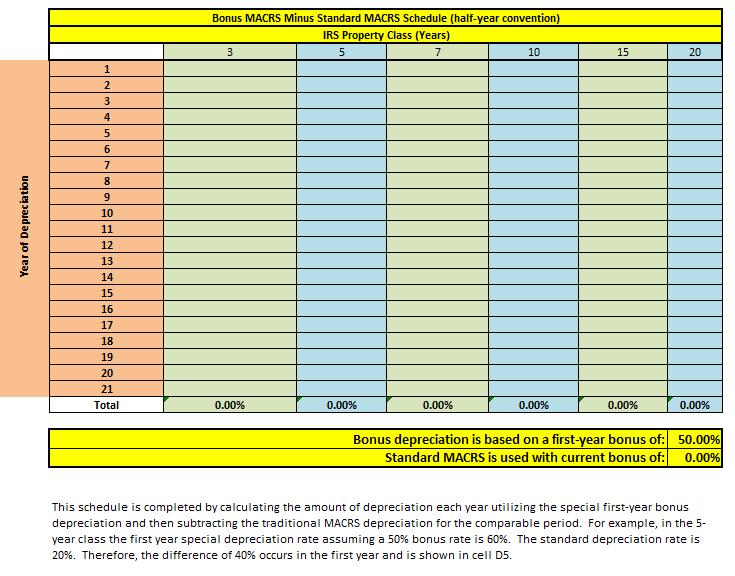

Web how to calculate the depreciation rate for macrs tables using excel depreciation formulas. The formula returns the depreciation amount as rs. Web download the blank simple scenario analysis spreadsheet template for excel. Web in this article, we’ll teach you how to make a depreciation worksheet in excel, from assembling column headers to entering formulas,.

20+ Free Depreciation Schedule Templates MS Excel & MS Word

I will use this data to calculate depreciation in excel. It allows you to reduce your taxable income, paying less in taxes and sometimes paying no tax at all. The spreadsheet is simple to use, and full instructions are included on this page. Web if you want to create a monthly depreciation schedule in excel,.

25+ Depreciation Schedule Template Excel Free to Use sample schedule

Here, we will walk you through some easy methods to do the task smoothly. It's perfect for team leaders and small business owners who are in the early. Web download a depreciation schedule template for excel. The function needs the initial and salvage costs of the asset, its useful life, and the period data by.

How To Calculate Depreciation Monthly In Excel Haiper

By jeff rohde, posted in investment strategy. With following rows of information for input. Web this straight line depreciation template demonstrates how to calculate depreciation expense using the straight line depreciation method. Web this depreciation methods template will show you the calculation of depreciation expenses using four types of commonly use depreciation methods. Depreciation is.

Depreciation Schedule Template for StraightLine and Declining Balance

Web if you want to create a monthly depreciation schedule in excel, you have come to the right place. This is the dataset for today’s article. Web our formula will =sln (b2, b3, b4). When to use this template: Depreciation is one of the most important features for real estate businesses apart from their regular.

Depreciation Template In Excel Using excel sln function in formula to calculate macrs depreciation. With following rows of information for input. The reduction in the value of an asset over multiple numbers of years is called depreciation. With this depreciation schedule template, businesses are able to create asset specific columns based on whatever criteria that is deemed necessary for tracking and recording the assets. Web if you want to create a monthly depreciation schedule in excel, you have come to the right place.

The Formula Returns The Depreciation Amount As Rs.

Web this straight line depreciation schedule calculator uses excel to produce a depreciation schedule based on asset cost, salvage value and depreciation rate. It's perfect for team leaders and small business owners who are in the early. The first method is to apply the sln function. Web download a fixed asset tracking template with depreciation schedule for.

Web How To Calculate The Depreciation Rate For Macrs Tables Using Excel Depreciation Formulas.

We have the initial cost, salvage value, and useful life of an instrument. Web this depreciation methods template will show you the calculation of depreciation expenses using four types of commonly use depreciation methods. By jeff rohde, posted in investment strategy. The function needs the initial and salvage costs of the asset, its useful life, and the period data by default.

Depreciation Is A Term Used To Describe The Reduction In The Value Of As Asset Over A Number Of Years.

Web this straight line depreciation template demonstrates how to calculate depreciation expense using the straight line depreciation method. With following rows of information for input. Web download a depreciation schedule template for excel. Thus, a depreciation schedule is a table that shows the depreciation amount over the span of the asset’s life.

We Want To Calculate Depreciation By Using The Sln Function.

Web how to calculate depreciation in excel: Web download depreciation calculator template in excel. The reduction in the value of an asset over multiple numbers of years is called depreciation. We’ve also prepared a downloadable depreciation worksheet template that’s ready to use.