Black Scholes Excel Template

Black Scholes Excel Template - This video tutorial covers the manual calculations and the. Built by finance professors and financial modelers. The spreadsheet allows for dividends and also gives you the greeks. In addition, for your better understanding, i’m going to use a. Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in excel.

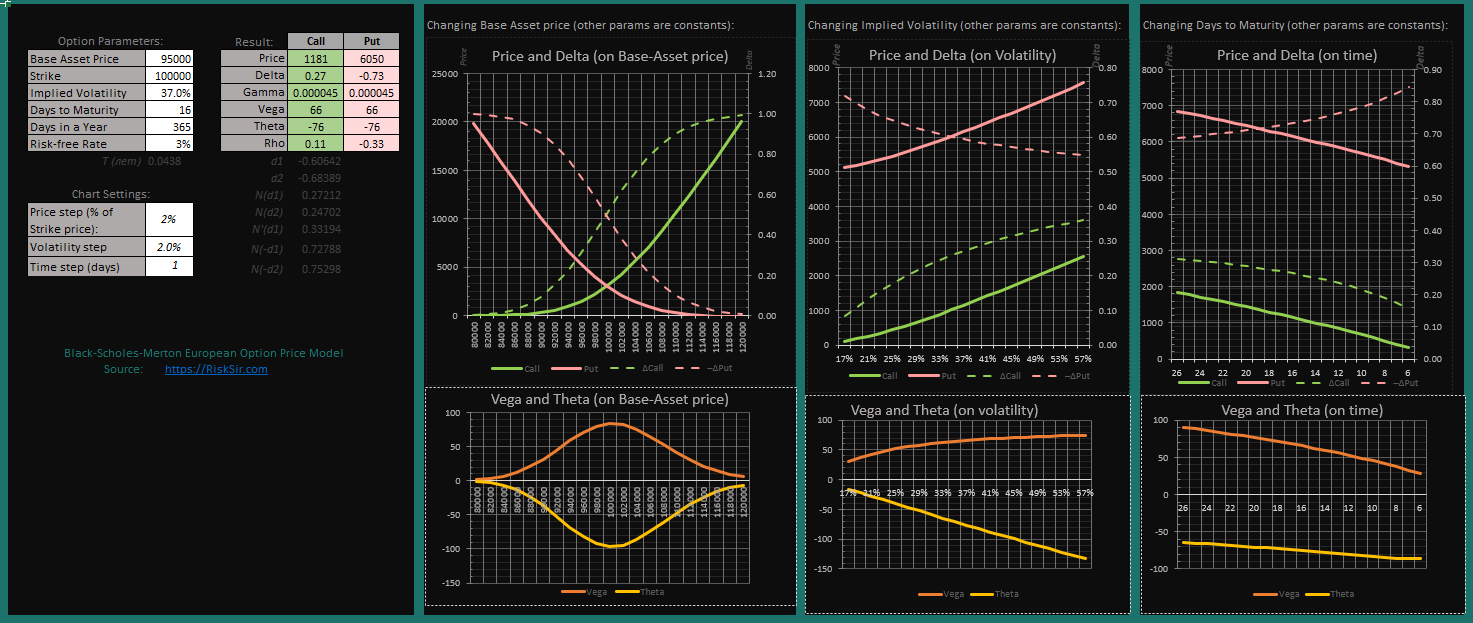

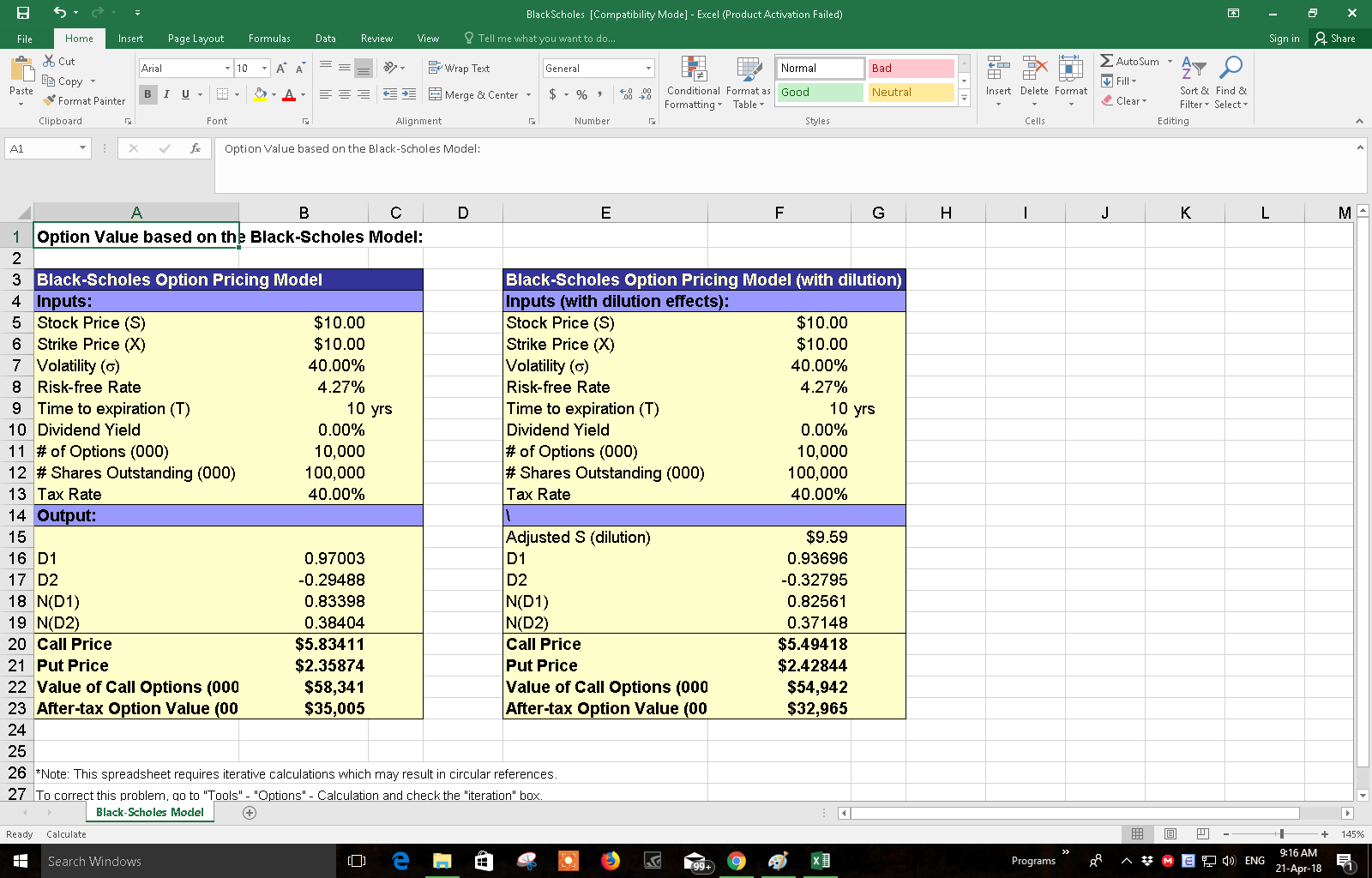

This video tutorial covers the manual calculations and the. The spreadsheet allows for dividends and also gives you the greeks. Web how do you determine the fair market value of a european call or put option? In addition, for your better understanding, i’m going to use a. These are sample parameters and results. Robert merton was the first to expand the mathematical understanding of the options pricing model. Let's learn about the intuition and apply it to price options in excel!

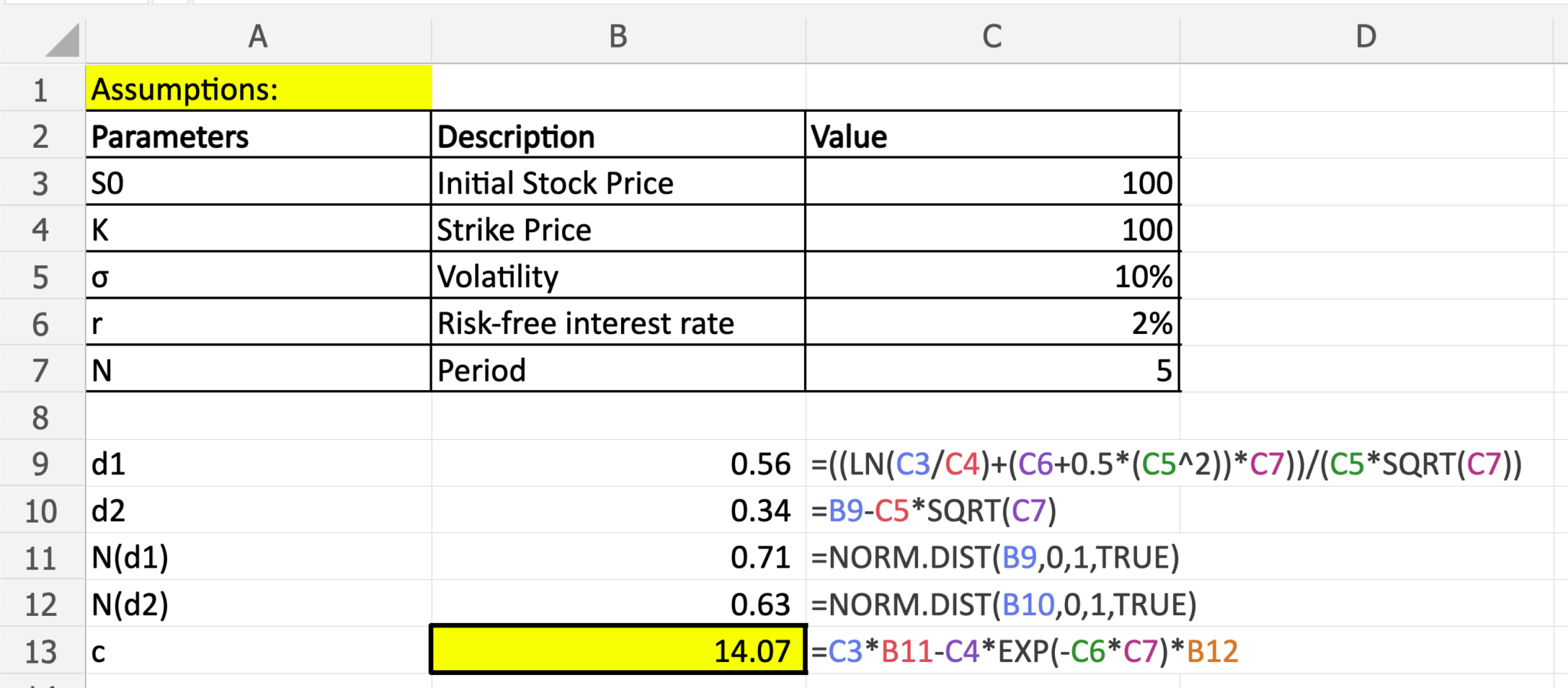

BlackScholes Option Pricing (Excel formula) Dollar Excel

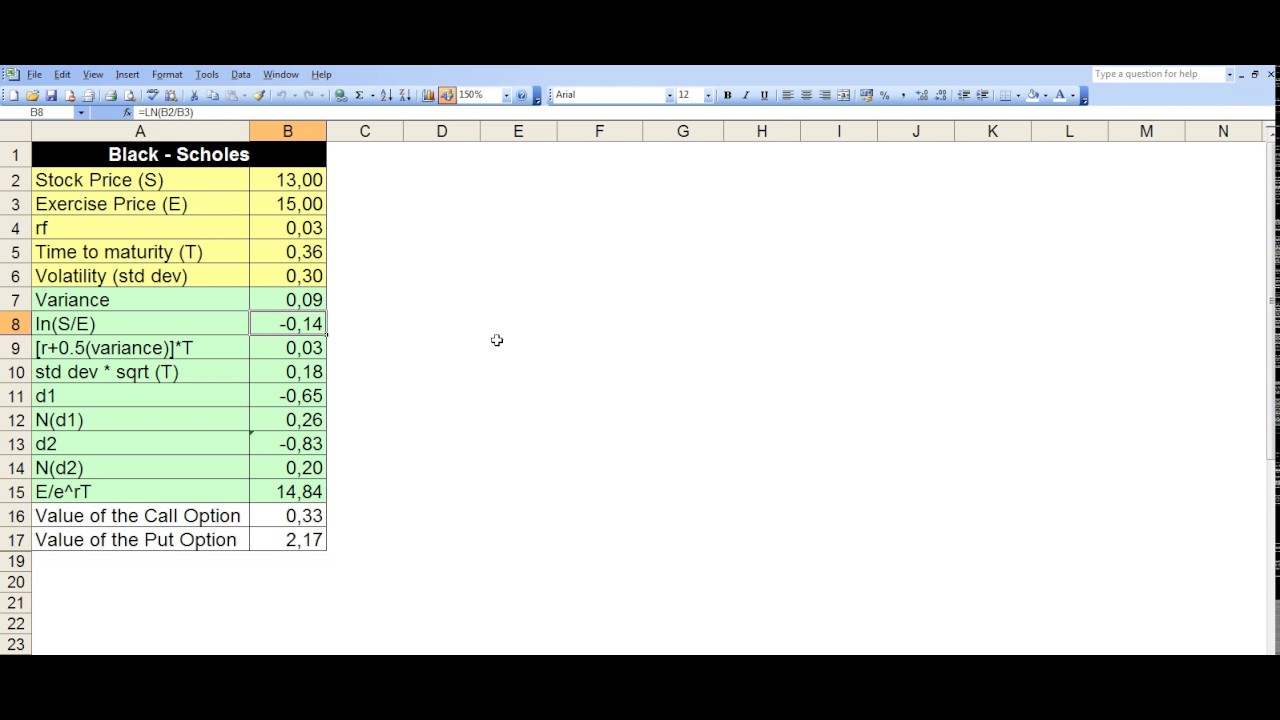

Web how to calculate volatility for black scholes in excel: Use marketxls with all options data in excel. The stock price at time 0, six months before expiration date of the option is $42.00, option exercise price is $40.00, the rate of interest on a government bond with 6 months to expiration is 5%, and.

10 Black Scholes Excel Template Excel Templates

Use marketxls with all options data in excel. Robert merton was the first to expand the mathematical understanding of the options pricing model. These are sample parameters and results. This video tutorial covers the manual calculations and the. The spreadsheet shoppe has got you covered! Join | learn about membership. Web how to calculate volatility.

10 Black Scholes Excel Template Excel Templates

Login to access this resource. Use marketxls with all options data in excel. Web black scholes excel model is the best framework to calculate the underlying value of an option contract. Robert merton was the first to expand the mathematical understanding of the options pricing model. If you’re just playing around it doesn’t matter how.

Excel BlackScholesMerton Option Price and Greeks Financial Risk

Web need to calculate some puts and calls? This video tutorial covers the manual calculations and the. Web how to calculate volatility for black scholes in excel: Is adequate for companies that do not grant many stock options. Robert merton was the first to expand the mathematical understanding of the options pricing model. If you’re.

Blackscholes option pricing model spreadsheet stock market

Let's learn about the intuition and apply it to price options in excel! Web how to calculate volatility for black scholes in excel: Web black scholes excel model is the best framework to calculate the underlying value of an option contract. Use marketxls with all options data in excel. Web sometimes an online option calculator.

BlackScholes Model on Excel for Option Pricing YouTube

Robert merton was the first to expand the mathematical understanding of the options pricing model. Join | learn about membership. Web how to calculate volatility for black scholes in excel: Use marketxls with all options data in excel. Setting up the input cells first, you’ll need to create cells for each of your input variables..

BlackScholes Excel Pricing Model Eloquens

This video tutorial covers the manual calculations and the. The stock price at time 0, six months before expiration date of the option is $42.00, option exercise price is $40.00, the rate of interest on a government bond with 6 months to expiration is 5%, and the annual volatility of the underlying stock is 20%..

Black Scholes Option Calculator

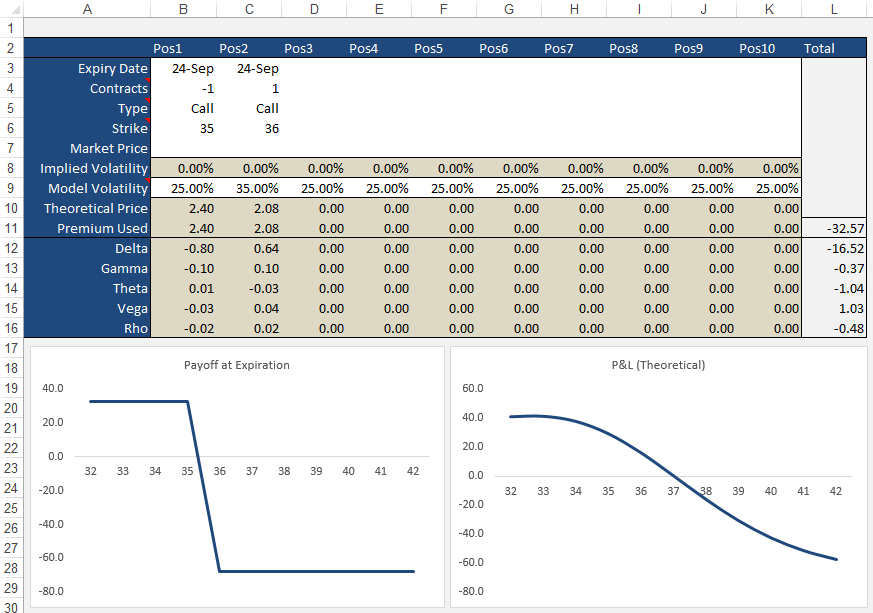

Web in this post, we’ll explore the options premium calculator spreadsheet that greatly simplifies options pricing as well as payoff calculation. Web black scholes excel model is the best framework to calculate the underlying value of an option contract. The spreadsheet shoppe has got you covered! Makes it easier to compare the financial results of.

Black Scholes Calculator Download Free Excel Template

Makes it easier to compare the financial results of different companies using it. Web how to calculate volatility for black scholes in excel: Use marketxls with all options data in excel. Built by finance professors and financial modelers. The spreadsheet is based on black scholes model and can be downloaded from the end of this.

Black Scholes Excel Template SampleTemplatess SampleTemplatess

The spreadsheet allows for dividends and also gives you the greeks. Is adequate for companies that do not grant many stock options. The spreadsheet is based on black scholes model and can be downloaded from the end of this post. Robert merton was the first to expand the mathematical understanding of the options pricing model..

Black Scholes Excel Template Web how do you determine the fair market value of a european call or put option? The spreadsheet allows for dividends and also gives you the greeks. Use marketxls with all options data in excel. These are sample parameters and results. Join | learn about membership.

Web Black Scholes Excel Model Is The Best Framework To Calculate The Underlying Value Of An Option Contract.

This content is exclusive to members. The spreadsheet is based on black scholes model and can be downloaded from the end of this post. These are sample parameters and results. The spreadsheet shoppe has got you covered!

Web Need To Calculate Some Puts And Calls?

Makes it easier to compare the financial results of different companies using it. Robert merton was the first to expand the mathematical understanding of the options pricing model. Setting up the input cells first, you’ll need to create cells for each of your input variables. In addition, for your better understanding, i’m going to use a.

Web How To Calculate Volatility For Black Scholes In Excel:

The spreadsheet allows for dividends and also gives you the greeks. Built by finance professors and financial modelers. Login to access this resource. The stock price at time 0, six months before expiration date of the option is $42.00, option exercise price is $40.00, the rate of interest on a government bond with 6 months to expiration is 5%, and the annual volatility of the underlying stock is 20%.

Web Sometimes An Online Option Calculator Isn’t Enough And You’d Like To Implement The Black & Scholes (B&S) Option Pricing Equations In Excel.

Let's learn about the intuition and apply it to price options in excel! Is adequate for companies that do not grant many stock options. Web how do you determine the fair market value of a european call or put option? In a new spreadsheet, choose cells to contain the following information (or use these exact cells for simplicity’s sake):