Accounting For Construction Loan Draws

Accounting For Construction Loan Draws - Web construction loans can be tricky to enter into quickbooks, but there are a few ways to do it. Web introduction to construction accounting by brittney abell and daniel gray last updated dec 7, 2023 construction companies have to make difficult choices among many financial alternatives, like bidding on one project over another, selecting financing for materials or equipment, or setting a project’s profit margin. Contract revenue recognition what is revenue recognition? Web construction draw schedule: Web i'm an accountant for a builder and am trying to find a way to automate the construction loan process in quickbooks (qb) premier for contractors.

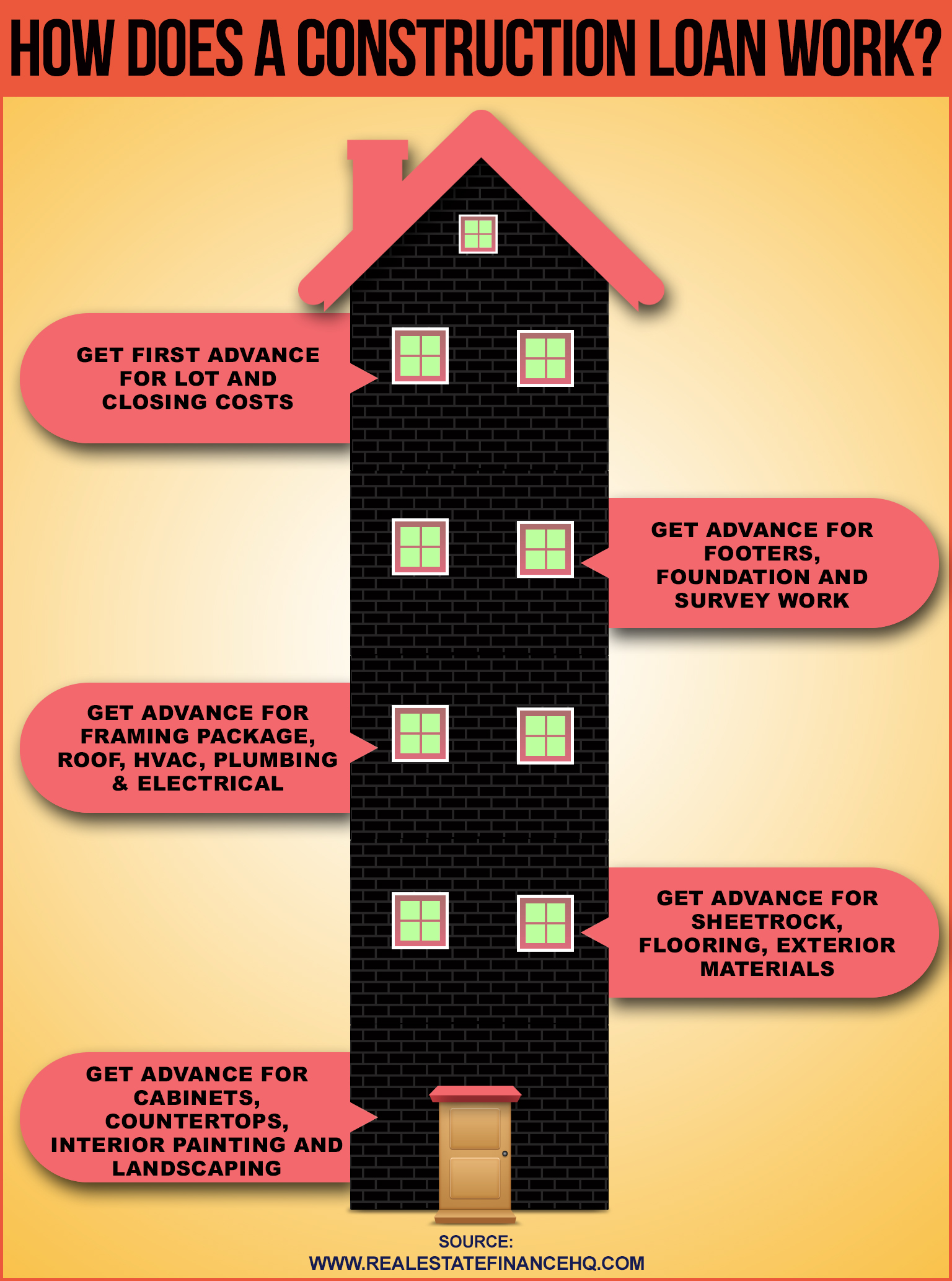

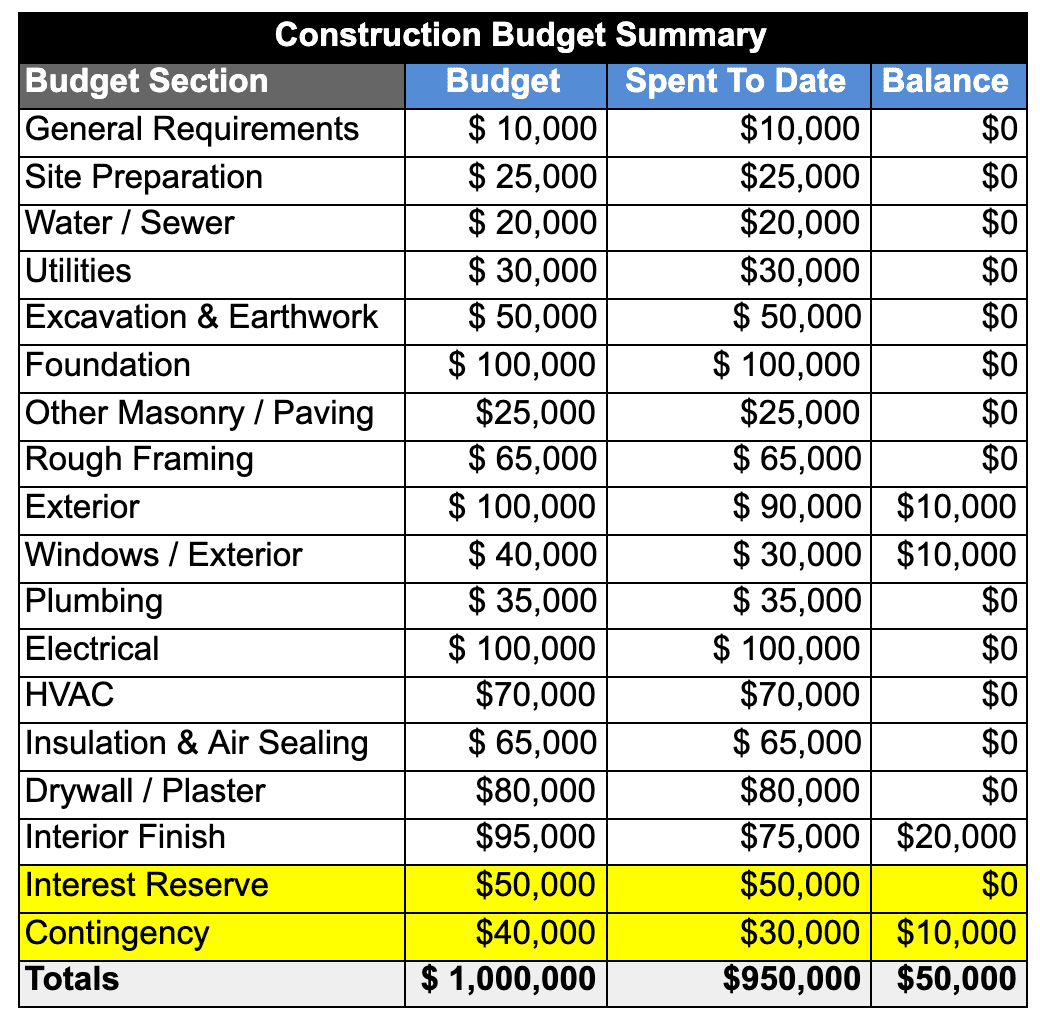

Set up a liability account for the loan, then deposit the draw into your bank account and assign it to the new liability account. Cash due from borrower = 50,500 which is the money due to the builder and the attorney fee being paid in cash. Web a construction draw is a liability since you owe it to the lender. Here's the link to the corresponding blog post: The construction draw schedule and schedule of values Web the draws are made according to a “construction draw schedule” which is defined in the loan agreement, and specific amounts are recorded against a predetermined construction budget. My total loan is $250187.00 which consists of the construction proceeds and a loan fee.

Construction Loans Draw Schedule For Construction Loans

That will put the funds in your bank account and record a corresponding amount as a liability due to your lender. One way is to create a loan account and then add the construction loan as a line item. Here's the link to the corresponding blog post: Start by developing your project schedule. Web here.

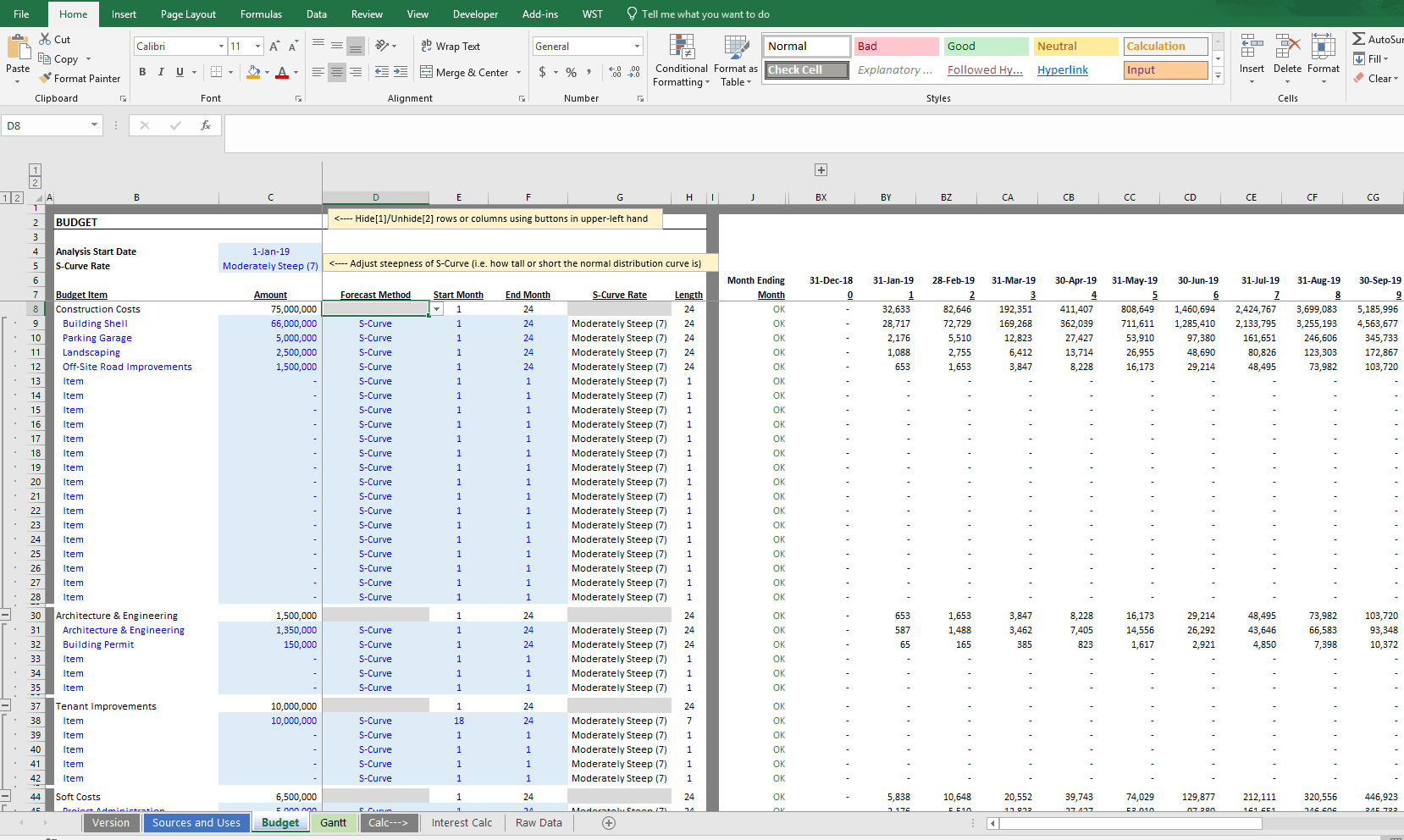

Tutorial Construction Draw and Interest Calculation Model

Click new to create a new account. Web in this video i build a construction loan draw in excel with circular references. What are the entries to set up (in a new company) a consturction loan with draws and interest only paid during construction project. The construction draw schedule and schedule of values Once occupancy.

Construction Draw Schedule How Construction Draws are Funded YouTube

Currently, the only way i can see to make qb automate the monthly. 4.1 chapter overview — loans. Once occupancy takes place, what entries are made to pay loan? Web a construction loan draw schedule is a detailed payment plan for the construction project. My total loan is $250187.00 which consists of the construction proceeds.

Pin on Spreadsheet Template

Web when you secure a construction loan, barring any initial advance, the starting liability is zero. Web the process for developing a construction draw schedule starts with creating a project schedule and schedule of values, then calculating what value of the work will be complete at each draw request. From your detail type menu, hit.

Construction Loan Draw Schedule Spreadsheet —

Here's the link to the corresponding blog post: Web the foundation for construction accounting 1. Cash due from borrower = 50,500 which is the money due to the builder and the attorney fee being paid in cash. The cash method the completed contract method the percentage of completion method asc 606 new revenue recognition. Web.

Understanding The Construction Loan Draw Process YouTube

Then when you cut a check it is to expense or asset (work in progress), depending on what you are building. My total loan is $250187.00 which consists of the construction proceeds and a loan fee. That will put the funds in your bank account and record a corresponding amount as a liability due to.

Understanding the Construction Draw Schedule PropertyMetrics

In the when do you want to start tracking your. Web my cd shows payoffs and payments: Go to the settings ⚙ menu and then select chart of accounts. Web the foundation for construction accounting 1. Set up a liability account for the loan, then deposit the draw into your bank account and assign it.

Construction Loans and Draw Schedules Timeline Infographic

What are the entries to set up (in a new company) a consturction loan with draws and interest only paid during construction project. These are typically split up into various milestones or phases of the overall project. What job costing does how job costing does it 2. Web construction loan draws, or simply loan draws,.

Construction Draws Accounting

Go to the settings ⚙ menu and then select chart of accounts. Web assurances, certifications, and agreements regarding the construction of the project and its completion. Web i'm an accountant for a builder and am trying to find a way to automate the construction loan process in quickbooks (qb) premier for contractors. Web if the.

How to Build Construction Loan Draw in Excel YouTube

Web the process for developing a construction draw schedule starts with creating a project schedule and schedule of values, then calculating what value of the work will be complete at each draw request. Contractors, seeking new business opportunities or higher profits, will on occasion participate directly in the financing or development of a project. What.

Accounting For Construction Loan Draws Use your gear (⚙️) icon and choose chart of accounts. My total loan is $250187.00 which consists of the construction proceeds and a loan fee. Web the process for developing a construction draw schedule starts with creating a project schedule and schedule of values, then calculating what value of the work will be complete at each draw request. Set up a liability account for the loan, then deposit the draw into your bank account and assign it to the new liability account. Web the foundation for construction accounting 1.

Contract Revenue Recognition What Is Revenue Recognition?

Another way is to create a construction. The goal is to make progress payments to. Web a construction loan draw schedule is a detailed payment plan for the construction project. Go to the settings ⚙ menu and then select chart of accounts.

Web The Draws Are Made According To A “Construction Draw Schedule” Which Is Defined In The Loan Agreement, And Specific Amounts Are Recorded Against A Predetermined Construction Budget.

Start by developing your project schedule. My total loan is $250187.00 which consists of the construction proceeds and a loan fee. Web introduction to construction accounting by brittney abell and daniel gray last updated dec 7, 2023 construction companies have to make difficult choices among many financial alternatives, like bidding on one project over another, selecting financing for materials or equipment, or setting a project’s profit margin. Web here are the four most useful indicators you’ll find in a final account in construction.

Web I'm An Accountant For A Builder And Am Trying To Find A Way To Automate The Construction Loan Process In Quickbooks (Qb) Premier For Contractors.

From the account type ▼ dropdown, choose long term liabilities. Click new to create a new account. Web in this video i build a construction loan draw in excel with circular references. A construction loan is simply a loan made on the security of a real estate mortgage (and

Web Construction Loan Draws, Or Simply Loan Draws, Are The Progress Payments You'll Receive Throughout A Construction Project To Reimburse You For Materials Delivered And Hours Worked, Culminating In The Final Payment And Return Of Retainage.

That will put the funds in your bank account and record a corresponding amount as a liability due to your lender. Set up a liability account for the loan, then deposit the draw into your bank account and assign it to the new liability account. Web if the arrangement is accounted for as a loan, interest and fees should be recognized as income, subject to recoverability. Web a construction draw is a liability since you owe it to the lender.